Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need answers please for each number st175 minutes Save Help Save & Et 26 A portfolio is composed of two stocks, A and B.

Just need answers please for each number

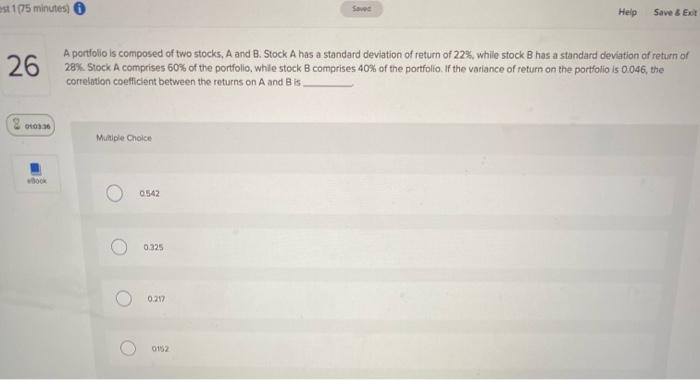

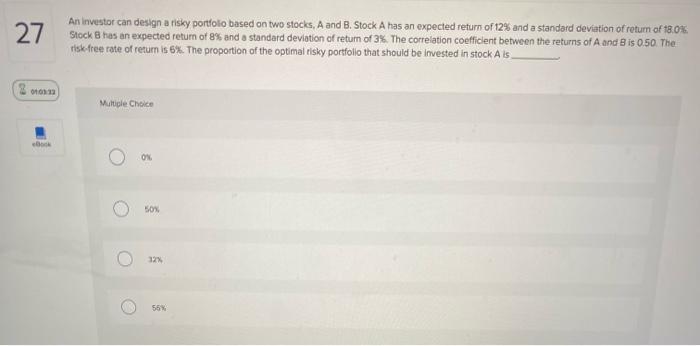

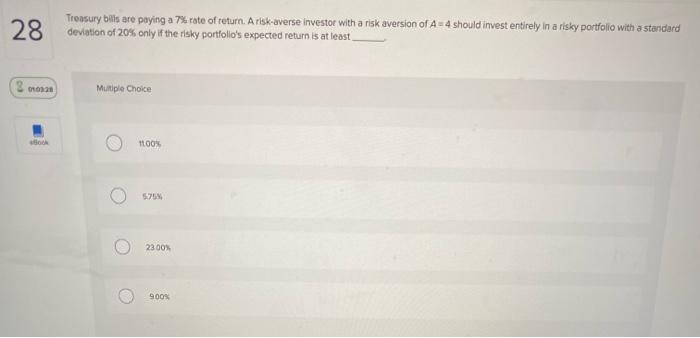

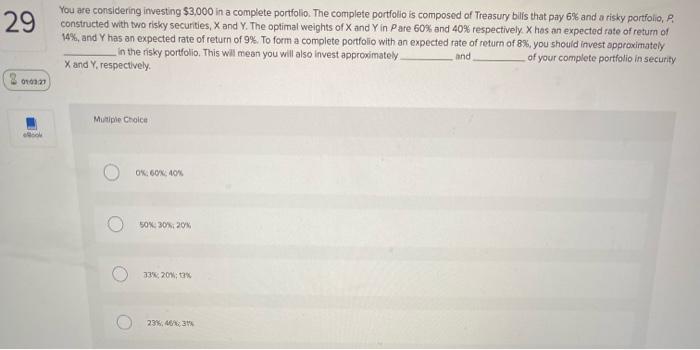

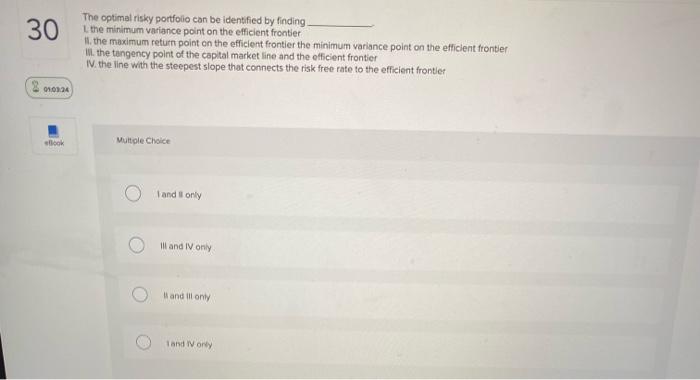

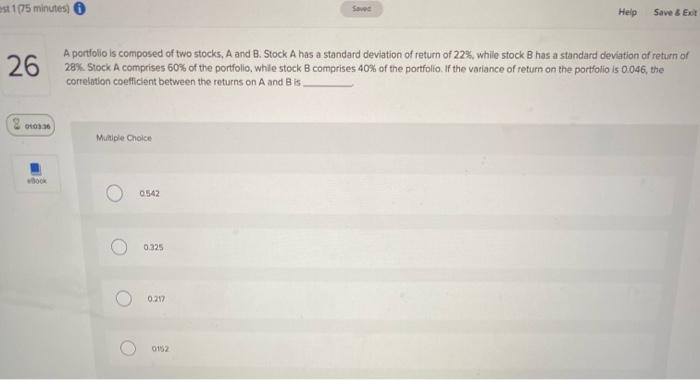

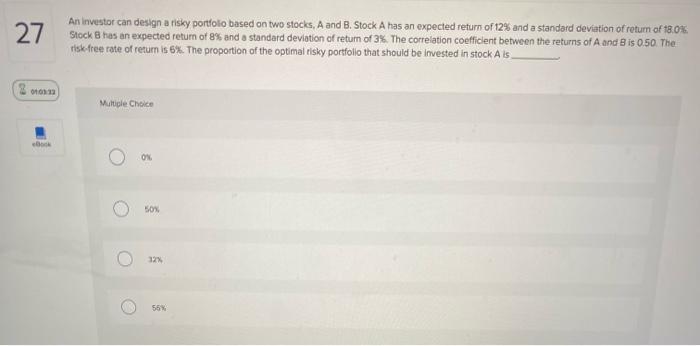

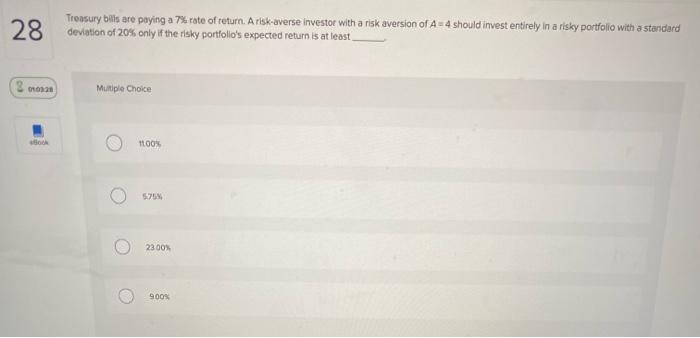

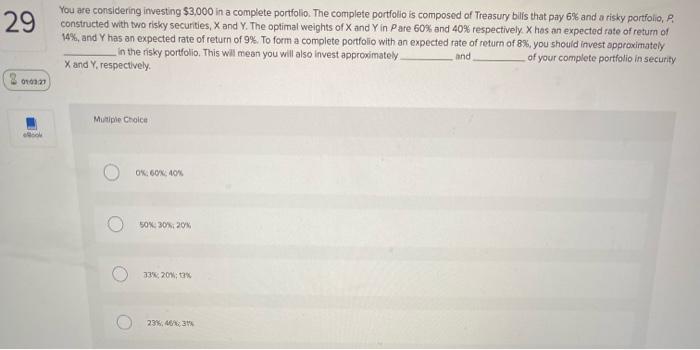

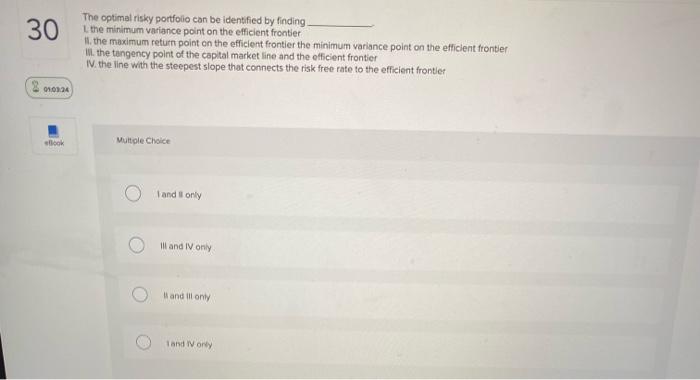

st175 minutes Save Help Save & Et 26 A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 22%, while stock B has a standard deviation of return of 28% Stock A comprises 60% of the portfolio, whle stock B comprises 40% of the portfolio If the variance of return on the portfolio is 0.046, the correlation coefficient between the returns on A and B is 010336 Multiple Choice 0542 0.325 0.217 0162 27 An Investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 12% and a standard deviation of return of 18.0% Stock Bhas an expected return of 8% and a standard deviation of return of 3%. The correlation coefficient between the returns of A and B is 0.50. The risk free rate of return is 6%. The proportion of the optimal risky portfolio that should be invested in stock A is Songa Multiple Choice 0 ox O 50% 0 12% 55% 28 Treasury bills are paying a 7% rate of return. A risk-averse investor with a risk aversion of A4 should invest entirely in a risky portfolio with a standard deviation of 20% only if the risky portfolio's expected return is at least 020 Multiple Choice 100% 5754 23.00% 9005 29 You are considering investing $3,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 6% and a risky portfolio, constructed with two risky securities, X and Y. The optimal weights of X and Y in Pare 60% and 40% respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 9%. To form a complete portfolio with an expected rate of return of 8%, you should invest approximately in the risky portfolio. This will mean you will also invest approximately and of your complete portfolio in security X and Y, respectively - 327 Multiple Choice OX. 6040% 50% 30% 20% 33,20% 13% 23% 3% 30 The optimal risky portfolio can be identified by finding the minimum variance point on the efficient frontier II. the maximum return point on the efficient frontier the minimum variance point on the efficient frontier III. the tangency point of the capital market line and the efficient frontier IV. the line with the steepest slope that connects the risk free rate to the efficient frontier 1024 ook Multple Choice I and only II and IV only and ill only and Ivory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started