Answered step by step

Verified Expert Solution

Question

1 Approved Answer

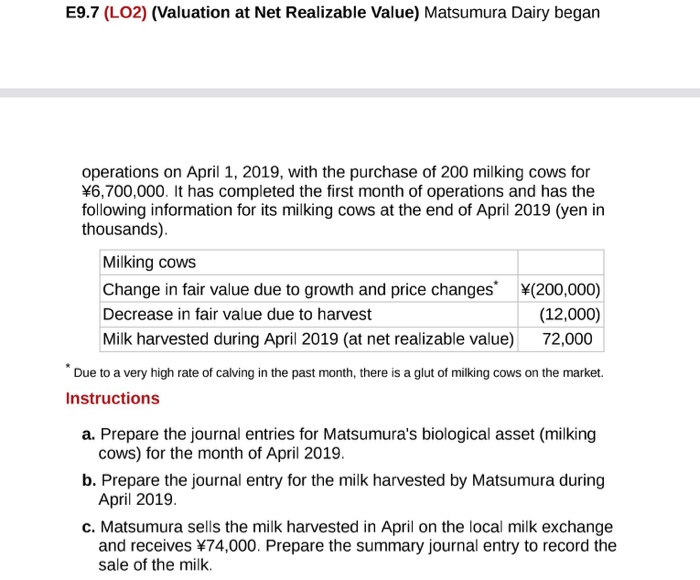

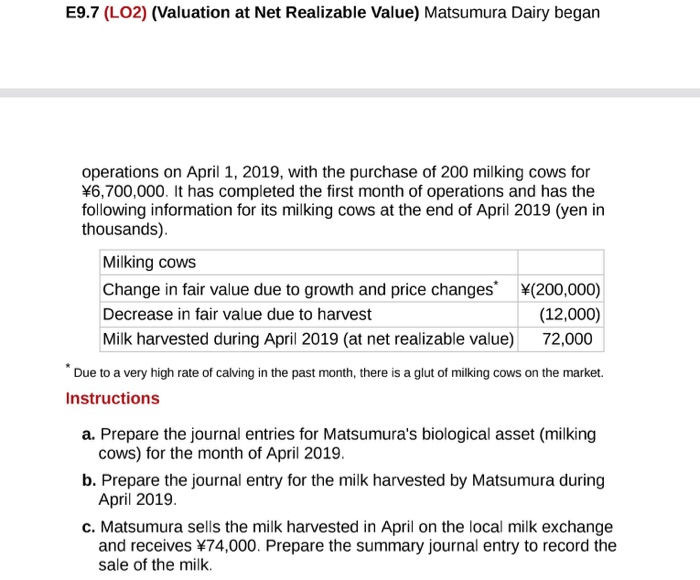

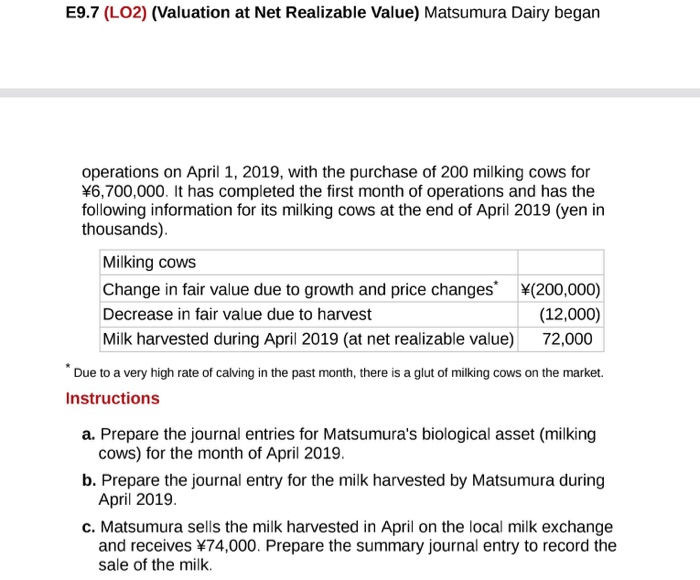

just need E9-7 thanks E9.7 (LO2) (Valuation at Net Realizable Value) Matsumura Dairy began operations on April 1, 2019, with the purchase of 200 mil

just need E9-7 thanks

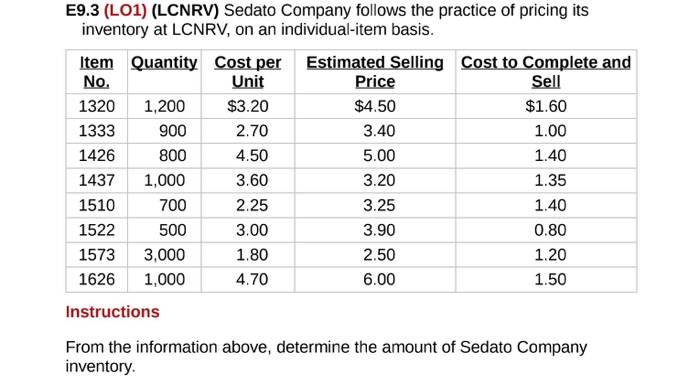

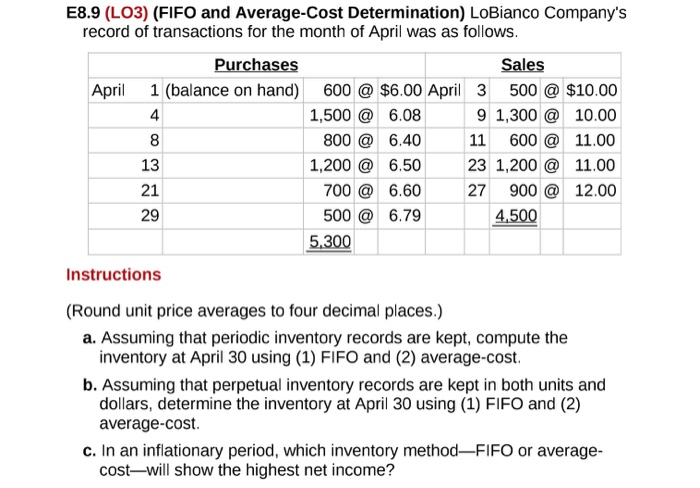

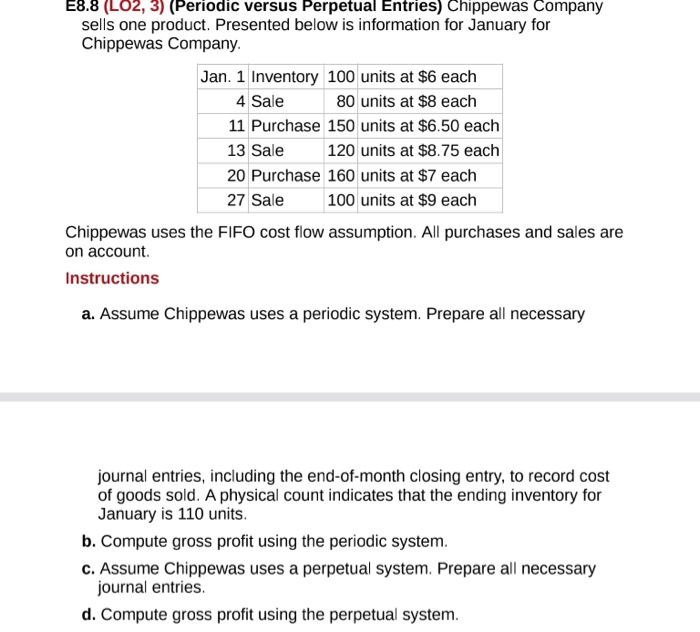

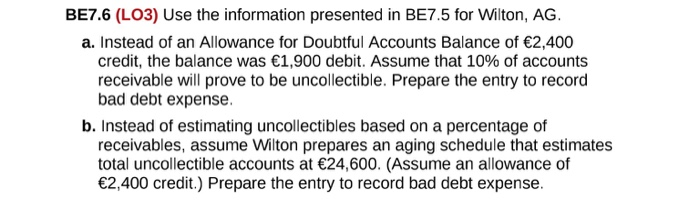

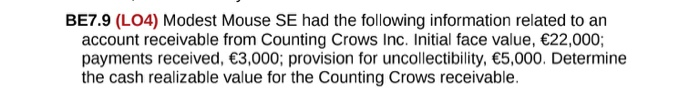

E9.7 (LO2) (Valuation at Net Realizable Value) Matsumura Dairy began operations on April 1, 2019, with the purchase of 200 mil king cows for 6,700,000. It has completed the first month of operations and has the following information for its milking cows at the end of April 2019 (yen in thousands) Milking cows Change in fair value due to growth and price changes (200,000) Decrease in fair value due to harvest (12,000) Milk harvested during April 2019 (at net realizable value) 72,000 Due to a very high rate of calving in the past month, there is a glut of milking cows on the market. Instructions a. Prepare the journal entries for Matsumura's biological asset (milking cows) for the month of April 2019. b. Prepare the journal entry for the milk harvested by Matsumura during April 2019. c. Matsumura sells the milk harvested in April on the local milk exchange and receives 74,000. Prepare the summary journal entry to record the sale of the milk. E9.3 (LO1) (LCNRV) Sedato Company follows the practice of pricing its inventory at LCNRV, on an individual-item basis. Estimated Selling Price Cost to Complete and Sell Item Quantity Cost per No. Unit $1.60 1320 1,200 $3.20 $4.50 1333 900 2.70 3.40 1.00 1426 800 4.50 5.00 1.40 1437 3.20 1,000 3.60 1.35 1.40 1510 700 2.25 3.25 3.90 0.80 1522 500 3.00 1573 3,000 1.80 2.50 1.20 1,000 6.00 1.50 1626 4.70 Instructions From the information above, determine the amount of Sedato Company inventory. E8.9 (LO3) (FIFO and Average-Cost Determination) LOBianco Company's record of transactions for the month of April was as follows. Purchases Sales 1 (balance on hand) 600@$6.00 April 3 April 500@ $10.00 1,500@6.08 9 1,300@ 10.00 4 11 600 800 6.40 11.00 13 1,200@6.50 23 1,200@ 11.00 21 700@6.60 27 900@ 12.00 500@6.79 4,500 5.300 Instructions (Round unit price averages to four decimal places.) a. Assuming that periodic inventory records are kept, compute the inventory at April 30 using (1) FIFO and (2) average-cost b. Assuming that perpetual inventory records are kept in both units and dollars, determine the inventory at April 30 using (1) FIFO and (2) average-cost c. In an inflationary period, which inventory method--FIFO or average- cost-will show the highest net income? E8.8 (LO2, 3) (Periodic versus Perpetual Entries) Chippewas Company sells one product. Presented below is information for January for Chippewas Company. Jan. 1 Inventory 100 units at $6 each 4 Sale 80 units at $8 each 11 Purchase 150 units at $6.50 each 13 Sale 120 units at $8.75 each 20 Purchase 160 units at $7 each 100 units at $9 each 27 Sale Chippewas uses the FIFO cost flow assumption. All purchases and sales are on account. Instructions a. Assume Chippewas uses a periodic system. Prepare all necessary journal entries, including the end-of-month closing entry, to record cost of goods sold. A physical count indicates that the ending inventory for January is 110 units. b. Compute gross profit using the periodic system. c. Assume Chippewas uses a perpetual system. Prepare all necessary journal entries. d. Compute gross profit using the perpetual system. BE7.6 (LO3) Use the information presented in BE7.5 for Wilton, AG. a. Instead of an Allowance for Doubtful Accounts Balance of 2,400 credit, the balance was 1,900 debit. Assume that 10% of accounts receivable will prove to be uncollectible. Prepare the entry to record bad debt expense. b. Instead of estimating uncollectibles based on a percentage of receivables, assume Wilton prepares an aging schedule that estimates total uncollectible accounts at 24,600. (Assume an allowance of 2,400 credit.) Prepare the entry to record bad debt expense BE7.9 (LO4) Modest Mouse SE had the following information related to an account receivable from Counting Crows Inc. Initial face value, 22,000; payments received, 3,000; provision for uncollectibility, 5,000. Determine the cash realizable value for the Counting Crows receivable. E9.7 (LO2) (Valuation at Net Realizable Value) Matsumura Dairy began operations on April 1, 2019, with the purchase of 200 mil king cows for 6,700,000. It has completed the first month of operations and has the following information for its milking cows at the end of April 2019 (yen in thousands) Milking cows Change in fair value due to growth and price changes (200,000) Decrease in fair value due to harvest (12,000) Milk harvested during April 2019 (at net realizable value) 72,000 Due to a very high rate of calving in the past month, there is a glut of milking cows on the market. Instructions a. Prepare the journal entries for Matsumura's biological asset (milking cows) for the month of April 2019. b. Prepare the journal entry for the milk harvested by Matsumura during April 2019. c. Matsumura sells the milk harvested in April on the local milk exchange and receives 74,000. Prepare the summary journal entry to record the sale of the milk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started