Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need federal withholding, thanks! Janice Wong receives an annual salary of $44,096, which is paid weekly. Her normal workweek is 40 hours, and she

Just need federal withholding, thanks!

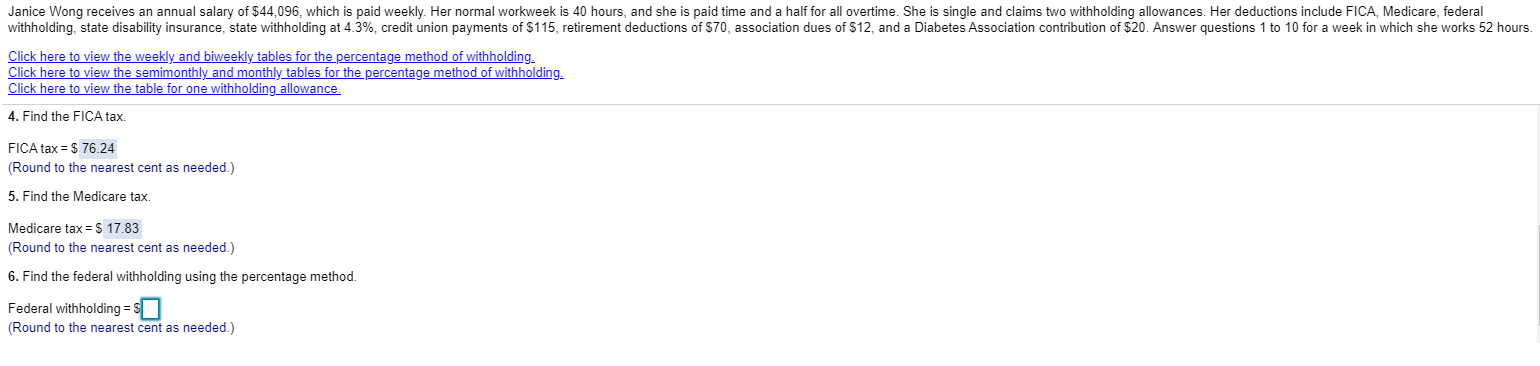

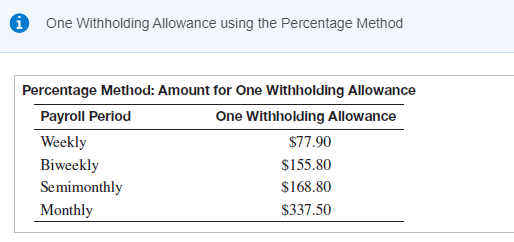

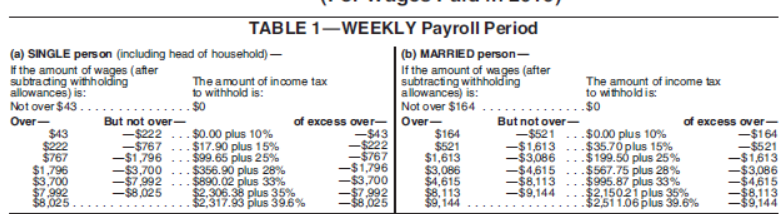

Janice Wong receives an annual salary of $44,096, which is paid weekly. Her normal workweek is 40 hours, and she is paid time and a half for all overtime. She is single and claims two withholding allowances. Her deductions include FICA, Medicare, federal withholding, state disability insurance, state withholding at 4.3%, credit union payments of $115, retirement deductions of $70, association dues of $12, and a Diabetes Association contribution of $20. Answer questions 1 to 10 for a week in which she works 52 hours. Click here to view the weekly and biweekly tables for the percentage method of withholding. Click here to view the semimonthly and monthly tables for the percentage method of withholding. Click here to view the table for one withholding allowance. 4. Find the FICA tax. FICA tax = $ 76.24 (Round to the nearest cent as needed.) 5. Find the Medicare tax. Medicare tax = $ 17.83 (Round to the nearest cent as needed.) 6. Find the federal withholding using the percentage method. Federal withholding=$1 (Round to the nearest cent as needed.) One Withholding Allowance using the Percentage Method Percentage Method: Amount for One Withholding Allowance Payroll Period One Withholding Allowance Weekly $77.90 Biweekly $155.80 Semimonthly $168.80 Monthly $337.50 TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withholdis: Not over $43.. Not over $164........... .$0 Over- But not over- of excess over Over- But not over- of excess over- $43 - $222 ... $0.00 plus 10% -$43 $164 -$521 ... $0.00 plus 10% -$164 $222 - $767 ... $17.90 plus 15% $521 -$1,613... $35.70 plus 15% -$521 $767 -$1,796 ... $99.65 plus 25% -5767 $1,613 -$3,086 ... $199.50 plus 25% -$1,613 $1,796 -$3,700 ... $356.90 plus 28% -$1,796 $3,086 -$4,615 ... $567.75 plus 28% - $3,086 $3,700 - $7 992 $890.02 plus 33% - $3,700 $4,615 -$8,113 ... $995.87 plus 33% -$4,615 -$8,025 $2,306.38 plus 35% $8,113 -$9,144... $2,150.21 plus 35% -$8.113 $2,317.93 plus 39.6% $9, 144 ... $2,511.06 plus 39.6% 9144 ...SO -$222 Janice Wong receives an annual salary of $44,096, which is paid weekly. Her normal workweek is 40 hours, and she is paid time and a half for all overtime. She is single and claims two withholding allowances. Her deductions include FICA, Medicare, federal withholding, state disability insurance, state withholding at 4.3%, credit union payments of $115, retirement deductions of $70, association dues of $12, and a Diabetes Association contribution of $20. Answer questions 1 to 10 for a week in which she works 52 hours. Click here to view the weekly and biweekly tables for the percentage method of withholding. Click here to view the semimonthly and monthly tables for the percentage method of withholding. Click here to view the table for one withholding allowance. 4. Find the FICA tax. FICA tax = $ 76.24 (Round to the nearest cent as needed.) 5. Find the Medicare tax. Medicare tax = $ 17.83 (Round to the nearest cent as needed.) 6. Find the federal withholding using the percentage method. Federal withholding=$1 (Round to the nearest cent as needed.) One Withholding Allowance using the Percentage Method Percentage Method: Amount for One Withholding Allowance Payroll Period One Withholding Allowance Weekly $77.90 Biweekly $155.80 Semimonthly $168.80 Monthly $337.50 TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withholdis: Not over $43.. Not over $164........... .$0 Over- But not over- of excess over Over- But not over- of excess over- $43 - $222 ... $0.00 plus 10% -$43 $164 -$521 ... $0.00 plus 10% -$164 $222 - $767 ... $17.90 plus 15% $521 -$1,613... $35.70 plus 15% -$521 $767 -$1,796 ... $99.65 plus 25% -5767 $1,613 -$3,086 ... $199.50 plus 25% -$1,613 $1,796 -$3,700 ... $356.90 plus 28% -$1,796 $3,086 -$4,615 ... $567.75 plus 28% - $3,086 $3,700 - $7 992 $890.02 plus 33% - $3,700 $4,615 -$8,113 ... $995.87 plus 33% -$4,615 -$8,025 $2,306.38 plus 35% $8,113 -$9,144... $2,150.21 plus 35% -$8.113 $2,317.93 plus 39.6% $9, 144 ... $2,511.06 plus 39.6% 9144 ...SO -$222Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started