Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just need g,h,j and k 1121 100% + To be done in the Excel File Many formulas are already created in the Excel File linking

just need g,h,j and k

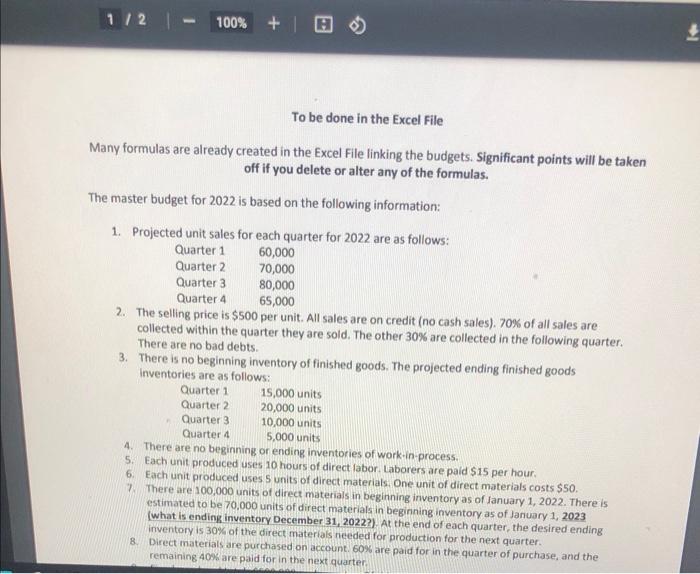

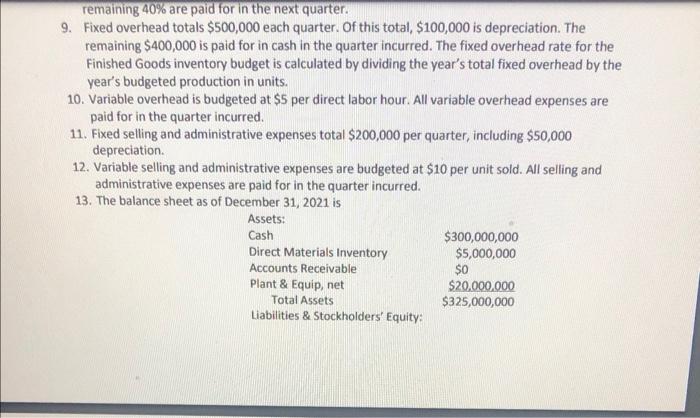

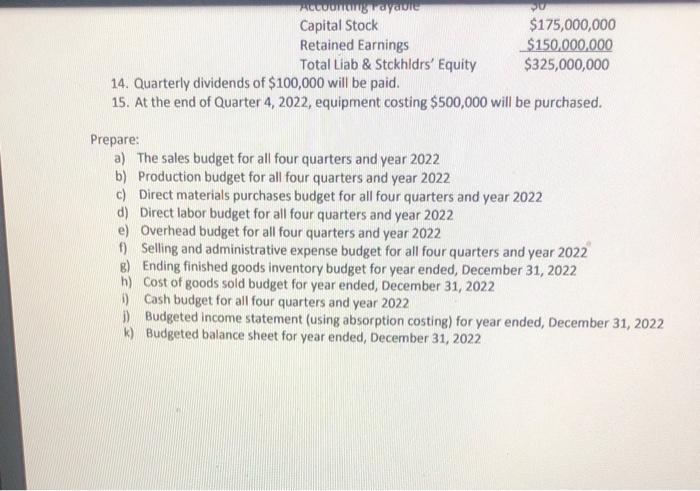

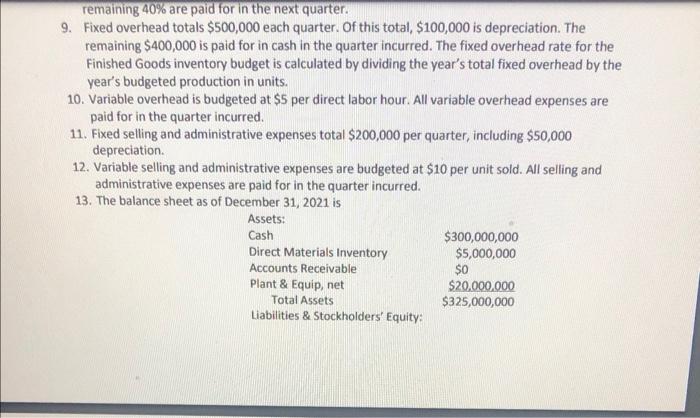

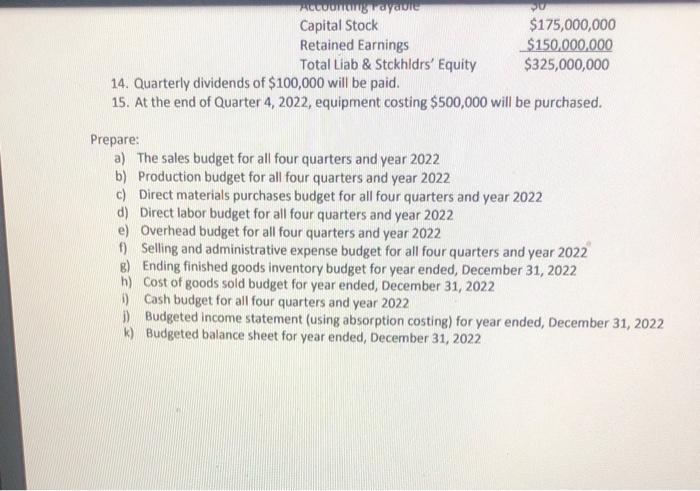

1121 100% + To be done in the Excel File Many formulas are already created in the Excel File linking the budgets. Significant points will be taken off if you delete or alter any of the formulas. The master budget for 2022 is based on the following information: 1. Projected unit sales for each quarter for 2022 are as follows: Quarter 1 60,000 Quarter 2 70,000 Quarter 3 80,000 Quarter 4 65,000 2. The selling price is $500 per unit. All sales are on credit (no cash sales). 70% of all sales are collected within the quarter they are sold. The other 30% are collected in the following quarter. There are no bad debts. 3. There is no beginning inventory of finished goods. The projected ending finished goods Inventories are as follows: Quarter 1 15,000 units Quarter 2 20,000 units Quarter 3 10,000 units Quarter 4 5,000 units 4. There are no beginning or ending inventories of work in process. 5. Each unit produced uses 10 hours of direct labor. Laborers are paid $15 per hour. 6. Each unit produced uses 5 units of direct materials. One unit of direct materials costs $50. 7. There are 100,000 units of direct materials in beginning inventory as of January 1, 2022. There is estimated to be 70,000 units of direct materials in beginning inventory as of January 1, 2023 (what is ending inventory December 31, 2022?) At the end of each quarter, the desired ending inventory is 30% of the direct materials needed for production for the next quarter. Direct materials are purchased on account. 60% are paid for in the quarter of purchase, and the remaining 40% are paid for in the next quarter. 8 remaining 40% are paid for in the next quarter. 9. Fixed overhead totals $500,000 each quarter of this total, $100,000 is depreciation. The remaining $400,000 is paid for in cash in the quarter incurred. The fixed overhead rate for the Finished Goods inventory budget is calculated by dividing the year's total fixed overhead by the year's budgeted production in units. 10. Variable overhead is budgeted at $5 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. 11. Fixed selling and administrative expenses total $200,000 per quarter, including $50,000 depreciation. 12. Variable selling and administrative expenses are budgeted at $10 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. 13. The balance sheet as of December 31, 2021 is Assets: Cash $300,000,000 Direct Materials Inventory $5,000,000 Accounts Receivable $0 Plant & Equip, net $20.000.000 Total Assets $325,000,000 Liabilities & Stockholders' Equity: ACCOUNTING yale Capital Stock $175,000,000 Retained Earnings $150,000,000 Total Liab & Stckhidrs' Equity $325,000,000 14. Quarterly dividends of $100,000 will be paid. 15. At the end of Quarter 4, 2022, equipment costing $500,000 will be purchased. Prepare: a) The sales budget for all four quarters and year 2022 b) Production budget for all four quarters and year 2022 c) Direct materials purchases budget for all four quarters and year 2022 d) Direct labor budget for all four quarters and year 2022 e) Overhead budget for all four quarters and year 2022 ) Selling and administrative expense budget for all four quarters and year 2022 e) Ending finished goods inventory budget for year ended, December 31, 2022 h) Cost of goods sold budget for year ended, December 31, 2022 0 Cash budget for all four quarters and year 2022 D) Budgeted income statement (using absorption costing) for year ended, December 31, 2022 k) Budgeted balance sheet for year ended, December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started