Answered step by step

Verified Expert Solution

Question

1 Approved Answer

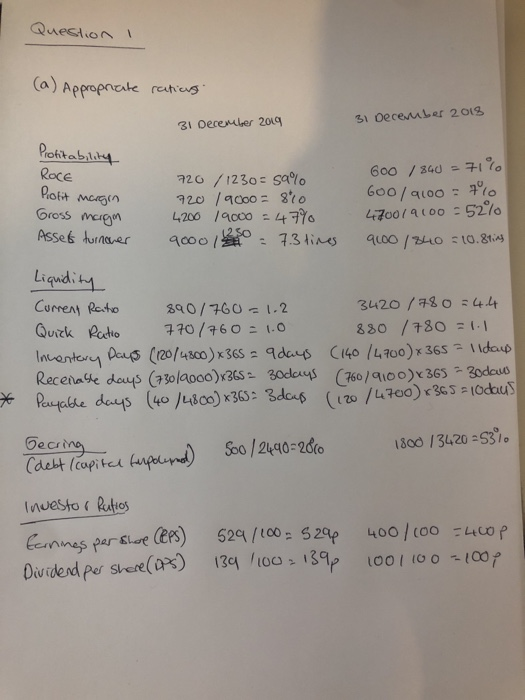

JUST NEED HELP WITH B C AND D PLEASE , IVE ATTACHED THE ANDWERS FOR PART A QUESTIONS 1. Jane Peters is an investor and

JUST NEED HELP WITH B C AND D PLEASE , IVE ATTACHED THE ANDWERS FOR PART A

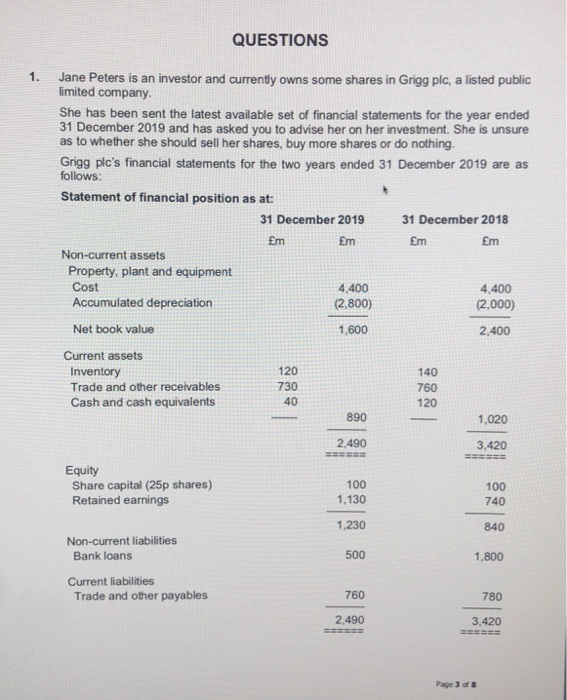

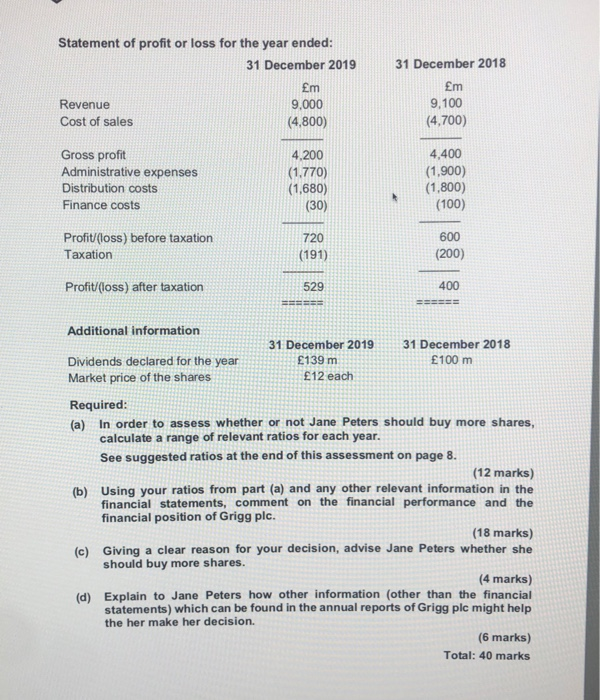

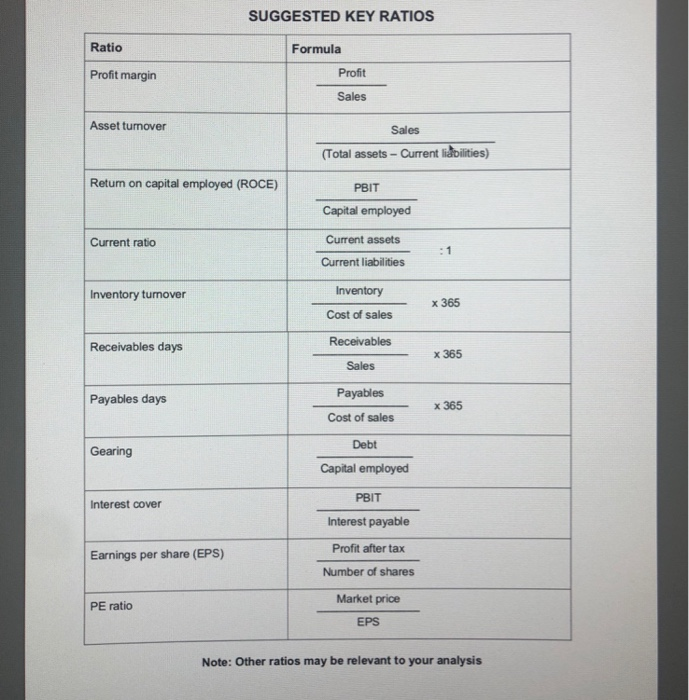

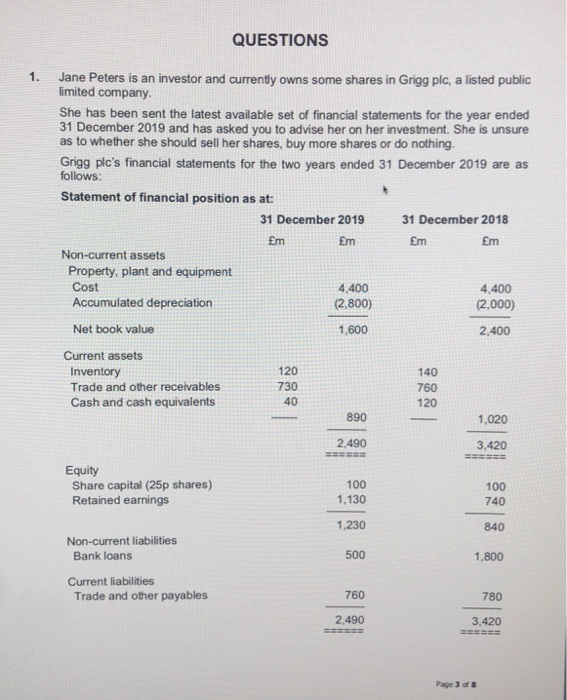

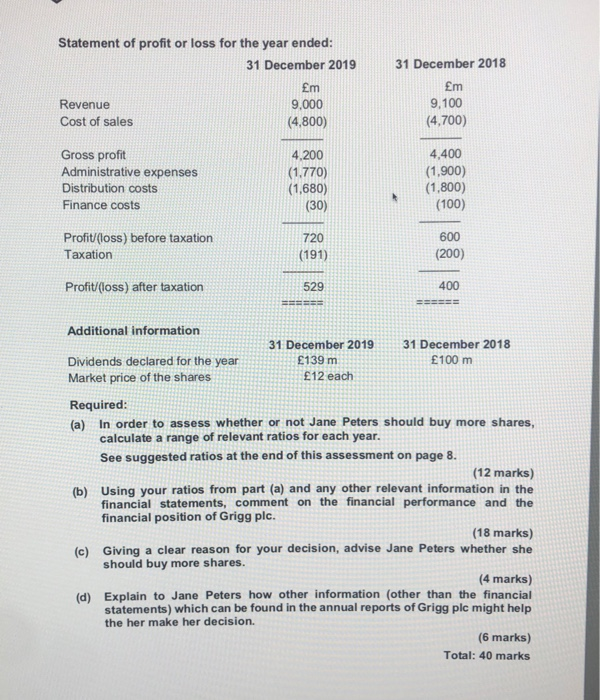

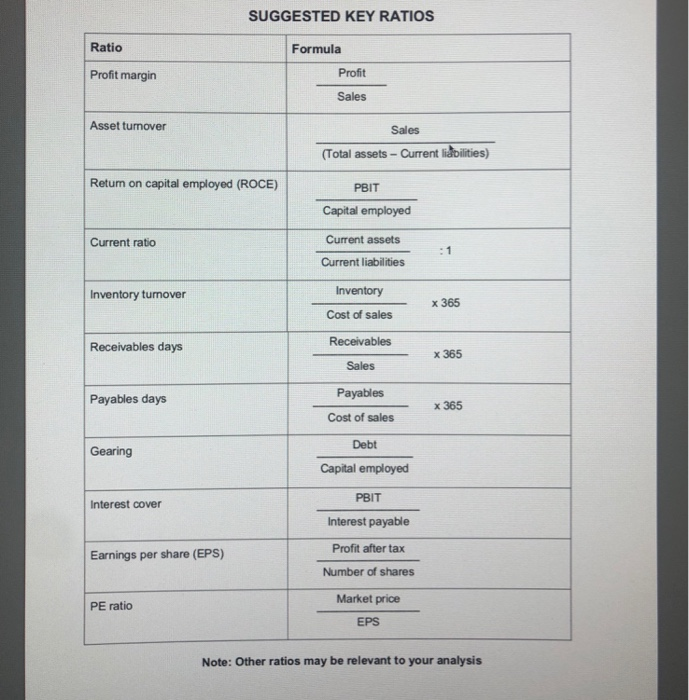

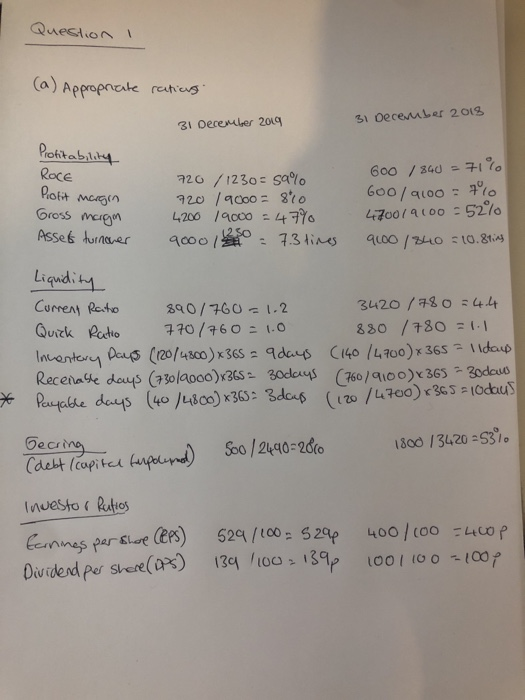

QUESTIONS 1. Jane Peters is an investor and currently owns some shares in Grigg plc, a listed public limited company She has been sent the latest available set of financial statements for the year ended 31 December 2019 and has asked you to advise her on her investment. She is unsure as to whether she should sell her shares, buy more shares or do nothing. Grigg plc's financial statements for the two years ended 31 December 2019 are as follows: Statement of financial position as at: 31 December 2019 31 December 2018 Em m m Em Non-current assets Property, plant and equipment Cost 4,400 4,400 Accumulated depreciation (2,800) (2,000) Net book value 1,600 2,400 Current assets Inventory 120 140 Trade and other receivables 730 760 Cash and cash equivalents 40 120 890 1.020 2,490 SEEEEE 3,420 Equity Share capital (25p shares) Retained earings 100 1,130 100 740 1.230 840 500 1.800 Non-current liabilities Bank loans Current liabilities Trade and other payables 760 780 2,490 3,420 Page 3 of 8 Statement of profit or loss for the year ended: 31 December 2019 m Revenue 9,000 Cost of sales (4,800) 31 December 2018 m 9,100 (4,700) Gross profit Administrative expenses Distribution costs Finance costs 4,200 (1.770) (1,680) (30) 4,400 (1,900) (1,800) (100) Profit/(loss) before taxation Taxation 720 (191) 600 (200) Profit/(loss) after taxation 529 400 EES ==== Additional information 31 December 2019 31 December 2018 Dividends declared for the year 139 m 100 m Market price of the shares 12 each Required: (a) In order to assess whether or not Jane Peters should buy more shares, calculate a range of relevant ratios for each year. See suggested ratios at the end of this assessment on page 8. (12 marks) (b) Using your ratios from part (a) and any other relevant information in the financial statements, comment on the financial performance and the financial position of Grigg plc. (18 marks) (c) Giving a clear reason for your decision, advise Jane Peters whether she should buy more shares. (4 marks) (d) Explain to Jane Peters how other information (other than the financial statements) which can be found in the annual reports of Grigg plc might help the her make her decision. (6 marks) Total: 40 marks SUGGESTED KEY RATIOS Ratio Formula Profit margin Profit Sales Asset turnover Sales (Total assets - Current liabilities) Retum on capital employed (ROCE) PBIT Capital employed Current ratio Current assets Current liabilities :1 Inventory tumover x 365 Inventory Cost of sales Receivables Receivables days X 365 Sales Payables days Payables Cost of sales x 365 Debt Gearing Capital employed PBIT Interest cover Interest payable Profit after tax Earnings per share (EPS) Number of shares PE ratio Market price EPS Note: Other ratios may be relevant to your analysis Question ! (a) Appropriate ratius 31 December 2018 31 December 2009 Profitability ROCE Profit margin Gross margm 720 /1230 = 59% 120 / qpo = 4200 19000 = 47% 12 50 9000 : 7.3 times 600 1840 = 71% 600 / 2100 = 7% 4700/4000 - 52% 9600/240 310.81ing Asset turnover Liquidity Current Ratio 890/760 = 1.2 3420 /780 = 4.4 Quick Ratio 770/760 = 1.0 880 / 780 = 1.1 Inventary Days (120/4800)x36S = 9 days (140 /4700)x365 = 1ldaus Recenaste days (73019000)x365 30days (760/9100) x 365 - 30dows * Payable days (40/4800) x365= 3das (120/4700) +365 = 10daus Gearing Soo/2490=2860 1800 13420 -53% (debt (capital forpolered) Investor Ratios Earnings per share Cleps) Dividend per share (DPS) 529/100 5292 400/100 =4000 139 /100, 139p 1001100 -1007 QUESTIONS 1. Jane Peters is an investor and currently owns some shares in Grigg plc, a listed public limited company She has been sent the latest available set of financial statements for the year ended 31 December 2019 and has asked you to advise her on her investment. She is unsure as to whether she should sell her shares, buy more shares or do nothing. Grigg plc's financial statements for the two years ended 31 December 2019 are as follows: Statement of financial position as at: 31 December 2019 31 December 2018 Em m m Em Non-current assets Property, plant and equipment Cost 4,400 4,400 Accumulated depreciation (2,800) (2,000) Net book value 1,600 2,400 Current assets Inventory 120 140 Trade and other receivables 730 760 Cash and cash equivalents 40 120 890 1.020 2,490 SEEEEE 3,420 Equity Share capital (25p shares) Retained earings 100 1,130 100 740 1.230 840 500 1.800 Non-current liabilities Bank loans Current liabilities Trade and other payables 760 780 2,490 3,420 Page 3 of 8 Statement of profit or loss for the year ended: 31 December 2019 m Revenue 9,000 Cost of sales (4,800) 31 December 2018 m 9,100 (4,700) Gross profit Administrative expenses Distribution costs Finance costs 4,200 (1.770) (1,680) (30) 4,400 (1,900) (1,800) (100) Profit/(loss) before taxation Taxation 720 (191) 600 (200) Profit/(loss) after taxation 529 400 EES ==== Additional information 31 December 2019 31 December 2018 Dividends declared for the year 139 m 100 m Market price of the shares 12 each Required: (a) In order to assess whether or not Jane Peters should buy more shares, calculate a range of relevant ratios for each year. See suggested ratios at the end of this assessment on page 8. (12 marks) (b) Using your ratios from part (a) and any other relevant information in the financial statements, comment on the financial performance and the financial position of Grigg plc. (18 marks) (c) Giving a clear reason for your decision, advise Jane Peters whether she should buy more shares. (4 marks) (d) Explain to Jane Peters how other information (other than the financial statements) which can be found in the annual reports of Grigg plc might help the her make her decision. (6 marks) Total: 40 marks SUGGESTED KEY RATIOS Ratio Formula Profit margin Profit Sales Asset turnover Sales (Total assets - Current liabilities) Retum on capital employed (ROCE) PBIT Capital employed Current ratio Current assets Current liabilities :1 Inventory tumover x 365 Inventory Cost of sales Receivables Receivables days X 365 Sales Payables days Payables Cost of sales x 365 Debt Gearing Capital employed PBIT Interest cover Interest payable Profit after tax Earnings per share (EPS) Number of shares PE ratio Market price EPS Note: Other ratios may be relevant to your analysis Question ! (a) Appropriate ratius 31 December 2018 31 December 2009 Profitability ROCE Profit margin Gross margm 720 /1230 = 59% 120 / qpo = 4200 19000 = 47% 12 50 9000 : 7.3 times 600 1840 = 71% 600 / 2100 = 7% 4700/4000 - 52% 9600/240 310.81ing Asset turnover Liquidity Current Ratio 890/760 = 1.2 3420 /780 = 4.4 Quick Ratio 770/760 = 1.0 880 / 780 = 1.1 Inventary Days (120/4800)x36S = 9 days (140 /4700)x365 = 1ldaus Recenaste days (73019000)x365 30days (760/9100) x 365 - 30dows * Payable days (40/4800) x365= 3das (120/4700) +365 = 10daus Gearing Soo/2490=2860 1800 13420 -53% (debt (capital forpolered) Investor Ratios Earnings per share Cleps) Dividend per share (DPS) 529/100 5292 400/100 =4000 139 /100, 139p 1001100 -1007

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started