Answered step by step

Verified Expert Solution

Question

1 Approved Answer

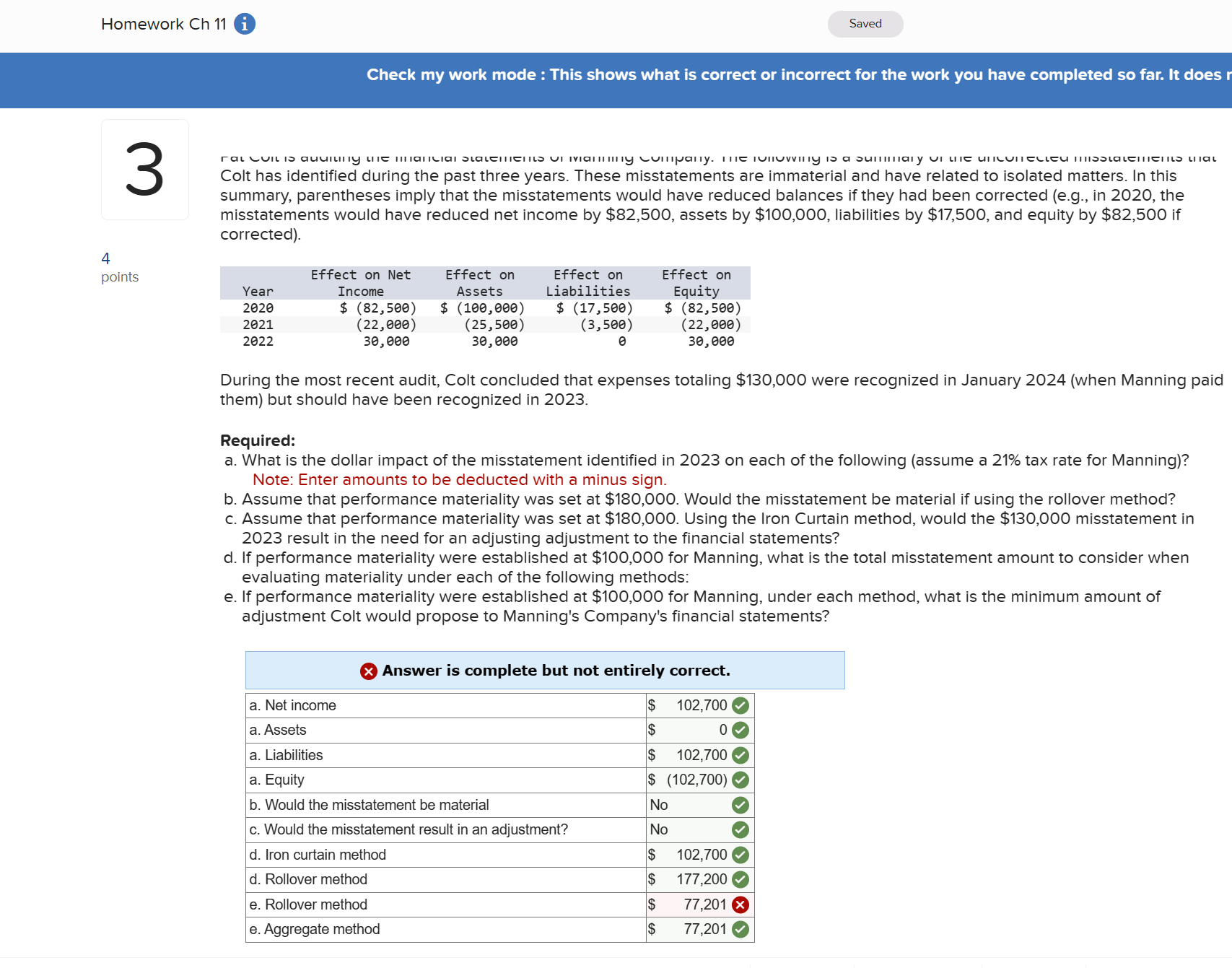

JUST NEED HELP WITH e . Pat Colt is auditing the financial statements of Manning Company. The following is a summary of the uncorrected misstatements

JUST NEED HELP WITH e Pat Colt is auditing the financial statements of Manning Company. The following is a summary of the uncorrected misstatements that Colt has identified during the past three years. These misstatements are immaterial and have related to isolated matters. In this summary, parentheses imply that the misstatements would have reduced balances if they had been corrected eg in the misstatements would have reduced net income by $ assets by $ liabilities by $ and equity by $ if corrected

Year Effect on Net Income Effect on Assets Effect on Liabilities Effect on Equity

$ $ $ $

During the most recent audit, Colt concluded that expenses totaling $ were recognized in January when Manning paid them but should have been recognized in

Required:

What is the dollar impact of the misstatement identified in on each of the following assume a tax rate for Manning

Note: Enter amounts to be deducted with a minus sign.

Assume that performance materiality was set at $ Would the misstatement be material if using the rollover method?

Assume that performance materiality was set at $ Using the Iron Curtain method, would the $ misstatement in result in the need for an adjusting adjustment to the financial statements?

If performance materiality were established at $ for Manning, what is the total misstatement amount to consider when evaluating materiality under each of the following methods:

If performance materiality were established at $ for Manning, under each method, what is the minimum amount of adjustment Colt would propose to Manning's Company's financial statements?Colt has identified during the past three years. These misstatements are immaterial and have related to isolated matters. In this

summary, parentheses imply that the misstatements would have reduced balances if they had been corrected eg in the

misstatements would have reduced net income by $ assets by $ liabilities by $ and equity by $ if

corrected

During the most recent audit, Colt concluded that expenses totaling $ were recognized in January when Manning paid

them but should have been recognized in

Required:

a What is the dollar impact of the misstatement identified in on each of the following assume a tax rate for Manning

Note: Enter amounts to be deducted with a minus sign.

b Assume that performance materiality was set at $ Would the misstatement be material if using the rollover method?

c Assume that performance materiality was set at $ Using the Iron Curtain method, would the $ misstatement in

result in the need for an adjusting adjustment to the financial statements?

d If performance materiality were established at $ for Manning, what is the total misstatement amount to consider when

evaluating materiality under each of the following methods:

e If performance materiality were established at $ for Manning, under each method, what is the minimum amount of

adjustment Colt would propose to Manning's Company's financial statements?

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started