JUST NEED LAST PART ANSWERED PLEASE USE EXCEL FORMULA THANKS

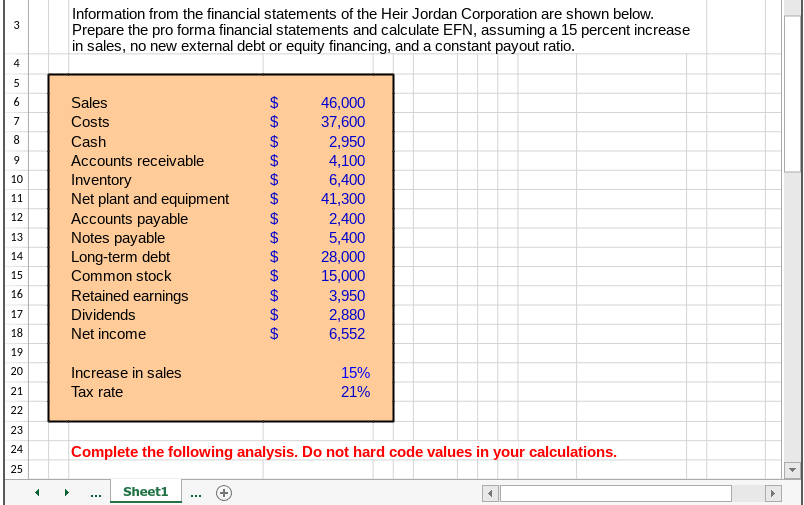

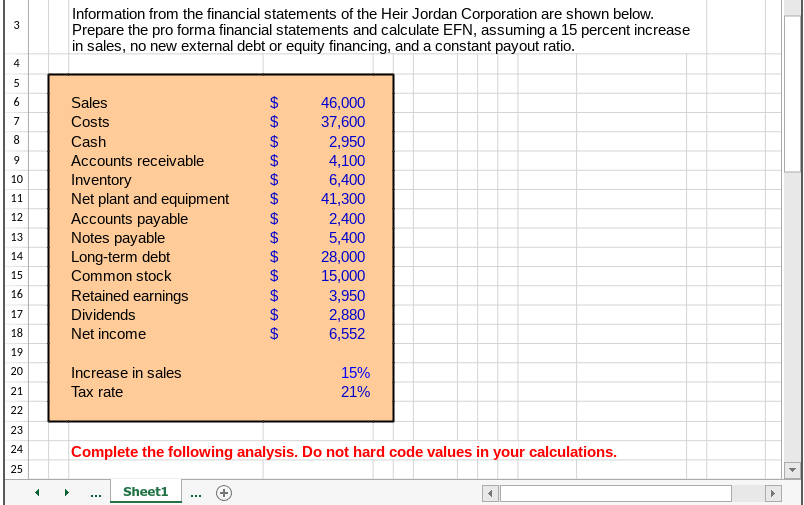

Information from the financial statements of the Heir Jordan Corporation are shown below Prepare the pro forma financial statements and calculate EFN , assuming a 15 percent increase in sales, no new external debt or equity financing , and a constant payout ratio

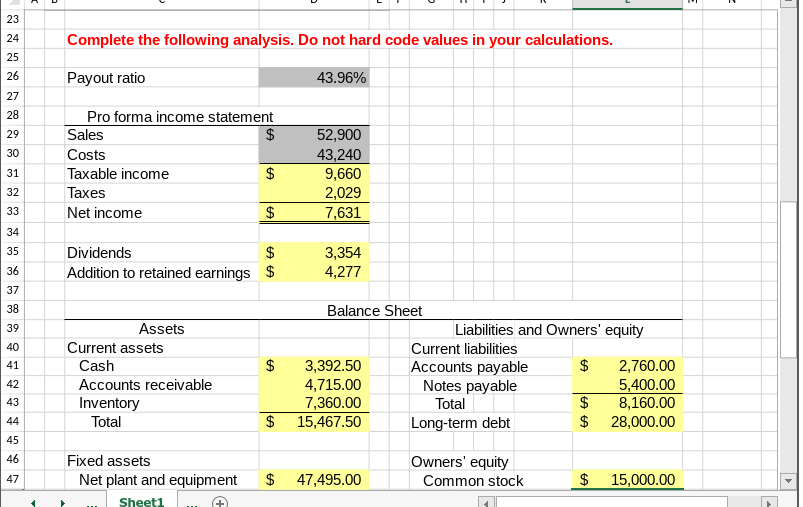

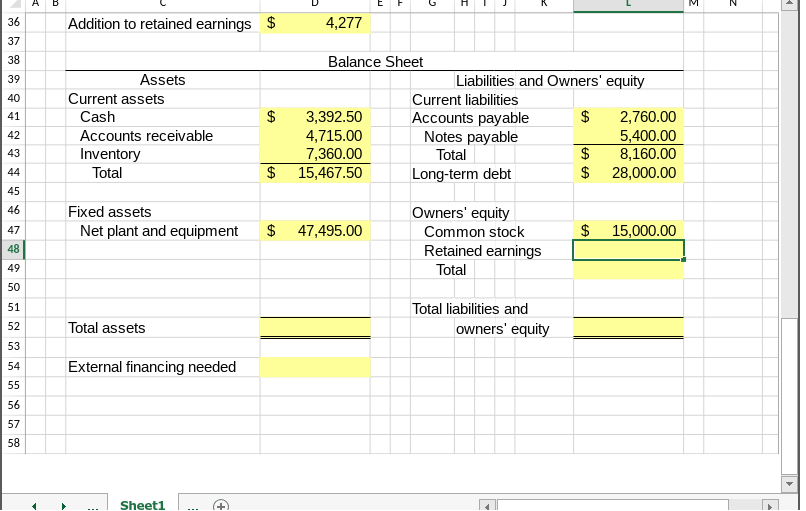

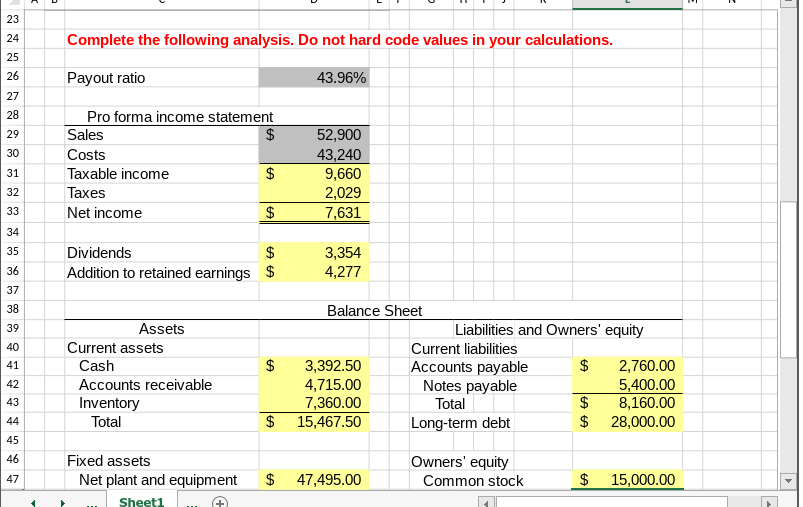

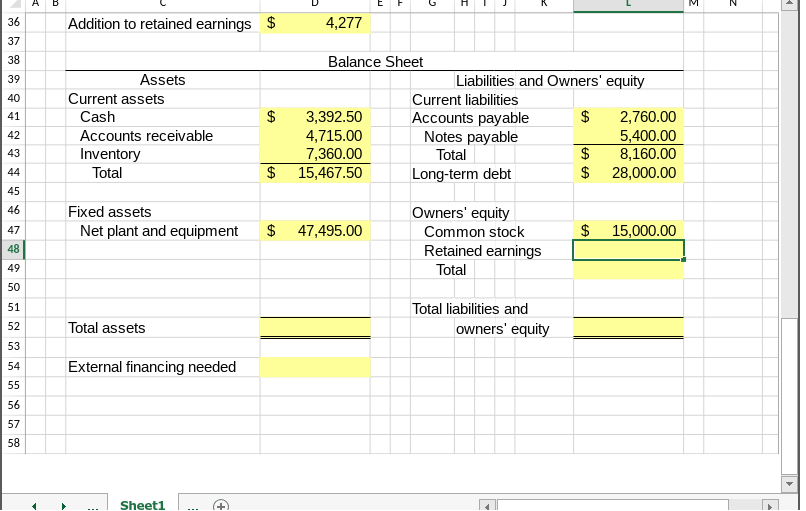

Information from the financial statements of the Heir Jordan Corporation are shown below. Prepare the pro forma financial statements and calculate EFN, assuming a 15 percent increase in sales, no new external debt or equity financing, and a constant payout ratio. 3 4 5 $ 6 Sales 46,000 37,600 Costs 7 $ 8 Cash 2,950 4,100 6,400 41,300 Accounts receivable 9 Inventory Net plant and equipment Accounts payable Notes payable Long-term debt Common stock 10 11 12 2,400 5,400 13 28,000 14 15,000 15 16 Retained earnings 3,950 2,880 6,552 Dividends 17 18 Net income 19 20 Increase in sales 15% Tax rate 21% 21 22 23 24 Complete the following analysis. Do not hard code values in your calculations. 25 Sheet1 23 24 Complete the following analysis. Do not hard code values in your calculations. 25 26 Payout ratio 43.96% 27 28 Pro forma income statement Sales 52,900 29 30 Costs 43,240 9,660 2,029 $ Taxable income 31 Taxes 32 $ 33 Net income 7,631 34 $ 35 Dividends 3,354 4,277 $ 36 Addition to retained earnings 37 38 Balance Sheet Liabilities and Owners' equity Assets 39 Current assets 40 Current liabilities 2,760.00 5,400.00 8,160.00 28,000.00 $ 3,392.50 4,715.00 7,360.00 Accounts payable Notes payable $ Cash 41 Accounts receivable 42 $ $ Inventory Total 43 Total $ 15,467.50 Long-term debt 44 45 46 Fixed assets Owners' equity $ 47,495.00 Net plant and equipment $ 15,000.00 47 Common stock Sheet1 $ 36 Addition to retained earnings 4,277 37 38 Balance Sheet Assets Liabilities and Owners' equity 39 Current assets Current liabilities Accounts payable Notes payable 40 $ $ Cash 3,392.50 2,760.00 5,400.00 8,160.00 28,000.00 41 Accounts receivable 4,715.00 7,360.00 15,467.50 42 $ Inventory 43 Total $ Total Long-term debt 44 45 46 Fixed assets Owners' equity $ 47,495.00 $ Net plant and equipment 15,000.00 47 Common stock Retained earnings 48 49 Total 50 51 Total liabilities and Total assets owners' equity 52 53 External financing needed 54 55 56 57 58 Sheet1 LA Information from the financial statements of the Heir Jordan Corporation are shown below. Prepare the pro forma financial statements and calculate EFN, assuming a 15 percent increase in sales, no new external debt or equity financing, and a constant payout ratio. 3 4 5 $ 6 Sales 46,000 37,600 Costs 7 $ 8 Cash 2,950 4,100 6,400 41,300 Accounts receivable 9 Inventory Net plant and equipment Accounts payable Notes payable Long-term debt Common stock 10 11 12 2,400 5,400 13 28,000 14 15,000 15 16 Retained earnings 3,950 2,880 6,552 Dividends 17 18 Net income 19 20 Increase in sales 15% Tax rate 21% 21 22 23 24 Complete the following analysis. Do not hard code values in your calculations. 25 Sheet1 23 24 Complete the following analysis. Do not hard code values in your calculations. 25 26 Payout ratio 43.96% 27 28 Pro forma income statement Sales 52,900 29 30 Costs 43,240 9,660 2,029 $ Taxable income 31 Taxes 32 $ 33 Net income 7,631 34 $ 35 Dividends 3,354 4,277 $ 36 Addition to retained earnings 37 38 Balance Sheet Liabilities and Owners' equity Assets 39 Current assets 40 Current liabilities 2,760.00 5,400.00 8,160.00 28,000.00 $ 3,392.50 4,715.00 7,360.00 Accounts payable Notes payable $ Cash 41 Accounts receivable 42 $ $ Inventory Total 43 Total $ 15,467.50 Long-term debt 44 45 46 Fixed assets Owners' equity $ 47,495.00 Net plant and equipment $ 15,000.00 47 Common stock Sheet1 $ 36 Addition to retained earnings 4,277 37 38 Balance Sheet Assets Liabilities and Owners' equity 39 Current assets Current liabilities Accounts payable Notes payable 40 $ $ Cash 3,392.50 2,760.00 5,400.00 8,160.00 28,000.00 41 Accounts receivable 4,715.00 7,360.00 15,467.50 42 $ Inventory 43 Total $ Total Long-term debt 44 45 46 Fixed assets Owners' equity $ 47,495.00 $ Net plant and equipment 15,000.00 47 Common stock Retained earnings 48 49 Total 50 51 Total liabilities and Total assets owners' equity 52 53 External financing needed 54 55 56 57 58 Sheet1 LA