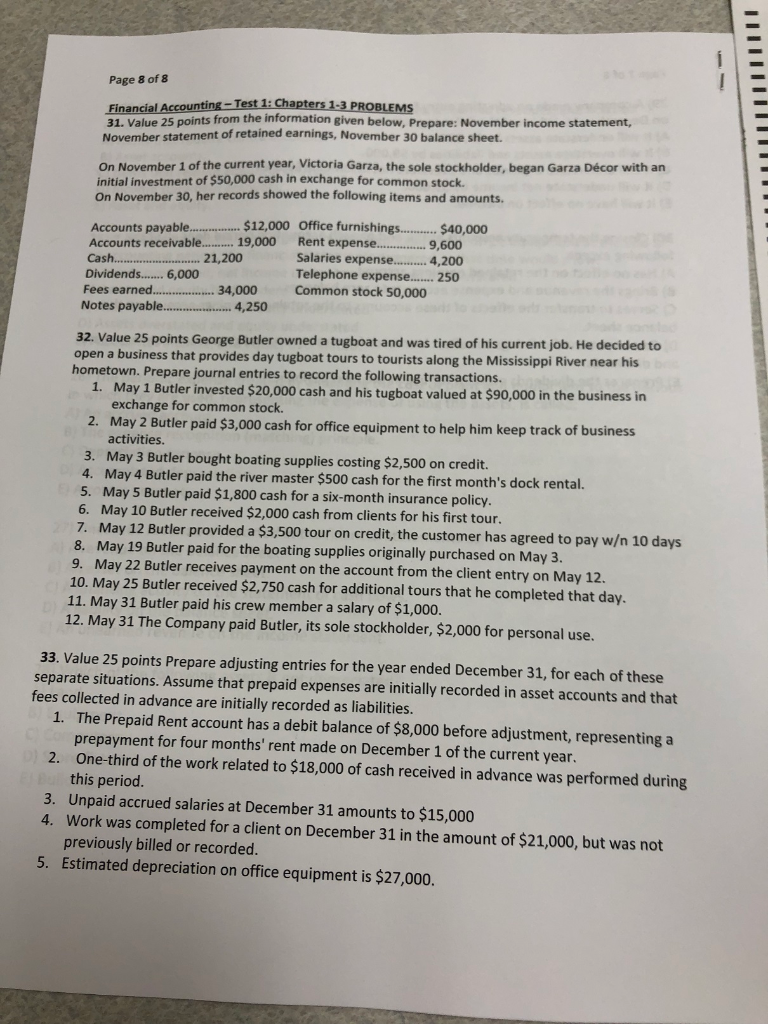

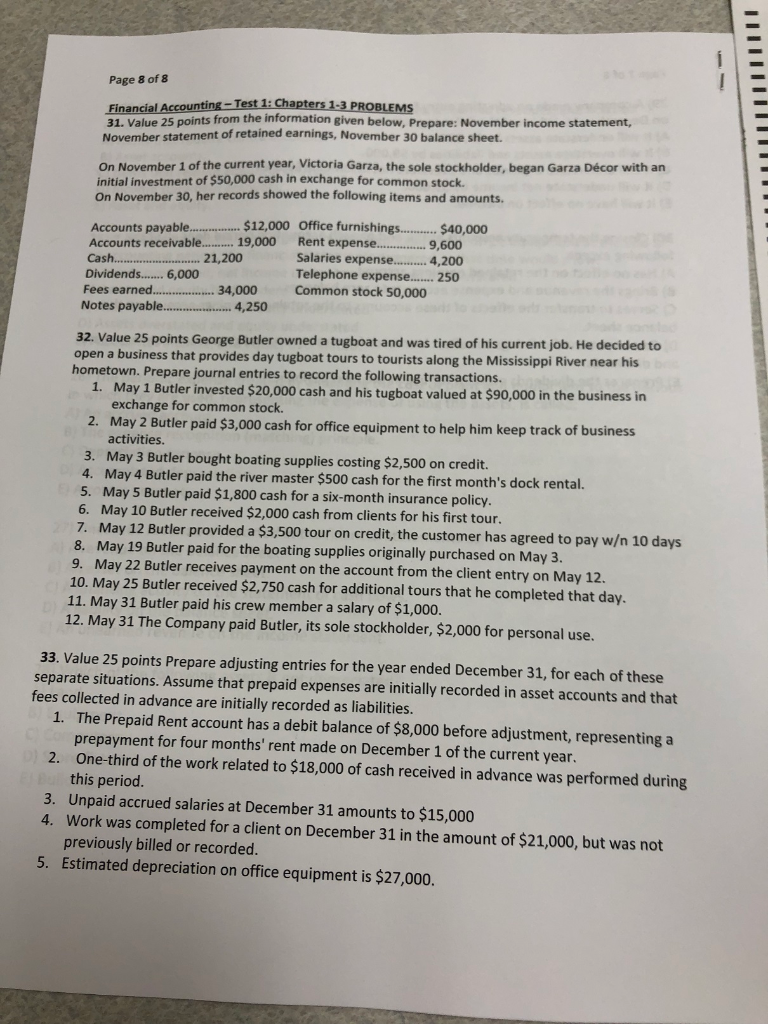

Just need number #33, thanks!

Page 8 of8 31- Value 25 points from the information given below, Prepare: November income statement, November statement of retained earnings, November 30 balance sheet On November 1 of the current year, Victoria Garza, the sole stockholder, began Garza Dcor with an initial investment of $50,000 cash in exchange for common stock. On November 30, her records showed the following items and amounts. $12,000 Office furnishings... $40,000 Rent expense....9.00 Accounts payabe. Accounts receivable Cash. 6,000 19,000 Salaries expens... 4,200 Telephone expense.. 250 .. 21,200 Fees earne.. 34,000Common stock 50,000 4,250 32. Value 25 points George Butler owned a tugboat and was tired of his current job. He decided to open a business that provides day tugboat tours to tourists along the Mississippi River near his hometown. Prepare journal entries to record the following transactions. 1. May 1 Butler invested $20,000 cash and his tugboat valued at $90,000 in the business in exchange for common stock. 2. May 2 Butler paid $3,000 cash for office equipment to help him keep track of business activities 3. May 3 Butler bought boating supplies costing $2,500 on credit. 4. May 4 Butler paid the river master $500 cash for the first month's dock rental. May 5 Butler paid $1,800 cash for a six-month insurance policy 6. 5. May 10 Butler received $2,000 cash from clients for his first tour 7. May 12 Butler provided a $3,500 tour on credit, the customer has agreed to pay w 10 days 8. May 19 Butler paid for the boating supplies originally purchased on May 3. 9. May 22 Butler receives payment on the account from the client entry on May 12 10. May 25 Butler received $2,750 cash for additional tours that he completed that day. 11. May 31 Butler paid his crew member a salary of $1,000. 12. May 31 The Company paid Butler, its sole stockholder, $2,000 for personal use. 33. Value 25 points Prepare adjusting entries for the year ended December 31, for each of these separate situations. Assume that prepaid expenses are initially recorded in asset accounts and that fees collected in advance are initially recorded as liabilities The Prepaid Rent account has a debit balance of $8,000 before adjustment, representing a prepayment for four months' rent made on December 1 of the current year. 1. One-third of the work related to $18,000 of cash received in advance was performed during this period. 2. 3. Unpaid accrued salaries at December 31 amounts to $15,000 4. Work was completed for a client on December 31 in the amount of $21,000, but was not previously billed or recorded. Estimated depreciation on office equipment is $27,000. 5. Page 8 of8 31- Value 25 points from the information given below, Prepare: November income statement, November statement of retained earnings, November 30 balance sheet On November 1 of the current year, Victoria Garza, the sole stockholder, began Garza Dcor with an initial investment of $50,000 cash in exchange for common stock. On November 30, her records showed the following items and amounts. $12,000 Office furnishings... $40,000 Rent expense....9.00 Accounts payabe. Accounts receivable Cash. 6,000 19,000 Salaries expens... 4,200 Telephone expense.. 250 .. 21,200 Fees earne.. 34,000Common stock 50,000 4,250 32. Value 25 points George Butler owned a tugboat and was tired of his current job. He decided to open a business that provides day tugboat tours to tourists along the Mississippi River near his hometown. Prepare journal entries to record the following transactions. 1. May 1 Butler invested $20,000 cash and his tugboat valued at $90,000 in the business in exchange for common stock. 2. May 2 Butler paid $3,000 cash for office equipment to help him keep track of business activities 3. May 3 Butler bought boating supplies costing $2,500 on credit. 4. May 4 Butler paid the river master $500 cash for the first month's dock rental. May 5 Butler paid $1,800 cash for a six-month insurance policy 6. 5. May 10 Butler received $2,000 cash from clients for his first tour 7. May 12 Butler provided a $3,500 tour on credit, the customer has agreed to pay w 10 days 8. May 19 Butler paid for the boating supplies originally purchased on May 3. 9. May 22 Butler receives payment on the account from the client entry on May 12 10. May 25 Butler received $2,750 cash for additional tours that he completed that day. 11. May 31 Butler paid his crew member a salary of $1,000. 12. May 31 The Company paid Butler, its sole stockholder, $2,000 for personal use. 33. Value 25 points Prepare adjusting entries for the year ended December 31, for each of these separate situations. Assume that prepaid expenses are initially recorded in asset accounts and that fees collected in advance are initially recorded as liabilities The Prepaid Rent account has a debit balance of $8,000 before adjustment, representing a prepayment for four months' rent made on December 1 of the current year. 1. One-third of the work related to $18,000 of cash received in advance was performed during this period. 2. 3. Unpaid accrued salaries at December 31 amounts to $15,000 4. Work was completed for a client on December 31 in the amount of $21,000, but was not previously billed or recorded. Estimated depreciation on office equipment is $27,000. 5