Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just need number 4 already did 1-3 c. Consider the 9.5% senior secured notes due February 2011 . i. What is the face value (i.e.

just need number 4 already did 1-3

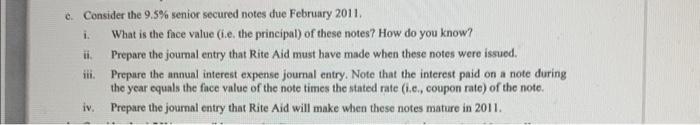

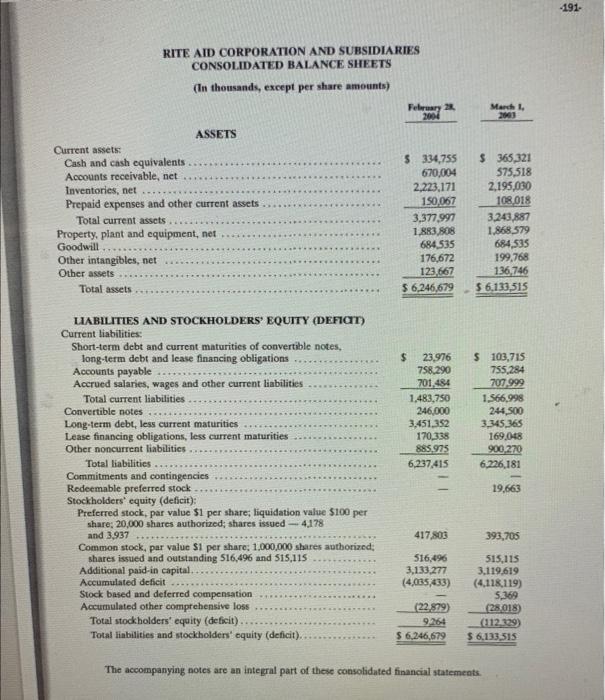

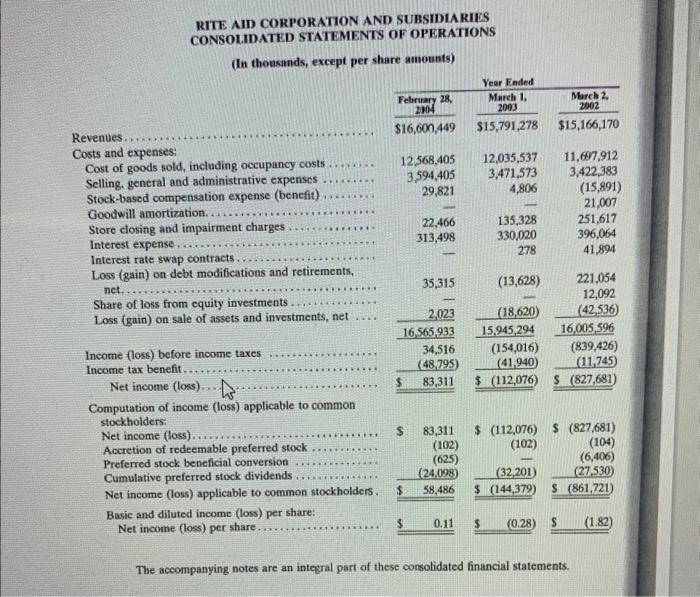

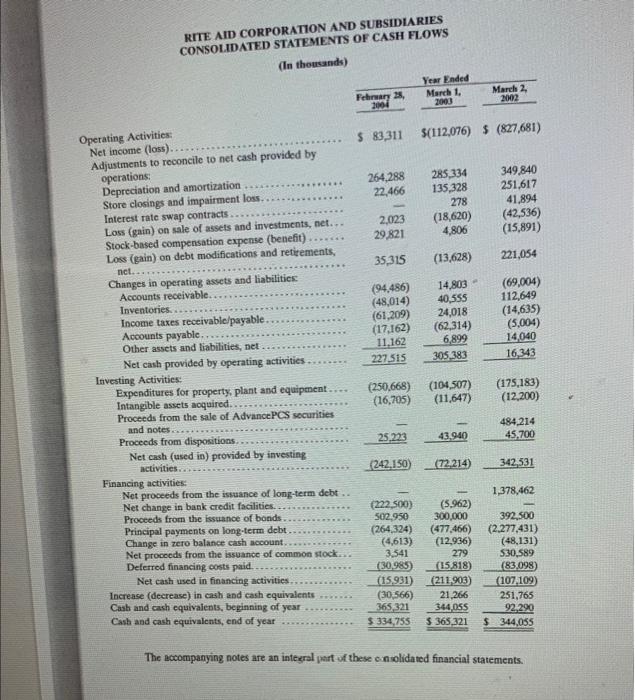

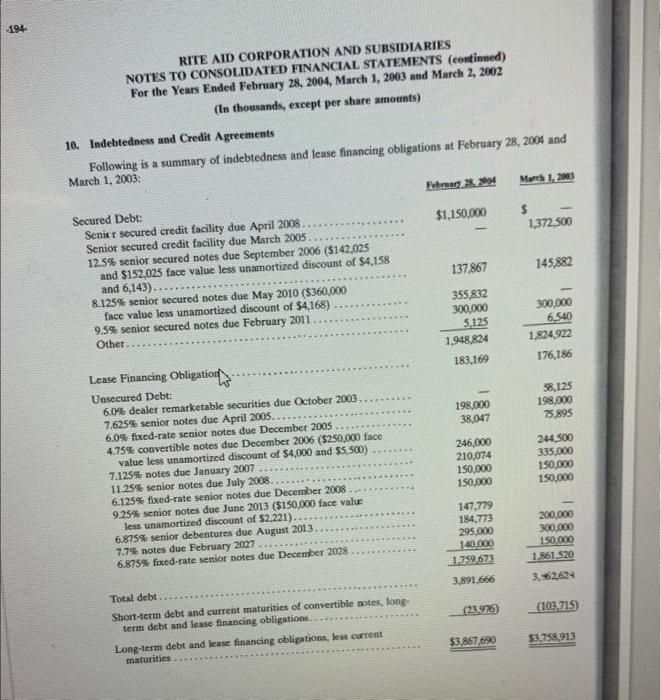

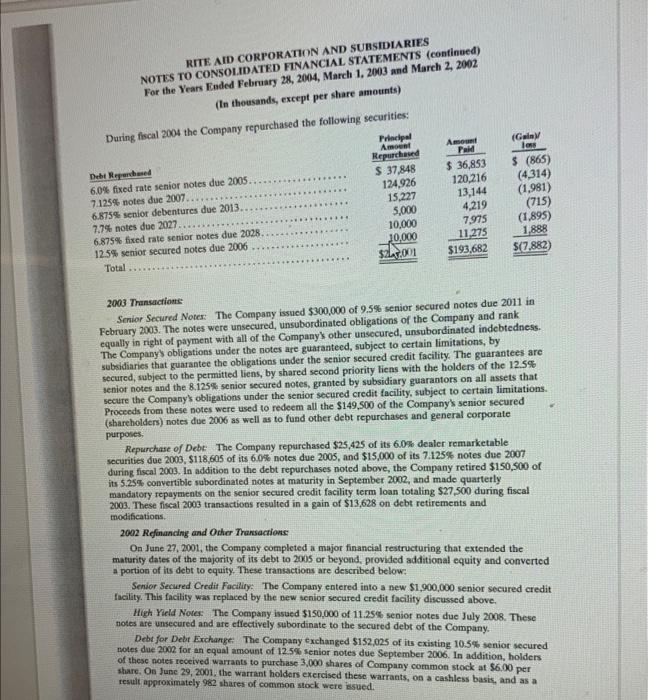

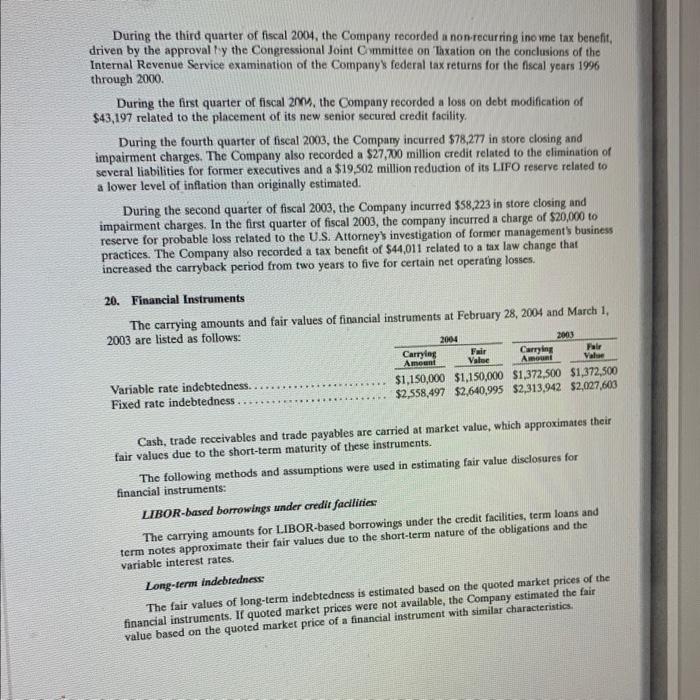

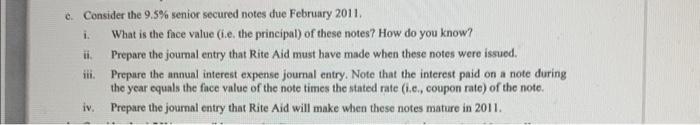

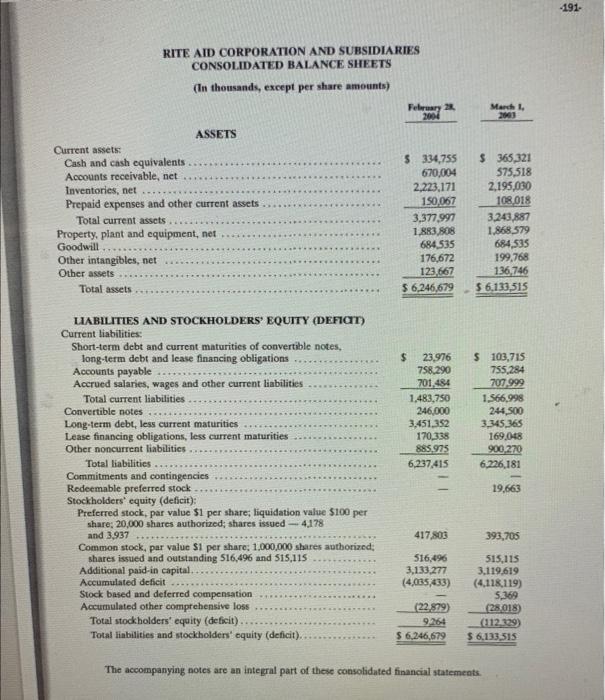

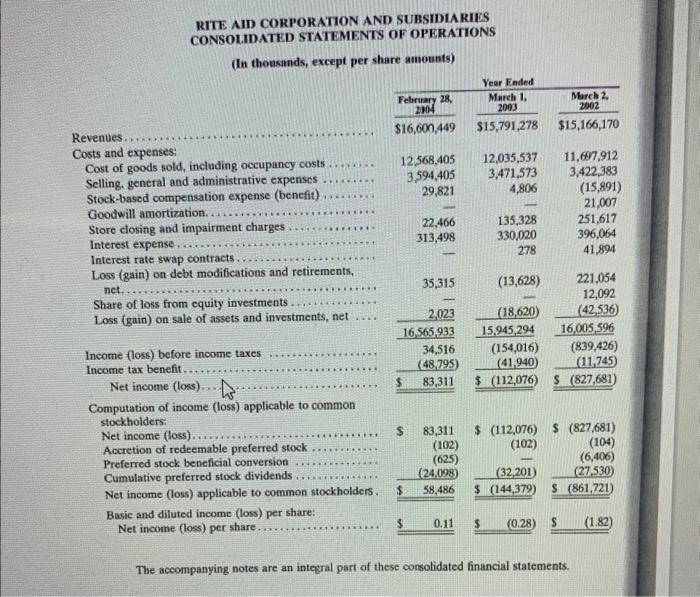

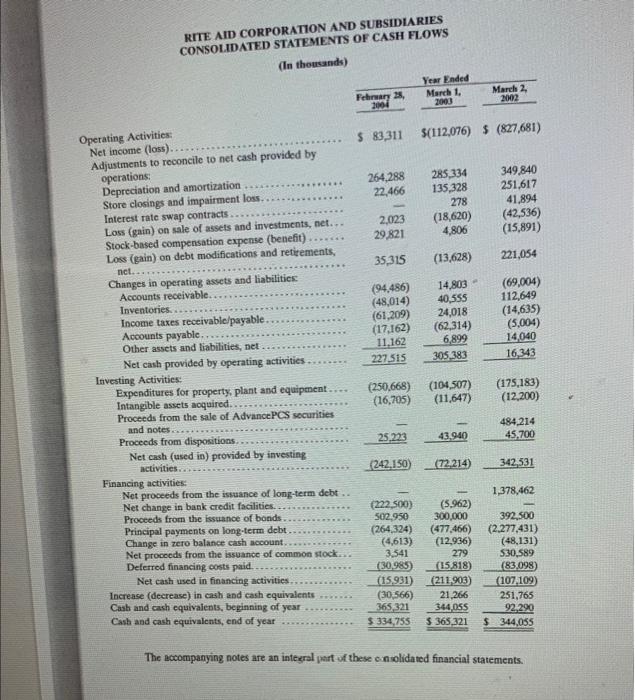

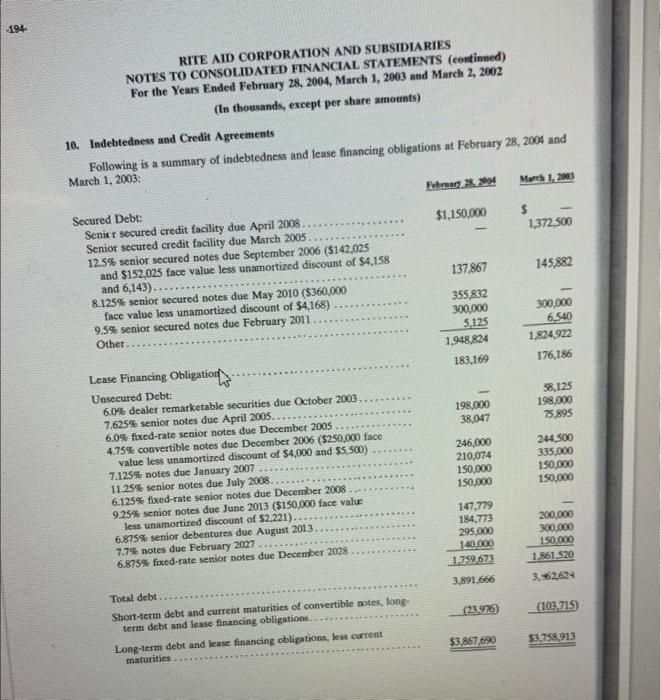

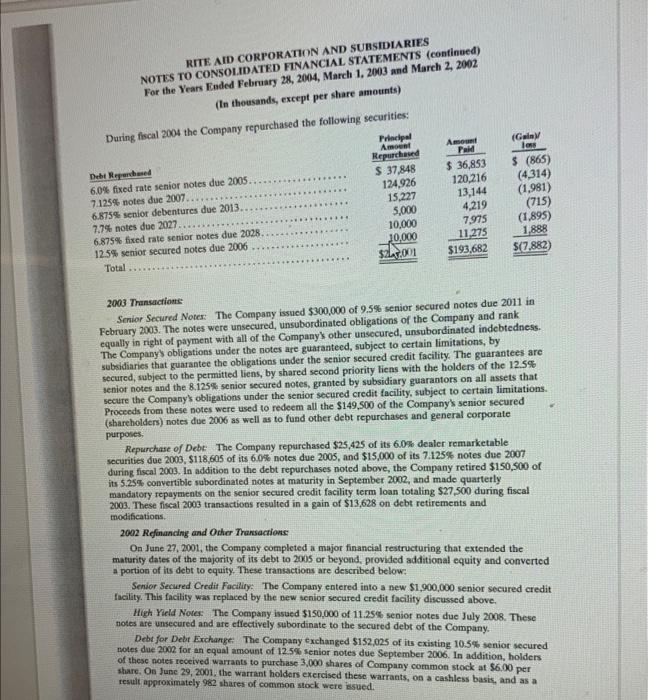

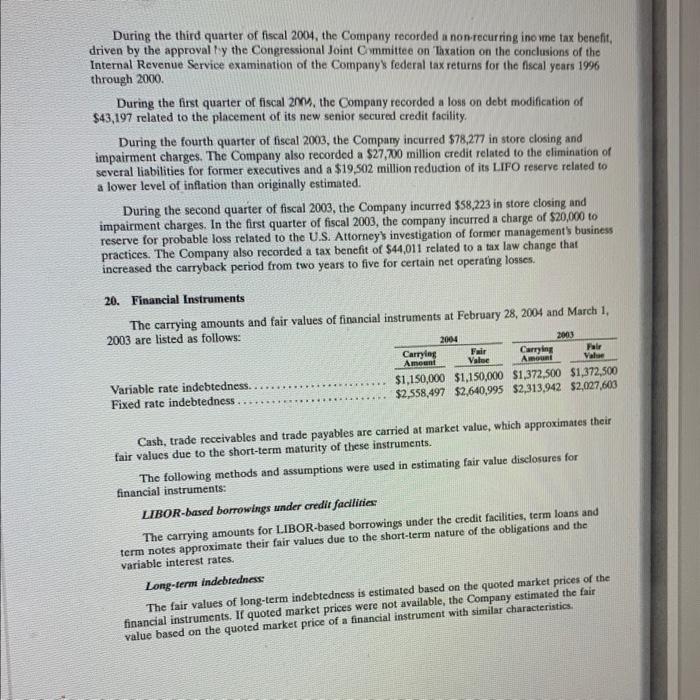

c. Consider the 9.5% senior secured notes due February 2011 . i. What is the face value (i.e. the principal) of these notes? How do you know? ii. Prepare the joumal entry that Rite Aid must have made when these notes were issued. iii. Prepure the annual interest expense journal entry. Note that the interest paid on a note during the year equals the face value of the note times the stated rate (i.e., coupon rate) of the note. iv. Prepare the journal entry that Rite Aid will make when these notes mature in 2011. RITE AID CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands, except per share amounts) The accompanying notes are an integral part of these consolidated financial statements. RITE AID CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Ifn thousinds. excent per share amounts) The accompanying notes are an mtegal park on ucse whoundateu masnal statemems. RITE AID CORPORATION AND SUBSIDLARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) RITE AID CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continned) For the Years Ended Febraary 28, 2004, March 1, 2003 and March 2, 2002 (In thousands, except per share amounts) 10. Indebtedness and Credit Agreements RITE AID CORPORATION AND SUBSIDIARIES For the Years Endel Feloriary 28, , Febraary 28, 2004, March 1, 2003 and March 2, 2002 2004 Thansactions with a new senior secured credit facility. The new facility consists of a 51,150,000 term loan and a $500,000 revolving credit facility, and will mature on April 30,2008 . The proceeds of the loans m amounts under the old facility and to purchase the land and buildings at the Companys Perryman, MD and Lancaster, CA distribution centers, which had previously bgen leased through a synthetic lease arrangement. On August 4, 2003, the Company amended and atatated the senior secured credit facility, which reduced the interest rate on term loan borrowings under the senior secured credit facility by 50 basis points. Borrowings under the new facility currently bear interest cither at LIBOR plas 3.00% for the term loan and 3.50% for the revolving credit facility, if the Company chooses to make LIBOR borrowings, or at Cribank's base rate plus 200% for the term of the loan and 230% for the revolving credit facility. The Company is required to pay fees of 0.50% per annum on the daily unused amount of the revolving facitity. Amortization payments of $2,875 related to the term loan will begin on May 31,2004 , and continue on a quarterly basis until February 28, 2008, with a final payment of 51,104,000 due April 30, 2008 . Substantially all of Rite Aid Corporation's wholly-owned subsidiaries guarantee the obligations under the new senior secured credit facility. The subsidiary guarantecs are secured by a first priority lien on, among other things, the inventory, accounts receivable and prescription files of the subsidiary. guarantors. Rite Aid Corporation is a holding company with no direct operations and is dependent upon dividends, distributions and other payments from its subsidiaries to service payments under the now senior secured credit facility. Rite Aid Corporations direct obligations under the new senior secured credit facility are unsecured. The new senior secured credit faclity allows for the issuance of up to $150,000 in additional term loans or additional revolver availability. The Company may request the additional loans at any time prior to the maturity of the senior secured credit facility. provided that the Company is not in default of any terms of the facility, nor is in violation of any financial covenants. The new senior secured credit facility allons the Company to have outstanding, at any time, up to $1,000,000 in secured debt in addition to the seniot secured credit faclity. At February 28,2004 , the remaining additional permitted secured debt under the new senior credit facility is $197,975. The Coenpany has the ability to incur an unlimited amount of unsecured debt, if the terms of such unsecured indebtedness comply with certain terms set forth in the crefit agreement and sabject to the Companyk compliance with certain financial covenants. If the Company issues unsecured debt that does not meet the credit agreement restrictions, it reduces the amount of availatlo permined secured debt. The new senior secured credit facility also allows for the repurchase of any debt with a muturity pricr to April 30 , 2008, and for a limited amount of debt with a maturity after April 30,2008 , based upon outstanding borrowings under the revolving credit facility and availabic cash at the time of the repurchase. The new senior secured credit facility contains curtumary covenants, which plase restrictions on incurrence of debt, the payment of dividends, mergens, liens and sale and leaceback transactions. The new senior secured credit facility also requires us to meet various financial natios and limits capital expenditures. For the twelve months ending February 26,2005 , the covenants require us to maintain a maximum leverage ratio of 6.05.1. Subsequent to February 26,2005 , the ratio gradually decreases to 3.8.1 for the twelve months ending March 1. 2008. We must also maintain a minimum interest coverage ratio of 2.05:1 for the twelve months ending February 26, 2005. Subvequent to February 26 , 2006, the ratio gradually increases to 325:1 for the twelve months ending March 1, 2008. In addition. we must maintain a minimum fixed charge ratio of 1.101 for the twelve months ending February 26 , 61 RTTE AID CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL. STATEMENIS (continued) For the Years Ended February 28, 2004, March 1, 2003 and March 2, 2002 (In thousands, except per share amounts) 2005. Subsequent to February 26, 2005, the ratio gradually increases to 1.25:1 for the twelve months ending March 1, 2008. Capital expenditures are limited to $386,085 for the fiscal year ending February 26,2005 , with the allowable amount increasing in subsequent years. The Company was in compliance with the covenants of the new senior secured credit facility and its other debt instruments as of February 28. 2004. With continuing improvements in operating performance, the Company anticipates that it will remain in compliance with its debt covenants. However, variations in operating performance and unanticipated developments may adversely affect the Company's ability to remain in compliance with the applicable debt covenants. The new senior secured credit facility provides for customary events of default, including nonpayment, misrepresentation, breach of covenants and bankruptcy. It is also an cvent of default if any event occurs that enables, or which with the giving of notice or the lapse of time would enable, the holder of the Company's debt to accelerate the maturity of debt having a principal amount in excess of 525,000 . The Company's ability to borrow under the senior secured credit facility is based on a specified borrowing base consisting of eligible accounts receivable, inventory and prescription files. At February 28,2004 , the term loan was fully drawn and the Company had no outstanding draws on the revolving credit facility. At February 28,2004 , the Company had additional borrowing capacity of $584,804, net of outstanding letters of credit of \$115,196. As a result of the placement of the new senior secured credit facility, the Company recorded a loss on debt modification in fiscal 2004 of $43,197 (which included the write-off of previously deferred debt issue costs of $35,120 ). On October 1, 2003, the Company paid, at maturity, its remaining outstanding balance on the 6.05 dealer remarketable securities. In May 2003, the Company issued \$150,000 aggregate principal amount of 9.25\% senior notes due 2013. These notes are unsecured and effectively subordinate to the Company's secured debt. The indenture governing the 9.25% senior notes contains customary covenant provisions that, amount other things, include limitations on the Company's ability to pay dividends, make investments or other restricted payments, incur debt, grant liens, sell assets and enter into sale lease-back transactions. In April 2003, the Company issued $360,000 aggregate principal amount of 8.125% senior secured notes due 2010. The notes are unsecured, unsubordinated obligations to Rite Aid Corporation and rank equally in right of payment with all other unsecured, unsubordinated indebtedness. The Company's obligations under the notes are guaranteed, subject to certain limitations, by subsidiaries that guarantee the obligations under our new senior secured credit facility. The guarantees are secured, subject to the permitted liens, by shared second priority liens, with the holders of the Company's 12.5\% senior notes and the Company's 9.5% senior secured notes, granted by subsidiary guarantors on all of their assets that secure the obligations under the new senior secured credir facility, subject to certuin exceptions. The indenture governing the Company's 8.125% senior secured notes contains customary covenant provisions that, among other things, include limitations on our ability to pay dividends, make investments or other restricted payments, incur debt, grant liens, sell assets and enter into aales lease-back transactions. RIE AID CORPORATUON AND SUBSIDIARIES NOTES TO CONSOL.IDATED FINANCIAL STATEMENTS (continued) For the Years Faded February 28, 2004, March 1, 2003 and March 2, 2002 (In thousands, except per share amounts) 2003 Thansactione Senior Secured Notex: The Company issued 5300,000 of 9.5% senior secured notes due 2011 in February 2003. The notes were unsecured, unsubordinated obligations of the Company and rank equally in right of payment with all of the Company's other unsecured, unsubordinated indebtedness. The Company's obligations under the notes are guaranteed, subject to certain limitations, by subsidiaries that guarantee the obligations under the senior secured credit facility. The guarantees are secured, subject to the permitted liens, by shared second priority liens with the holders of the 12.5% senior notes and the 8.125% senior secured notes, granted by subsidiary guarantors on all assets that secure the Companys obligations under the senior secured credit facility, subject to certain limitations. Proceeds from these notes were used to redeem all the $149,500 of the Company's senior secured (shareholders) notes due 2006 as well as to fund other debt repurchases and general corporate purposes. Repurchase of Debe. The Company repurchased $25,425 of its 6.0% dealer remarketable securities due 2003,$118,605 of its 6.05 notes due 2005 , and $15,000 of its 7.125% notes due 2007 during fiscal 2003 . In addition to the debt repurchases noted above, the Company retired $150,500 of its 5.255 convertible subordinated notes at maturity in September 2002, and made quarterly mandatory repayments on the senior secured credit facility term loan totaling $27,500 during fiscal 2003. These fiscal 2003 transactions resulted in a gain of $13,628 on debt retirements and modifications. 2002 Refinancing and Ocher Transactions On June 27, 2001, the Company completed a major financial restructuring that extended the maturity dater of the majority of its debt to 2005 or beyond, provided additional equity and converted a portion of its debt to equity. These transactions are described below: Senior Secured Credit Faciliy: The Company entered into a new $1,900,000 senior secured credit facility. This facility was replaced by the new senior secured credit facility discussed above. High Yield Nores The Company issued $150,000 of 11.25% senior notes due July 2008 . These notes are unsecured and are effectively subordinate to the secured debt of the Company. Debt for Debr Exchange: The Company exchanged \$152,025 of its cxisting 10.5\% senior secured noles due 2002 for an equal amount of 12.5% senior notes due September 2006 . In addition, holders of these notes received warrants to purchase 3,000 shares of Company common stock at $6,00 per share. On June 29, 2001, the warrant holders exercised these warrants, on a cashless basis, and as a result approximately 982 shares of common stock were issued. During the third quarter of fiscal 2004, the Company recorded a non-recurring ino ime tax benefit, driven by the approval fy the Congressional Joint Committee on Taxation on the conclusions of the Internal Revenue Service examination of the Company' federal tax returns for the fiscal years 1996 through 2000. During the first quarter of fiscal 2m, the Company recorded a loss on debt modification of $43,197 related to the placement of its new senior secured credit facility. During the fourth quarter of fiscal 2003 , the Company incurred $78,277 in store closing and impairment charges. The Company also recorded a $27,700 million credit related to the climination of several liabilities for former executives and a $19,502 million redudion of its L.IFO reserve related to a lower level of inflation than originally estimated. During the second quarter of fiscal 2003, the Company incurred $58,223 in store closing and impairment charges. In the first quarter of fiscal 2003, the company incurred a charge of $20,000 to reserve for probable loss related to the U.S. Attorney's investigation of former management's business practices. The Company also recorded a tax benefit of $44,011 related to a tax law change that increased the carryback period from two years to five for certain net operating losses. 20. Financial Instruments The carrying amounts and fair values of financial instruments at February 28, 2004 and March 1, Cash, trade receivables and trade payables are carried at market value, which approximates their fair values due to the short-term maturity of these instruments. The following methods and assumptions were used in estimating fair value disclosures for financial instruments: LIBOR-based borrowings under credit fadilities The carrying amounts for LIBOR-based borrowings under the credit facilities, term loans and term notes approximate their fair values due to the short-term nature of the obligations and the variable interest rates. Long-term indebtedness: The fair values of long-term indebtedness is estimated based on the quoted market prices of the financial instruments. If quoted market prices were not available, the Company estimated the fair value based on the quoted market price of a financial instrument with similar characteristics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started