Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need numbers 1 and 3 3 2 * Through this program, you have essentially sold an annuity, collecting an annual fee at the beginning

Just need numbers 1 and 3

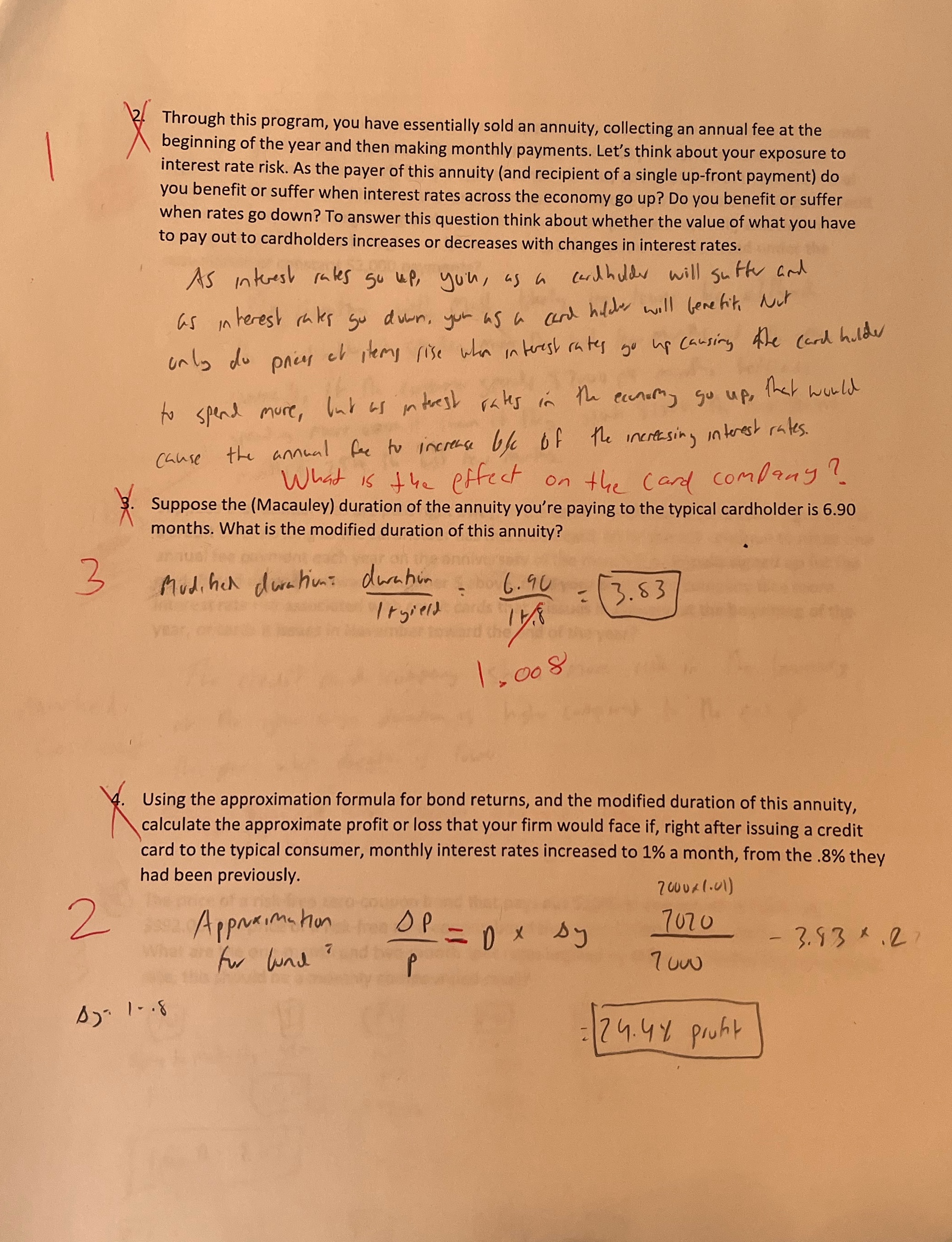

3 2 * Through this program, you have essentially sold an annuity, collecting an annual fee at the beginning of the year and then making monthly payments. Let's think about your exposure to interest rate risk. As the payer of this annuity (and recipient of a single up-front payment) do you benefit or suffer when interest rates across the economy go up? Do you benefit or suffer when rates go down? To answer this question think about whether the value of what you have to pay out to cardholders increases or decreases with changes in interest rates. As interest rates go up, you, as a card holder will sutter and as interest rates gu down, you as a card holder will benefiti Nut only du et items rise when interest rates go up causing the card holder pney to spend more, but as interest rates in the economy go up, that would cause the annual fee to increase ble of the increasing interest rates. What is the effect Suppose the (Macauley) duration of the annuity you're paying to the typical cardholder is 6.90 months. What is the modified duration of this annuity? on the card company? Mudihed duration duration It gield Ay: 1-.8 bo 6.90 178 1,008 Using the approximation formula for bond returns, and the modified duration of this annuity, calculate the approximate profit or loss that your firm would face if, right after issuing a credit card to the typical consumer, monthly interest rates increased to 1% a month, from the .8% they had been previously. Approximation for lund 7 3.83 DP = D x sy P 2000*(.01) 7070 7000 24.48 pount - 3.93 * .27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 2 As the payer of this annuity and recipient of a single upfront payment I benefit when int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started