JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

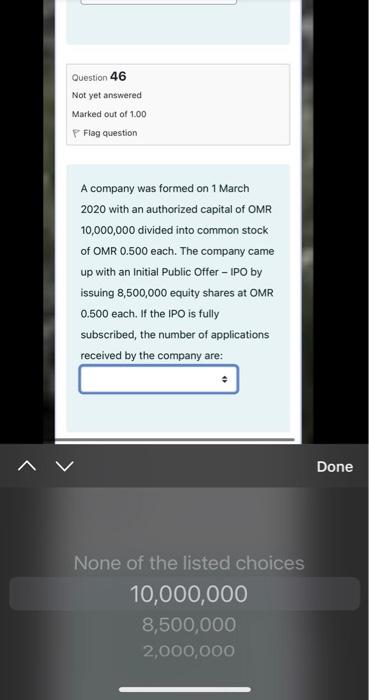

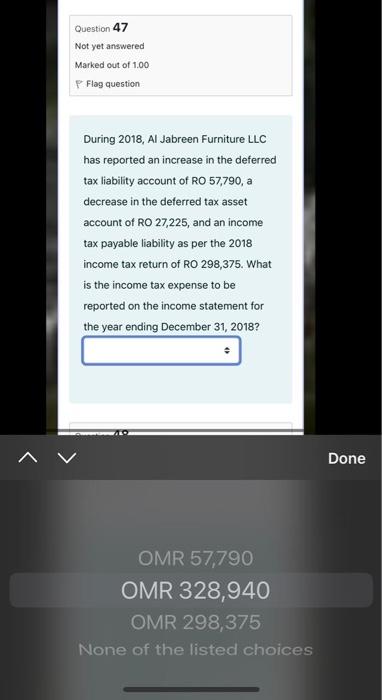

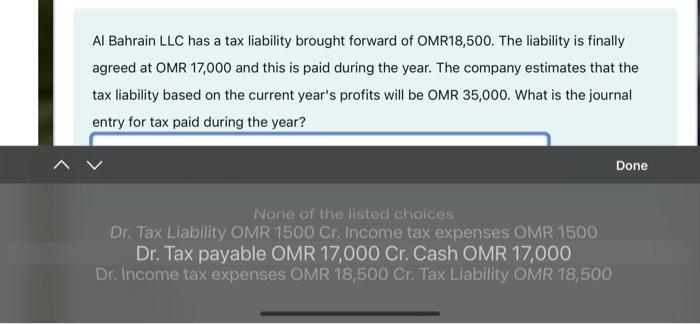

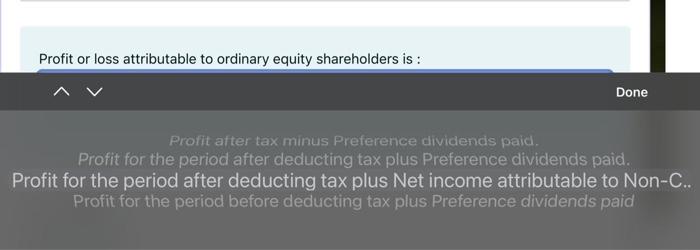

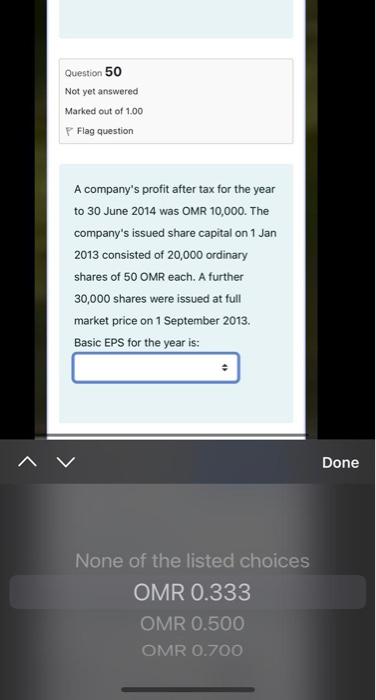

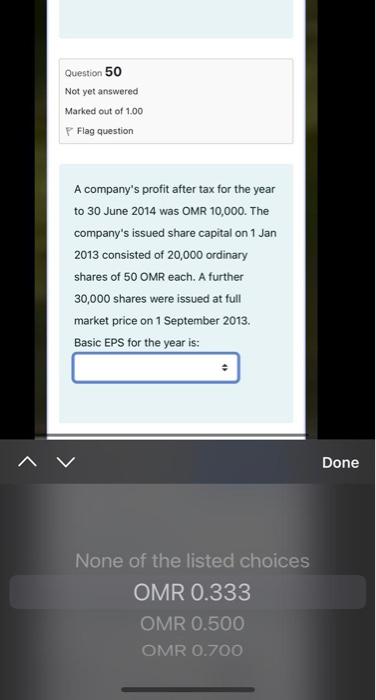

Question 46 Not yet answered Marked out of 1.00 P Flag question A company was formed on 1 March 2020 with an authorized capital of OMR 10,000,000 divided into common stock of OMR 0.500 each. The company came up with an initial Public Offer - IPO by issuing 8,500,000 equity shares at OMR 0.500 each. If the IPO is fully subscribed, the number of applications received by the company are: Done None of the listed choices 10,000,000 8,500,000 2,000,000 Question 47 Not yet answered Marked out of 1.00 Flag question During 2018, Al Jabreen Furniture LLC has reported an increase in the deferred tax liability account of RO 57,790, a decrease in the deferred tax asset account of RO 27,225, and an income tax payable liability as per the 2018 income tax return of RO 298,375. What is the income tax expense to be reported on the income statement for the year ending December 31, 2018? Done OMR 57,790 OMR 328,940 OMR 298,375 None of the listed choices Al Bahrain LLC has a tax liability brought forward of OMR18,500. The liability is finally agreed at OMR 17,000 and this is paid during the year. The company estimates that the tax liability based on the current year's profits will be OMR 35,000. What is the journal entry for tax paid during the year? Done None of the listed choices Dr. Tax Liability OMR 1500 Cr. Income tax expenses OMR 1500 Dr. Tax payable OMR 17,000 Cr. Cash OMR 17,000 Dr. Income tax expenses OMR 18,500 Cr. Tax Liability OMR 18,500 Profit or loss attributable to ordinary equity shareholders is : Done Profit after tax minus Preference dividends paid. Profit for the period after deducting tax plus Preference dividends paid. Profit for the period after deducting tax plus Net income attributable to Non-C.. Profit for the period before deducting tax plus Preference dividends paid Question 50 Not yet answered Marked out of 1.00 P Flag question A company's profit after tax for the year to 30 June 2014 was OMR 10,000. The company's issued share capital on 1 Jan 2013 consisted of 20,000 ordinary shares of 50 OMR each. A further 30,000 shares were issued at full market price on 1 September 2013. Basic EPS for the year is: . Done None of the listed choices OMR 0.333 OMR 0.500 OMR 0.700