JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

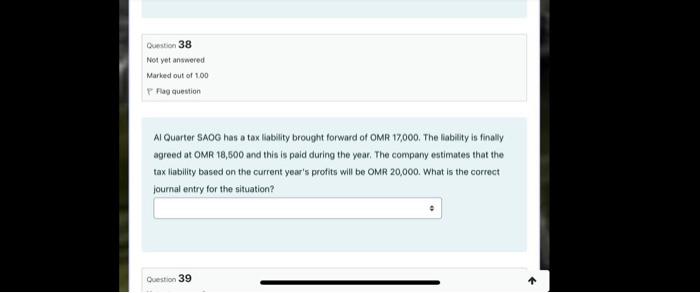

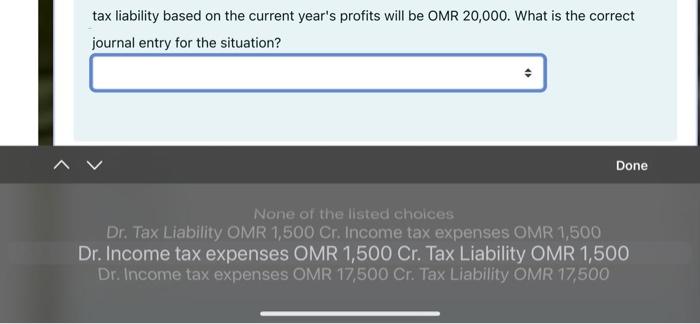

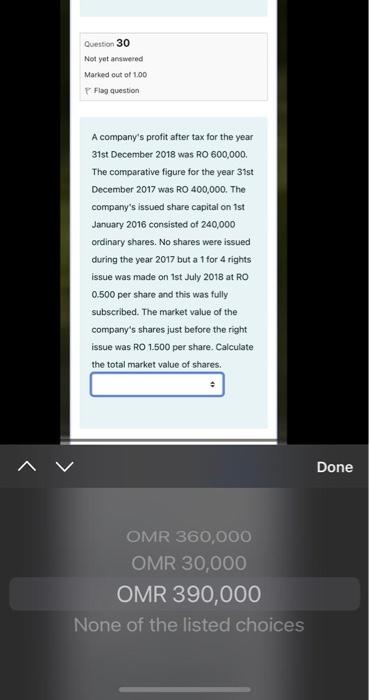

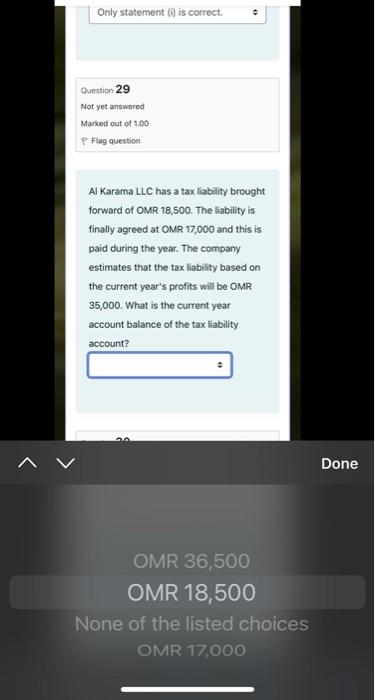

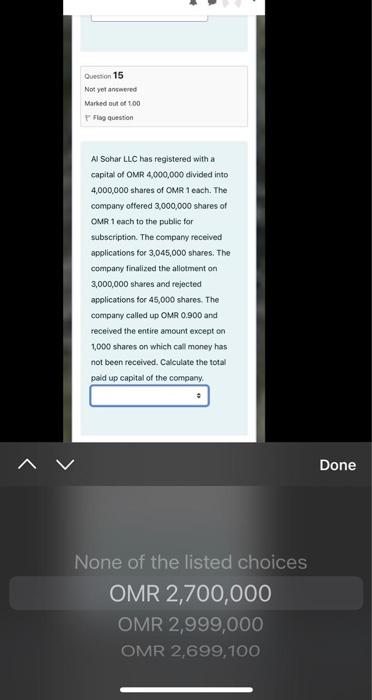

Question 38 Not yet answered Marked out of 100 Prag question Al Quarter SAOG has a tax Hability brought forward of OMR 17,000. The liability is finally agreed at OMR 18,500 and this is paid during the year. The company estimates that the tax liability based on the current year's profits will be OMR 20,000. What is the correct journal entry for the situation? Question 39 tax liability based on the current year's profits will be OMR 20,000. What is the correct journal entry for the situation? Done None of the listed choices Dr. Tax Liability OMR 1,500 Cr. Income tax expenses OMR 1,500 Dr. Income tax expenses OMR 1,500 Cr. Tax Liability OMR 1,500 Dr. Income tax expenses OMR 17,500 Cr. Tax Liability OMR 17,500 Question 30 Not yet answered Marked out of 1.00 P Flag question A company's profit after tax for the year 31st December 2018 was RO 600,000 The comparative figure for the year 31st December 2017 was RO 400,000. The company's issued share capital on 1st January 2016 consisted of 240,000 ordinary shares. No shares were issued during the year 2017 but a 1 for 4 rights issue was made on 1st July 2018 at RO 0.500 per share and this was fully subscribed. The market value of the company's shares just before the right issue was RO 1.500 per share. Calculate the total market value of shares. Done OMR 360,000 OMR 30,000 OMR 390,000 None of the listed choices Only statement is correct. Question 29 Not yet answered Marked out of 100 Flag question Al Karama LLC has a tax liability brought forward of OMR 18,500. The liability is finally agreed at OMR 17,000 and this is paid during the year. The company estimates that the tax liability based on the current year's profits will be OMR 35,000. What is the current year account balance of the tax liability account? Done OMR 36,500 OMR 18,500 None of the listed choices OMR 17,000 Question 15 Not yet answered Marked out of 100 Flag question Al Sohar LLC has registered with a capital of OMR 4,000,000 divided into 4,000,000 shares of OMR 1 each. The company offered 3,000,000 shares of OMR 1 each to the public for subscription. The company received applications for 3,045,000 shares. The company finalized the allotment on 3,000,000 shares and rejected applications for 45,000 shares. The company called up OMR 0.900 and received the entire amount except on 1,000 shares on which call money has not been received. Calculate the total paid up capital of the company > Done None of the listed choices OMR 2,700,000 OMR 2,999,000 OMR 2,699,100