Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need part C The following are selected 2025 transactions of Nash Corporation. Sept. 1 Purchased inventory from Encino Company on account for $58,500. Nash

Just need part C

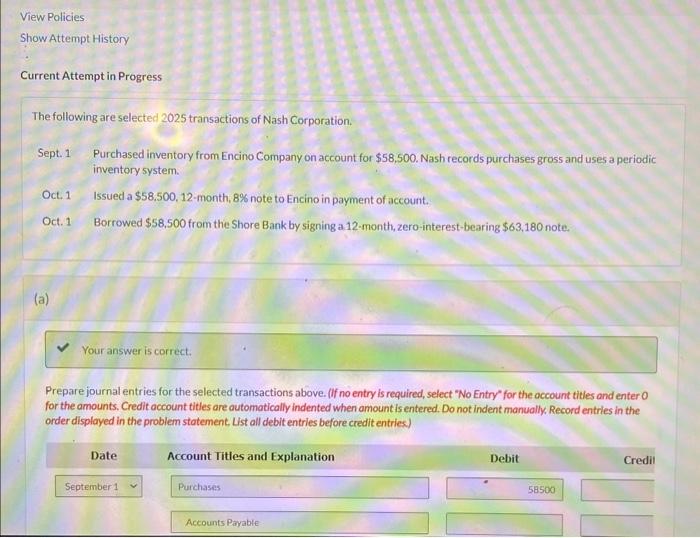

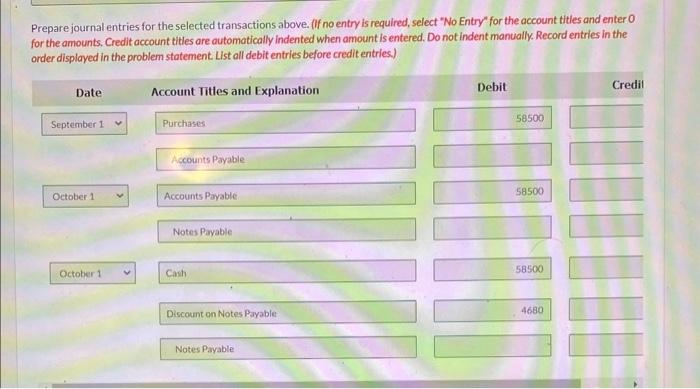

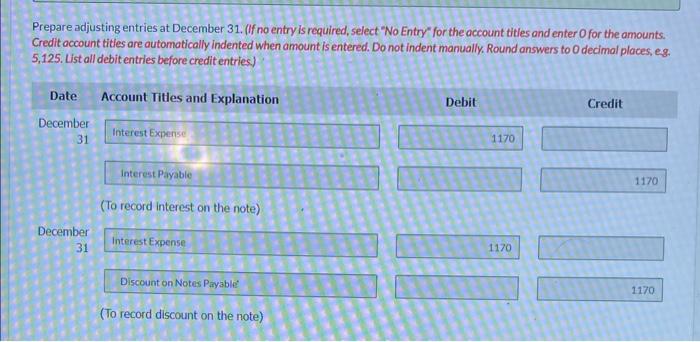

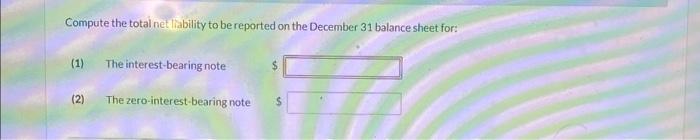

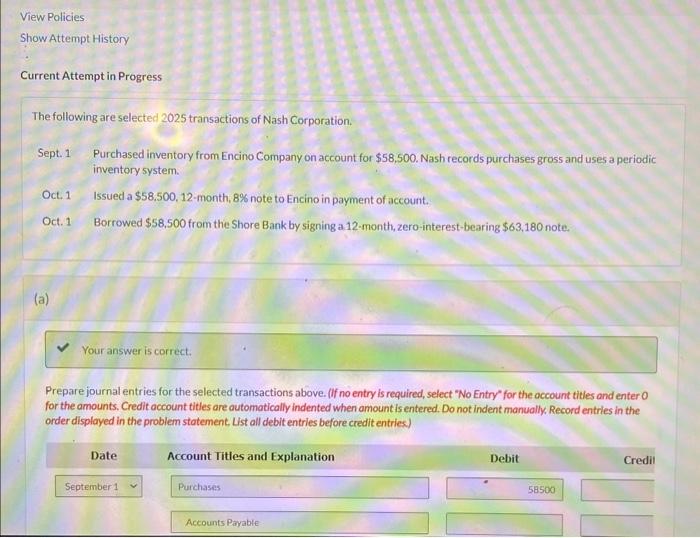

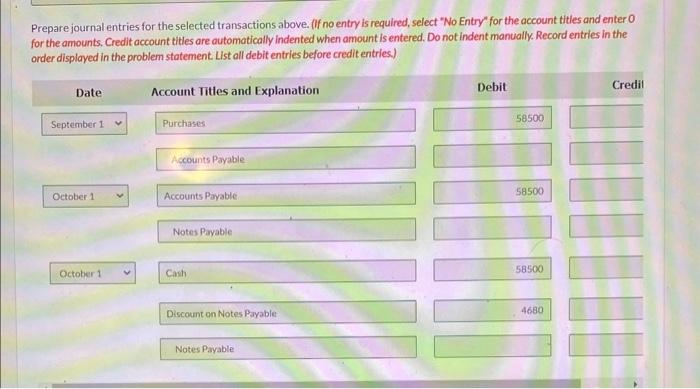

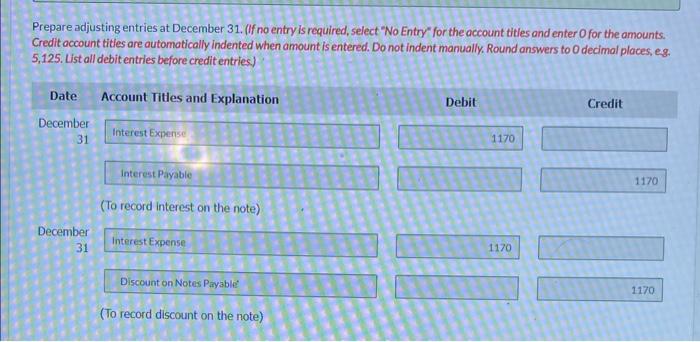

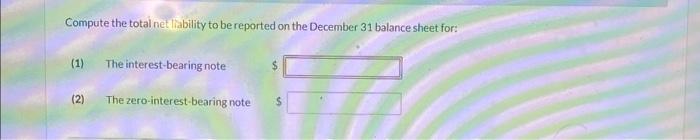

The following are selected 2025 transactions of Nash Corporation. Sept. 1 Purchased inventory from Encino Company on account for $58,500. Nash records purchases gross and uses a periodic inventory system. Oct. 1 Issued a $58.500,12-month, 8% note to Encino in payment of account. Oct. 1 Borrowed $58,500 from the Shore Bank by signing a 12-month, zero-interest-bearing $63,180 note. (a) Prepare journal entries for the selected transactions above. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts. Credit account titles are outomatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List all debit entries before credit entriec) Prepare journal entries for the selected transactions above. (If no entry is required, select " No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List all debit entries before credit entries.) Prepare adjusting entries at December 31. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit occount titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, eg. 5,125. List all debit entries before credit entries) Compute the total net liability to be reported on the December 31 balance sheet for: (1) The interest-bearing note (2) The zero-interest-bearing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started