Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just need part e Marigold Artworks creates hand-painted picture frames. The frames are cast from resin in an automated process. Once the casting is done,

just need part e

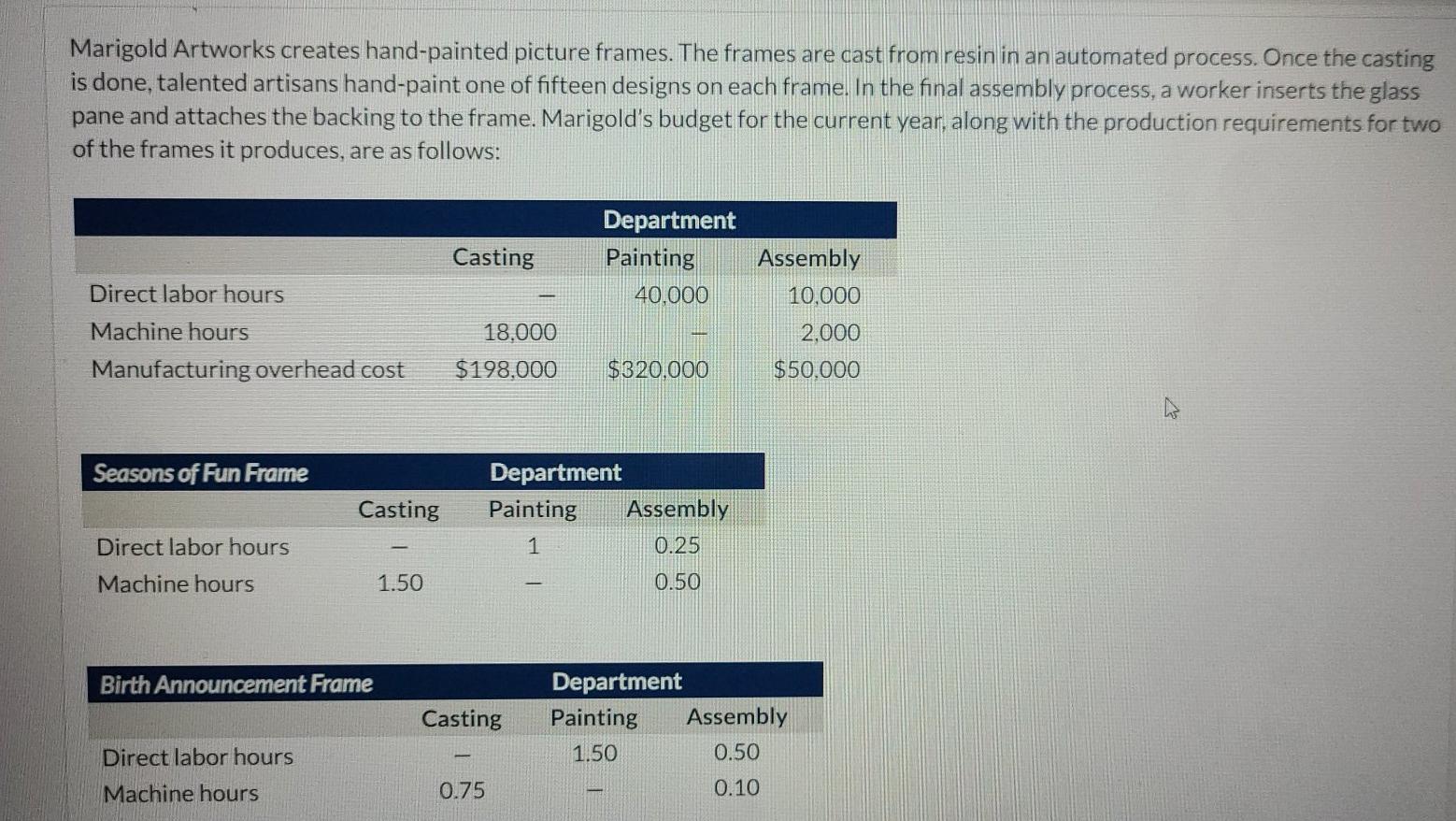

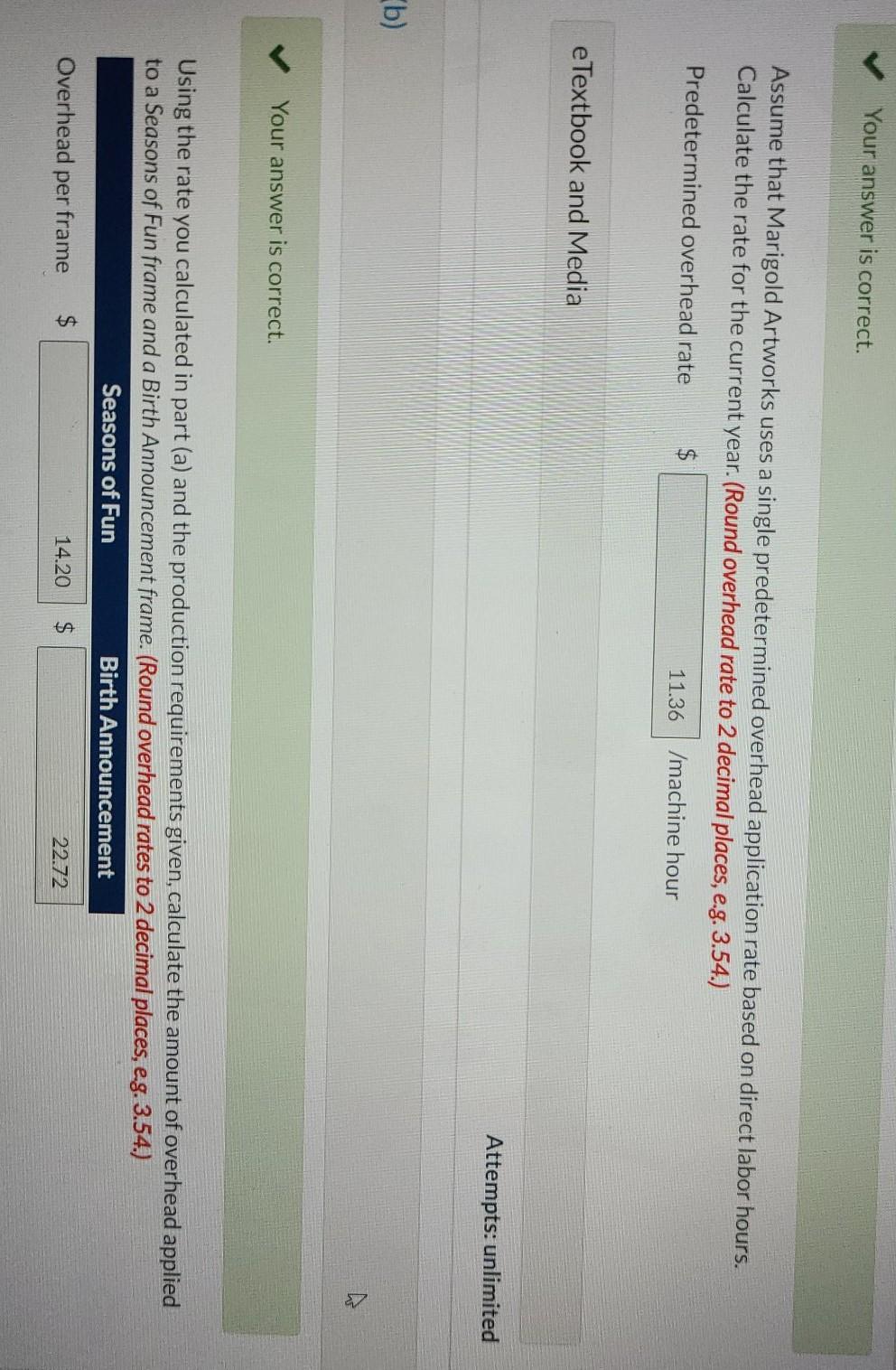

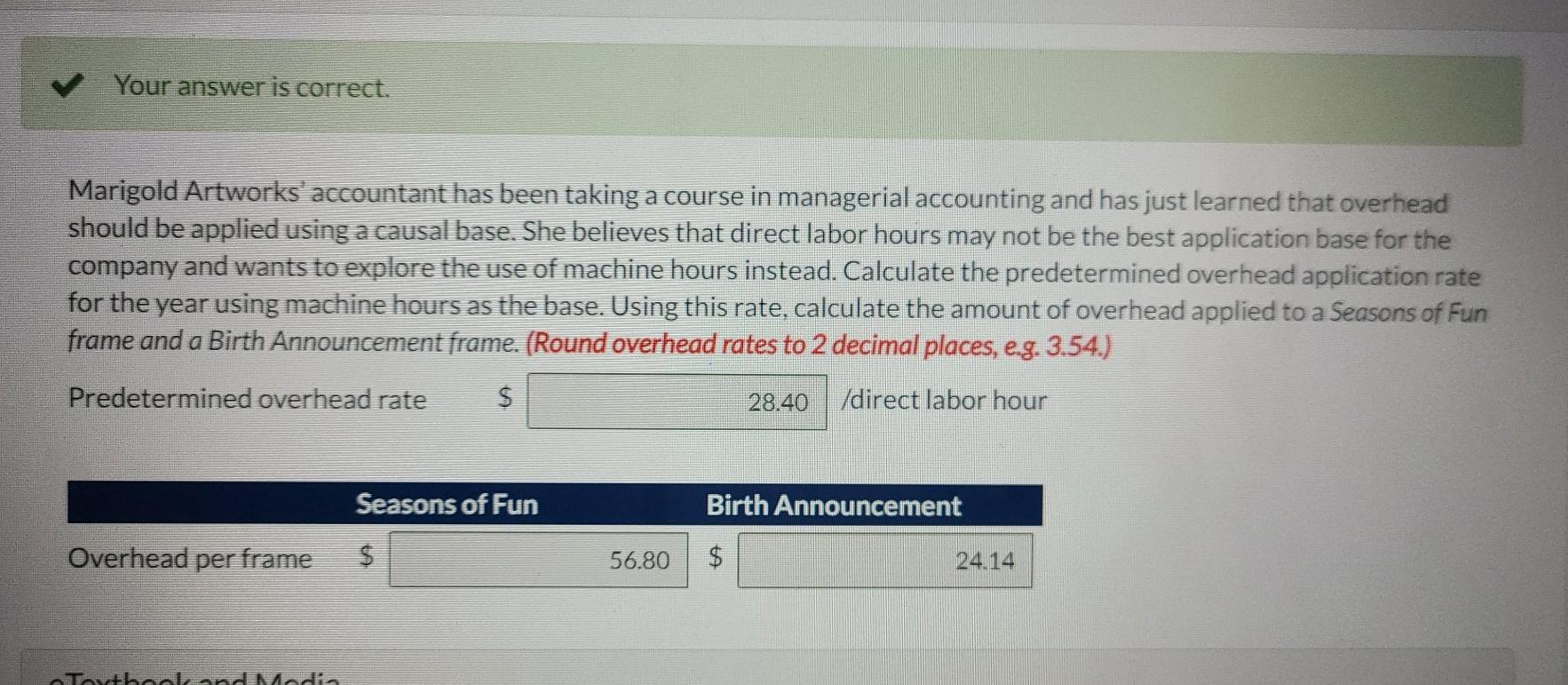

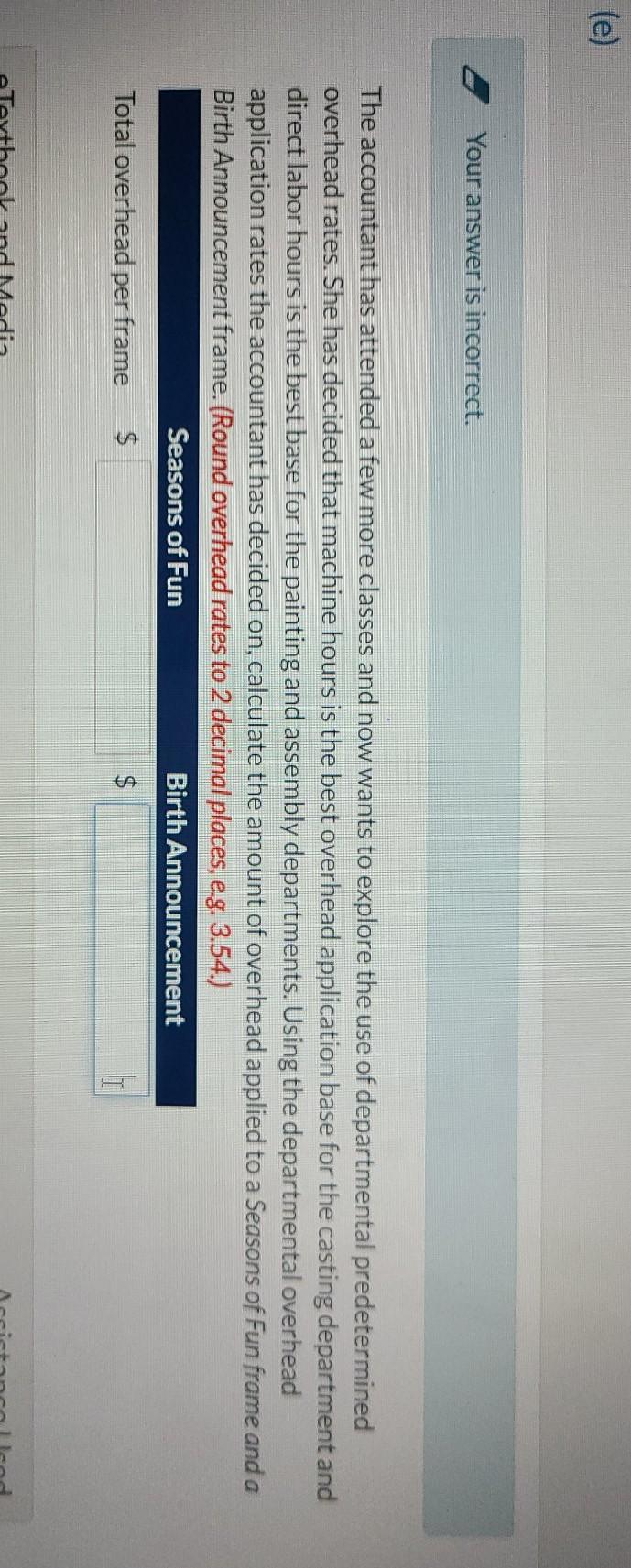

Marigold Artworks creates hand-painted picture frames. The frames are cast from resin in an automated process. Once the casting is done, talented artisans hand-paint one of fifteen designs on each frame. In the final assembly process, a worker inserts the glass pane and attaches the backing to the frame. Marigold's budget for the current year, along with the production requirements for two of the frames it produces, are as follows: Casting Department Painting 40,000 Assembly 10,000 Direct labor hours 2.000 Machine hours Manufacturing overhead cost 18.000 $198,000 $320,000 $50.000 Seasons of Fun Frame Casting Department Painting Assembly 1 0.25 0.50 Direct labor hours Machine hours 1.50 Birth Announcement Frame Casting Department Painting Assembly 1.50 0.50 0.10 Direct labor hours Machine hours 0.75 Your answer is correct. Assume that Marigold Artworks uses a single predetermined overhead application rate based on direct labor hours. Calculate the rate for the current year. (Round overhead rate to 2 decimal places, e.g. 3.54.) Predetermined overhead rate $ 11.36 /machine hour e Textbook and Media Attempts: unlimited b) Your answer is correct. Using the rate you calculated in part (a) and the production requirements given, calculate the amount of overhead applied to a Seasons of Fun frame and a Birth Announcement frame. (Round overhead rates to 2 decimal places, e.g. 3.54.) Seasons of Fun Birth Announcement Overhead per frame TA 14.20 ta 22.72 Your answer is correct. Marigold Artworks' accountant has been taking a course in managerial accounting and has just learned that overhead should be applied using a causal base. She believes that direct labor hours may not be the best application base for the company and wants to explore the use of machine hours instead. Calculate the predetermined overhead application rate for the year using machine hours as the base. Using this rate, calculate the amount of overhead applied to a Seasons of Fun frame and a Birth Announcement frame. (Round overhead rates to 2 decimal places, e.g. 3.54.) Predetermined overhead rate $ 28.40 /direct labor hour Seasons of Fun Birth Announcement Overhead per frame $ 56.80 $ 24.14 bandmade (e) Your answer is incorrect. The accountant has attended a few more classes and now wants to explore the use of departmental predetermined overhead rates. She has decided that machine hours is the best overhead application base for the casting department and direct labor hours is the best base for the painting and assembly departments. Using the departmental overhead application rates the accountant has decided on, calculate the amount of overhead applied to a Seasons of Fun frame and a Birth Announcement frame. (Round overhead rates to 2 decimal places, eg. 3.54.) Seasons of Fun Birth Announcement Total overhead per frame $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started