Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JUST NEED QUESTION 5 4. (10) Points The Big CompanyTM is considering two pieces of machinery that perform the same repetitive task. The two alternatives

JUST NEED QUESTION 5

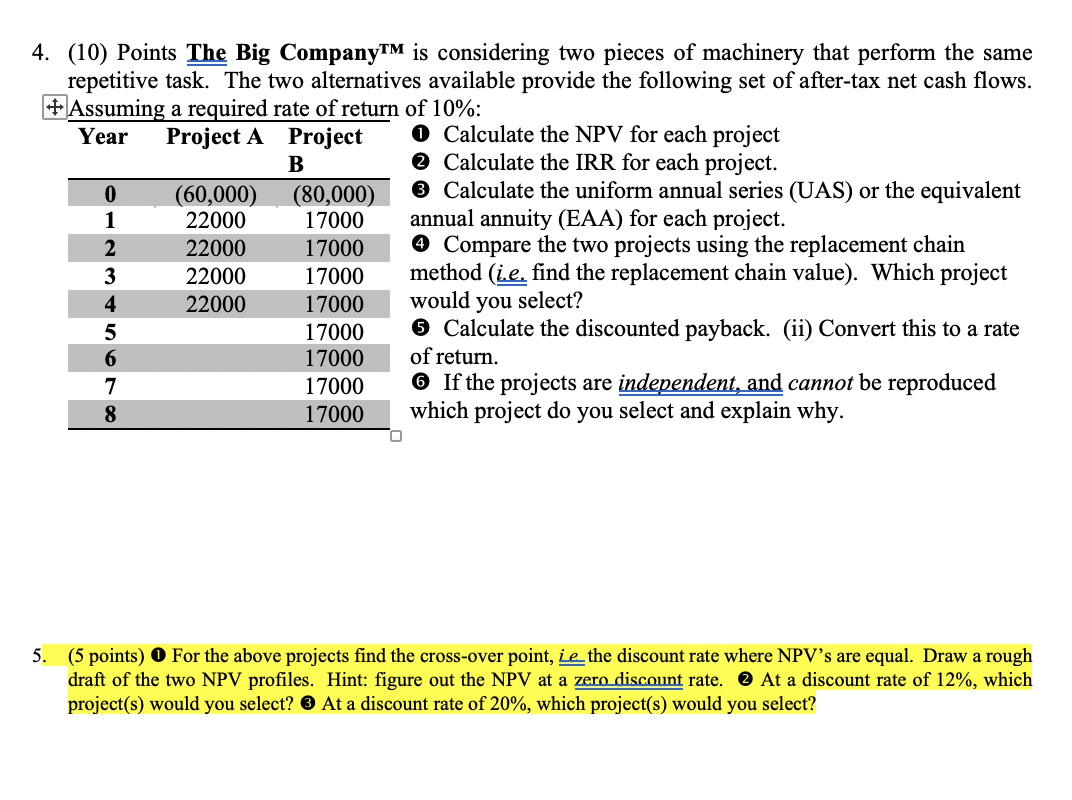

4. (10) Points The Big CompanyTM is considering two pieces of machinery that perform the same repetitive task. The two alternatives available provide the following set of after-tax net cash flows. A ccumina a recuivired rate of return of 10% : Calculate the NPV for each project Calculate the IRR for each project. 3 Calculate the uniform annual series (UAS) or the equivalent annual annuity (EAA) for each project. 4 Compare the two projects using the replacement chain method (i.e. find the replacement chain value). Which project would you select? (5) Calculate the discounted payback. (ii) Convert this to a rate of return. 6 If the projects are independent, and cannot be reproduced which project do you select and explain why. 5. (5 points) (1) For the above projects find the cross-over point, ie the discount rate where NPV's are equal. Draw a rough draft of the two NPV profiles. Hint: figure out the NPV at a zern discount rate. (2) At a discount rate of 12%, which project(s) would you select? 3 At a discount rate of 20%, which project(s) would you selectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started