Answered step by step

Verified Expert Solution

Question

1 Approved Answer

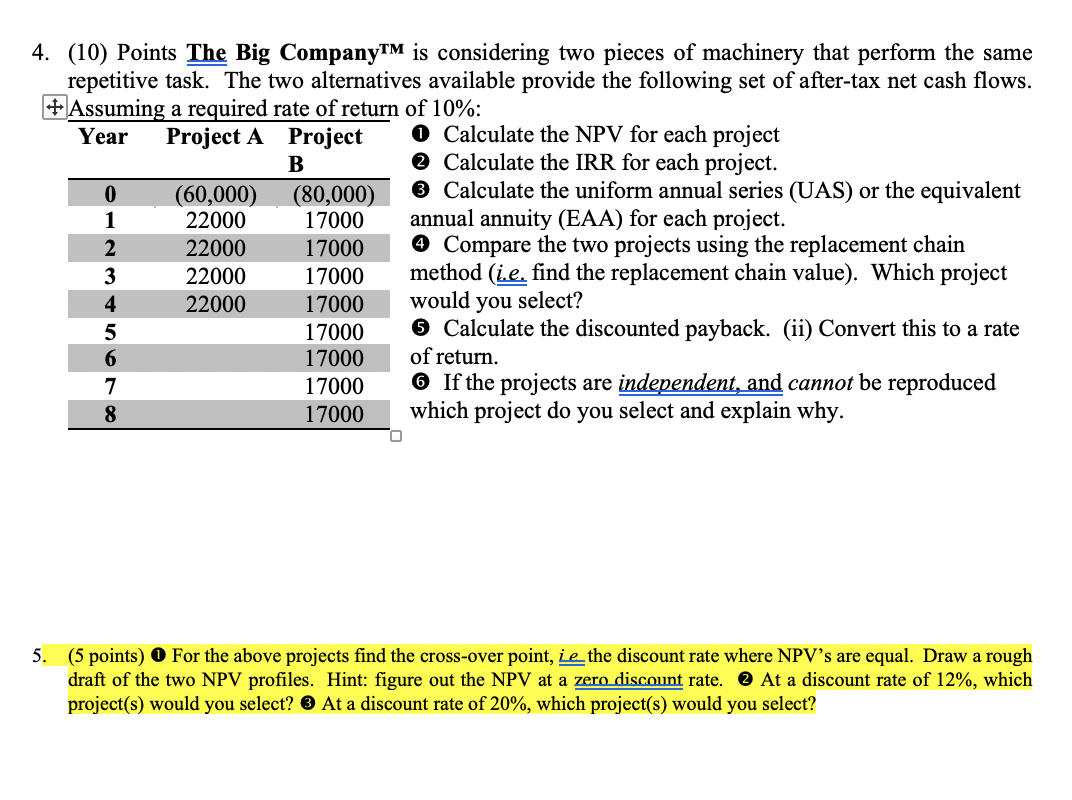

JUST NEED QUESTION 5. ADDING QUESTION 4 FOR REFERENCE. THANK YOU! 4. (10) Points The Big CompanyTM is considering two pieces of machinery that perform

JUST NEED QUESTION 5. ADDING QUESTION 4 FOR REFERENCE. THANK YOU!

4. (10) Points The Big CompanyTM is considering two pieces of machinery that perform the same repetitive task. The two alternatives available provide the following set of after-tax net cash flows. A ccumina a recuivired rate of return of 10% : Calculate the NPV for each project Calculate the IRR for each project. 3 Calculate the uniform annual series (UAS) or the equivalent annual annuity (EAA) for each project. 4 Compare the two projects using the replacement chain method (i.e. find the replacement chain value). Which project would you select? (5) Calculate the discounted payback. (ii) Convert this to a rate of return. 6 If the projects are independent, and cannot be reproduced which project do you select and explain why. 5. (5 points) (1) For the above projects find the cross-over point, ie the discount rate where NPV's are equal. Draw a rough draft of the two NPV profiles. Hint: figure out the NPV at a zern discount rate. (2) At a discount rate of 12%, which project(s) would you select? 3 At a discount rate of 20%, which project(s) would you select? 4. (10) Points The Big CompanyTM is considering two pieces of machinery that perform the same repetitive task. The two alternatives available provide the following set of after-tax net cash flows. A ccumina a recuivired rate of return of 10% : Calculate the NPV for each project Calculate the IRR for each project. 3 Calculate the uniform annual series (UAS) or the equivalent annual annuity (EAA) for each project. 4 Compare the two projects using the replacement chain method (i.e. find the replacement chain value). Which project would you select? (5) Calculate the discounted payback. (ii) Convert this to a rate of return. 6 If the projects are independent, and cannot be reproduced which project do you select and explain why. 5. (5 points) (1) For the above projects find the cross-over point, ie the discount rate where NPV's are equal. Draw a rough draft of the two NPV profiles. Hint: figure out the NPV at a zern discount rate. (2) At a discount rate of 12%, which project(s) would you select? 3 At a discount rate of 20%, which project(s) would you selectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started