Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need some help please and the parts to follow! I will rate! Many thanks and God bless!!! S13-7 (similar to) Question Help Carmel Company

Just need some help please and the parts to follow!

I will rate!

Many thanks and God bless!!!

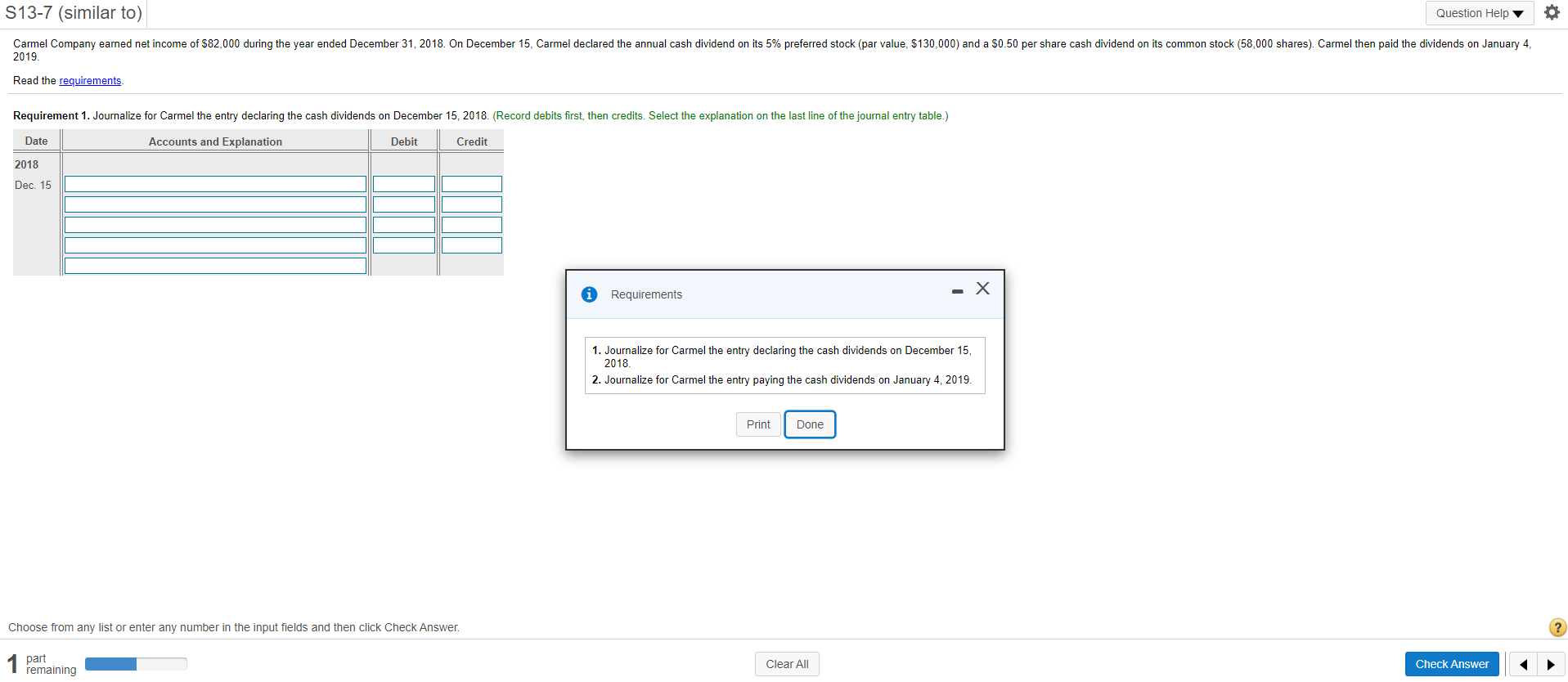

S13-7 (similar to) Question Help Carmel Company earned net income of $82,000 during the year ended December 31, 2018. On December 15, Carmel declared the annual cash dividend on its 5% preferred stock (par value, $130,000) and a $0.50 per share cash dividend on its common stock (58,000 shares). Carmel then paid the dividends on January 4, 2019. Read the requirements Requirement 1. Journalize for Carmel the entry declaring the cash dividends on December 15, 2018. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit 2018 Dec. 15 Requirements -X 1. Journalize for Carmel the entry declaring the cash dividends on December 15, 2018 2. Journalize for Carmel the entry paying the cash dividends on January 4, 2019 Print Done Choose from any list or enter any number in the input fields and then click Check Answer. part remaining Clear All CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started