Answered step by step

Verified Expert Solution

Question

1 Approved Answer

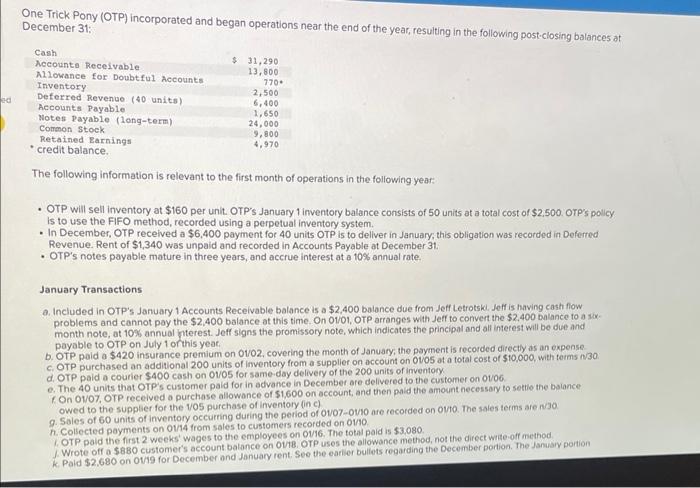

JUST NEED THE ANALYSIS PART PLEASE One Trick Pony (OTP) incorporated and began operations near the end of the year, resulting in the following post.closing

JUST NEED THE ANALYSIS PART PLEASE

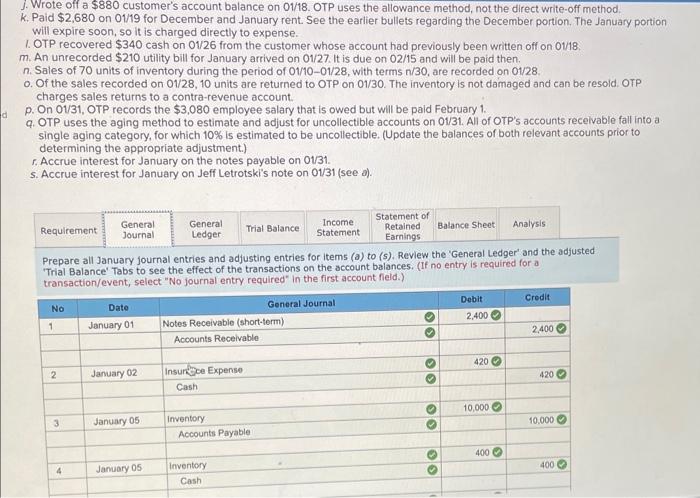

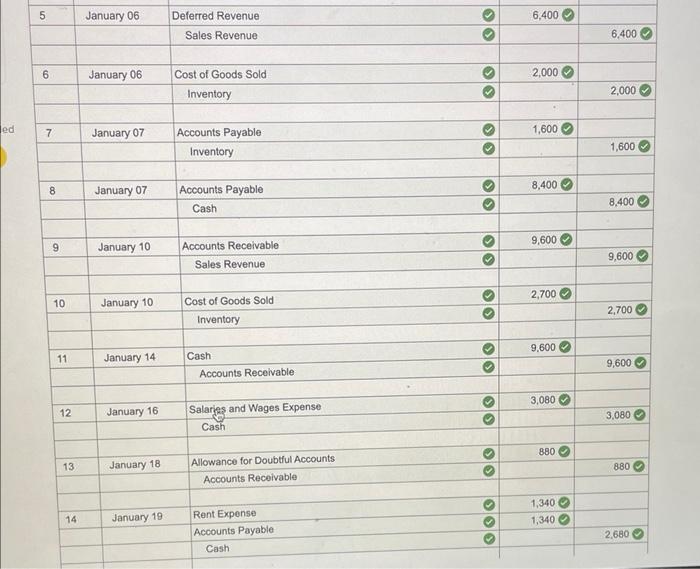

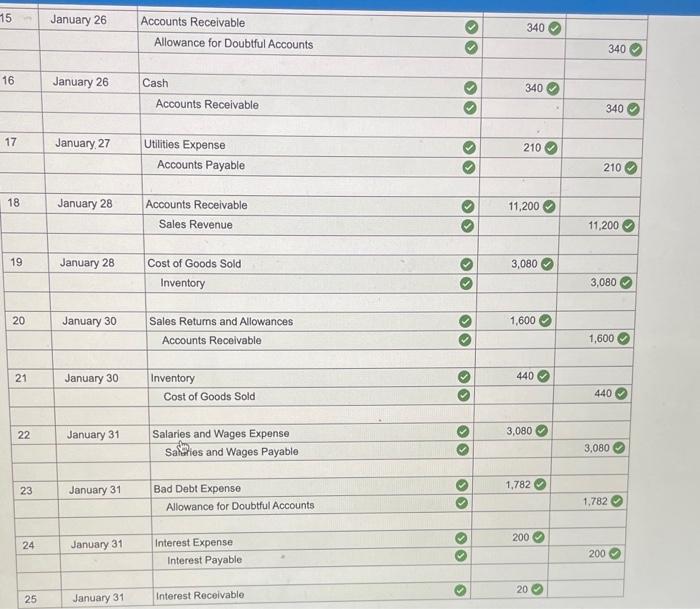

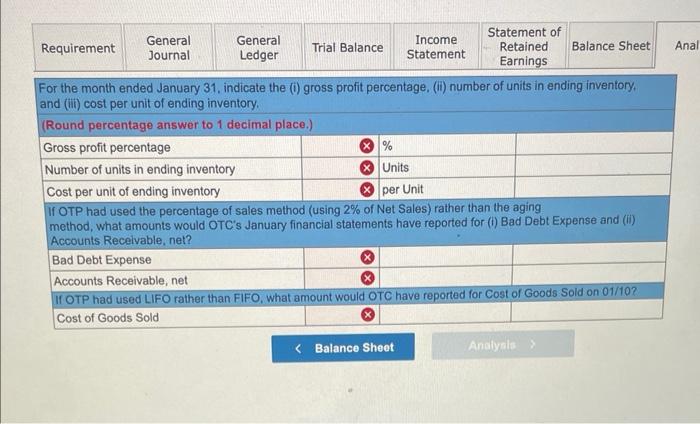

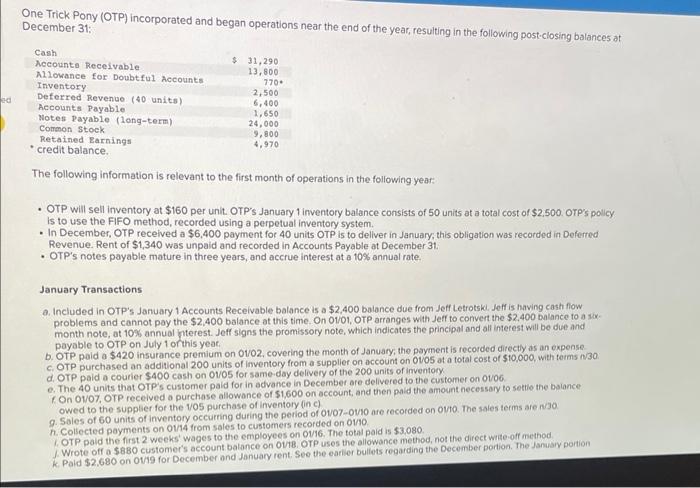

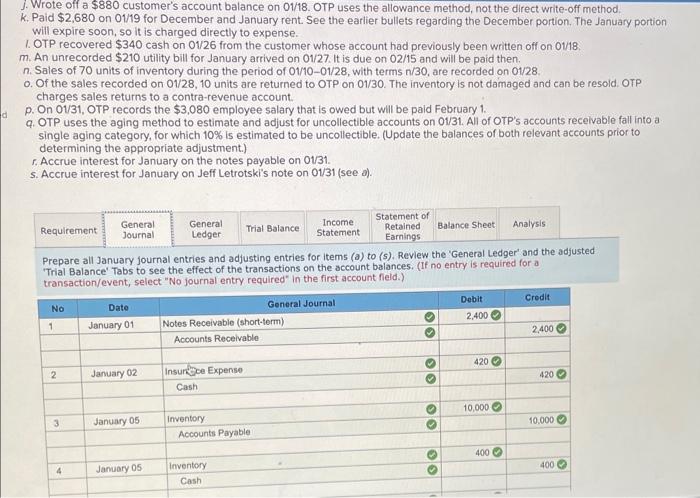

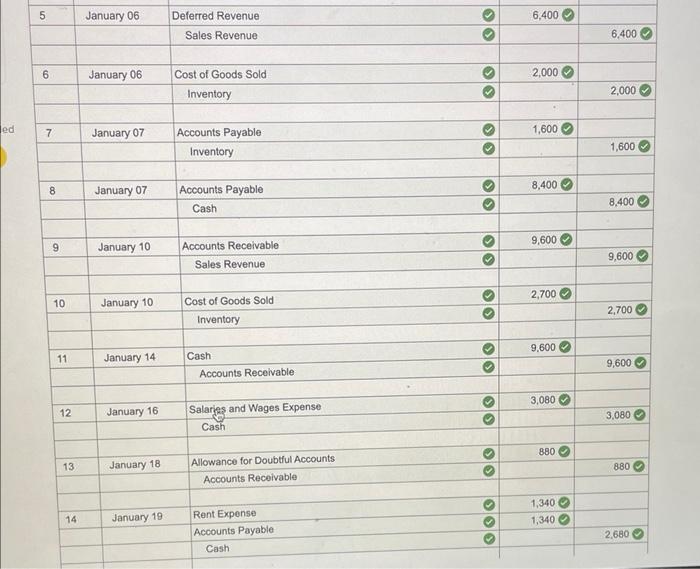

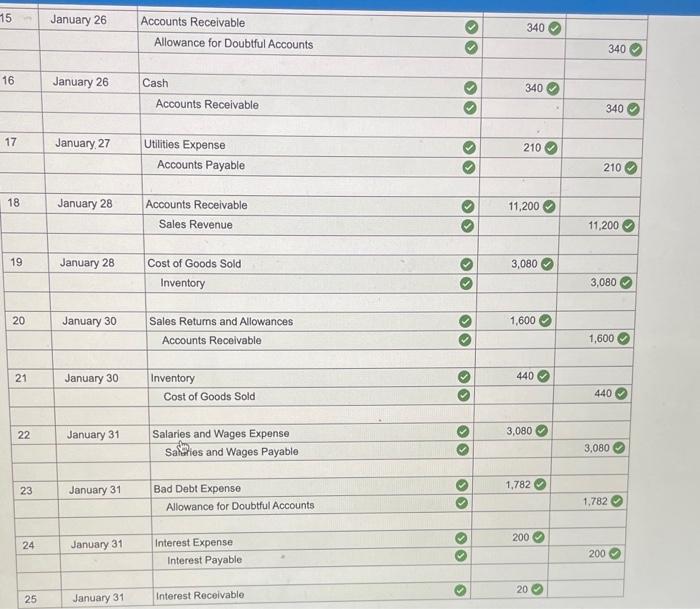

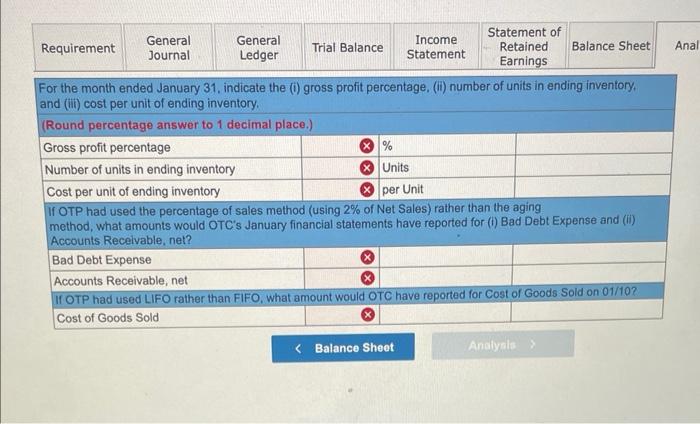

One Trick Pony (OTP) incorporated and began operations near the end of the year, resulting in the following post.closing balances at December 31 The following information is relevant to the first month of operations in the following year: - OTP will sell inventory at $160 per unit OTP's January 1 inventory balance conisists of 50 units at a total cost of $2,500. orp's policy is to use the FIFO method, recorded using a perpetual inventory system. - In December, OTP recelved a $6,400 payment for 40 units OTP is to deliver in January, this obligation was recorded in Deferred Revenue. Rent of $1,340 was unpaid and recorded in Accounts Payable at December 31 . - OTP's notes payable mature in three years, and accrue interest at a 10% annual rate January Transactions a. Included in OTP's January 1 Accounts Receivable balance is a $2,400 balance due from Jeff Letrotskl. Jeff is having cash flow problems and cannot pay the $2,400 balance at this time. On 01/01, OTP arranges with Jeff to convert the $2,400 balance to a sir month note, at 10% annual knterest. Jeff signs the promissory note, which indicates the principal and all interest will be due and payoble to OTP on July 1 onthis yeat. b. OTP poid a $420 insurance premium on 0102, covering the month of January, the payment is recorded directly as an expense c. OTP purchased an additional 200 units of inventory from a supplier on account on 0vo5 at a total cost of $10,000, with terms n30 d. OTP paid a courier $400 cash on 0vo 5 for same-day delivery of the 200 units of inventory e. The 40 units that OTP's customer paid for in advance in December are delivered to the custamer on ovoo f On 0107, OTP recelved a purchase allowance of $1,600 on account, and then pald the amount necessary to settie the balance owed to the supplier for the V0S purchase of inventory (in c) 9. Soles of 60 units of inventory occurring during the period of 01/07-0vo are recorded on Ovto. The sales terms are n30 h. Colsected payments on 01/14 from sales to customers recorded on 01/10. 1. OTP poid the first 2 weeks' wages to the employees on 0116. The total paid is $3.080. 1. Wrote off a $880 customer's account batance on 0178. OTP uses the allowance method, not the direct wite. off method k. Paid $2.680 on 0199 for December and Januacy rent. See the eariler bultets regarding the December portion. The January portion 1. Wrote off a $880 customer's account balance on 01/18. OTP uses the allowance method, not the direct write-off method. k. Paid $2,680 on 01/19 for December and January rent. See the earlier bullets regarding the December portion. The January portion will expire soon, so it is charged directly to expense. 1. OTP recovered $340 cash on 01/26 from the customer whose account had previously been written off on 01/18 m. An unrecorded $210 utility bill for January arrived on 01/27. It is due on 02/15 and will be paid then. n. Sales of 70 units of inventory during the period of 01/1001/28, with terms n/30, are recorded on 01/28. 0 . Of the sales recorded on 01/28, 10 units are returned to OTP on 01/30. The inventory is not damaged and can be resold. OTP charges sales returns to a contra-revenue account. p. On 01/31, OTP records the $3,080 employee salary that is owed but will be paid February 1. q. OTP uses the aging method to estimate and adjust for uncollectible accounts on 01/31. All of OTP's accounts receivable fall into a single aging category, for which 10% is estimated to be uncollectible. (Update the balances of both relevant accounts prior to determining the appropriate adjustment.) r. Accrue interest for January on the notes payable on 0131 . s. Accrue interest for January on Jeff Letrotski's note on 01/31 (see o). Prepare all January journal entries and adjusting entries for items (a) to ( s ). Review the 'General Ledger' and the adjusted 'Trial Balance' Tabs to see the effect of the transactions on the account balances. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline Requirement & GeneralJournal & GeneralLedger & Trial Balance & IncomeStatement & StatementofRetainedEarnings & Balance Sheet & Anal \\ \hline \end{tabular} For the month ended January 31 , indicate the (i) gross profit percentage, (ii) number of units in ending inventory, and (iii) cost per unit of ending inventory. (Round percentage answer to 1 decimal place.) \begin{tabular}{|l|l|l|l|} \hline Gross profit percentage & % & % \\ \hline Number of units in ending inventory & & Units \\ \hline Cost per unit of ending inventory & & per Unit \\ \hline \end{tabular} If OTP had used the percentage of sales method (using 2% of Net Sales) rather than the aging method, what amounts would OTC's January financial statements have reported for (i) Bad Debt Expense and (ii) Accounts Recelvable, net? \begin{tabular}{|l|l|l|l|} \hline Bad Debt Expense & \\ \hline Accounts Receivable, net \\ \hline II OTP had used LIFO rather than FIFO, what amount would OTC have reported for Cost of Goods Sold on 01/10? \\ \hline Cost of Goods Sold & O \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started