Answered step by step

Verified Expert Solution

Question

1 Approved Answer

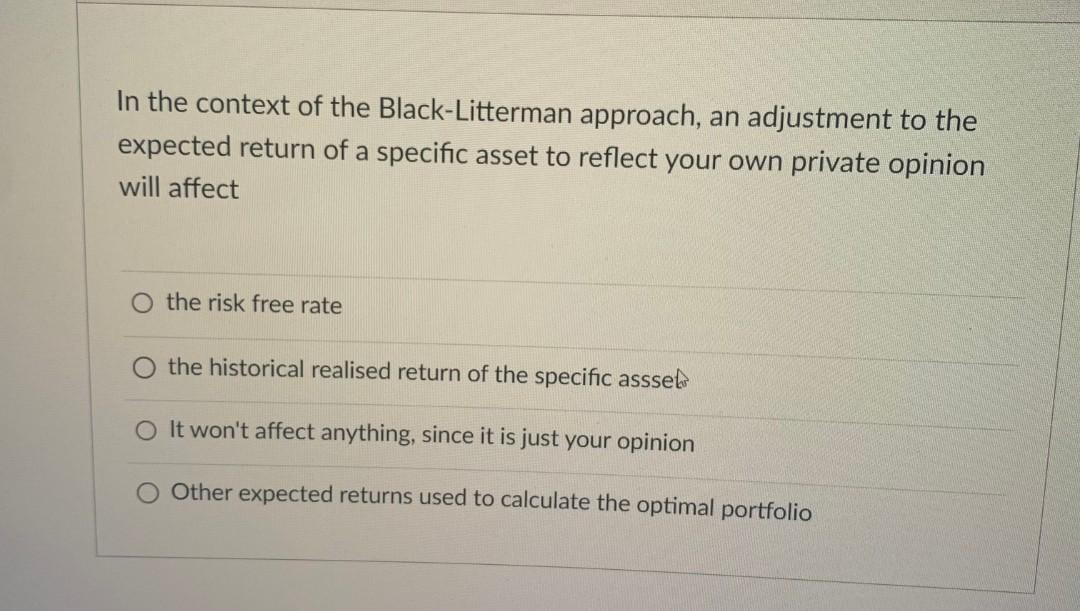

just need the ans. asap thank you In the context of the Black-Litterman approach, an adjustment to the expected return of a specific asset to

just need the ans. asap thank you

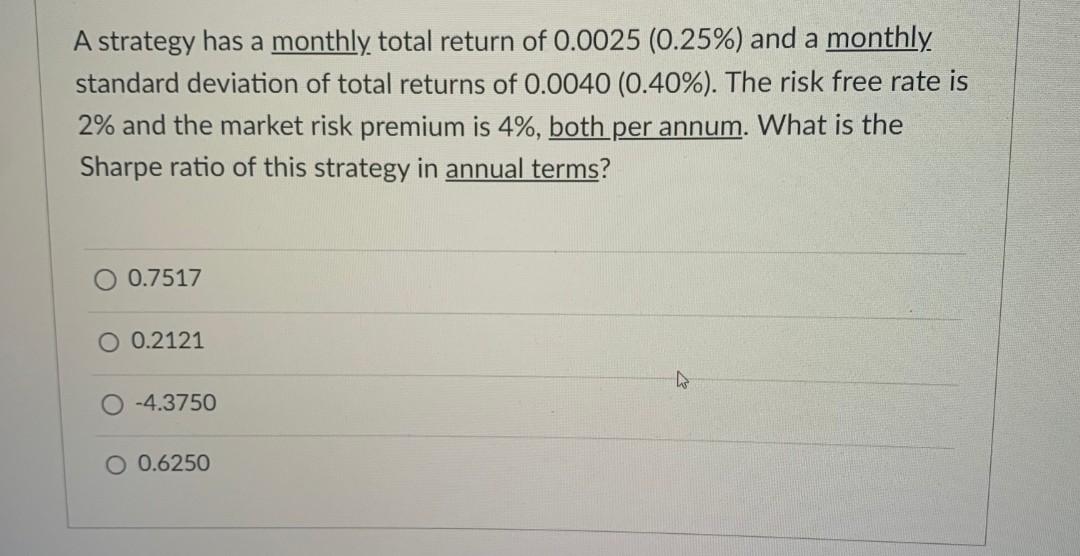

In the context of the Black-Litterman approach, an adjustment to the expected return of a specific asset to reflect your own private opinion will affect the risk free rate the historical realised return of the specific assseto It won't affect anything, since it is just your opinion Other expected returns used to calculate the optimal portfolio A strategy has a monthly total return of 0.0025(0.25%) and a monthly. standard deviation of total returns of 0.0040(0.40%). The risk free rate is 2% and the market risk premium is 4%, both per annum. What is the Sharpe ratio of this strategy in annual terms? 0.7517 0.2121 4.3750 0.6250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started