just need the last two journal entries and letter h.

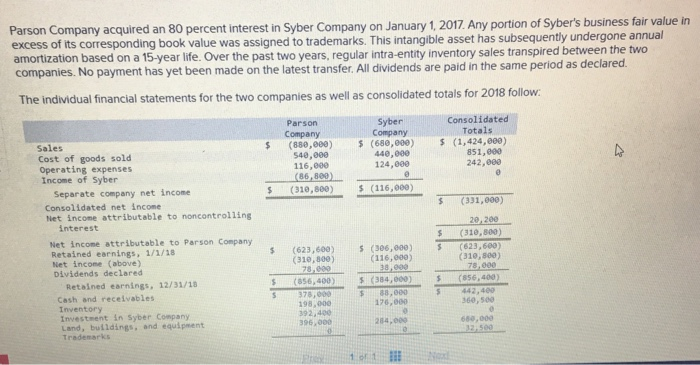

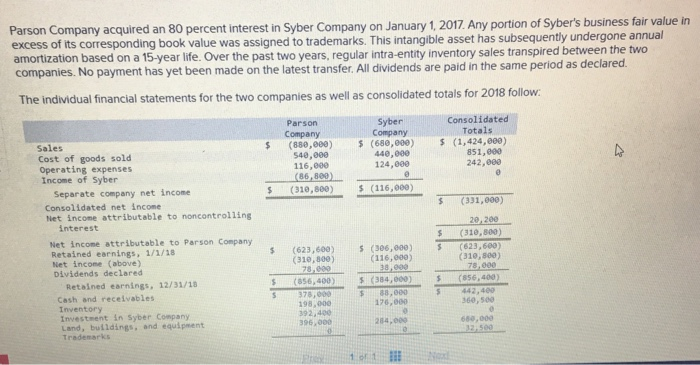

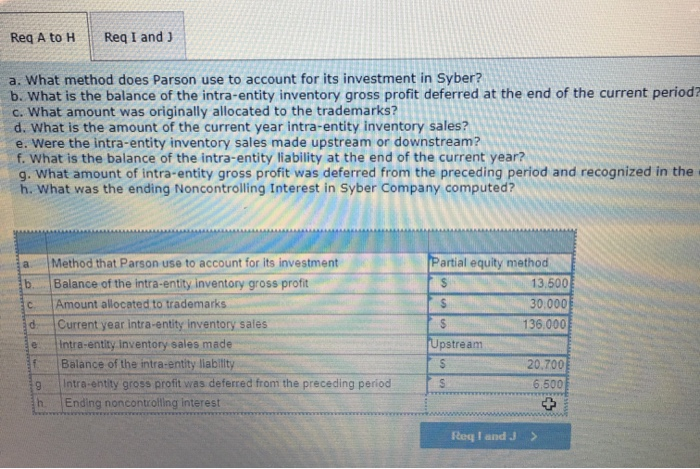

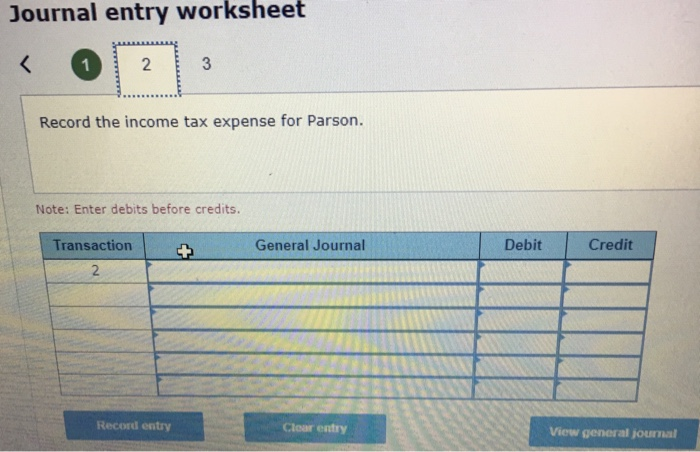

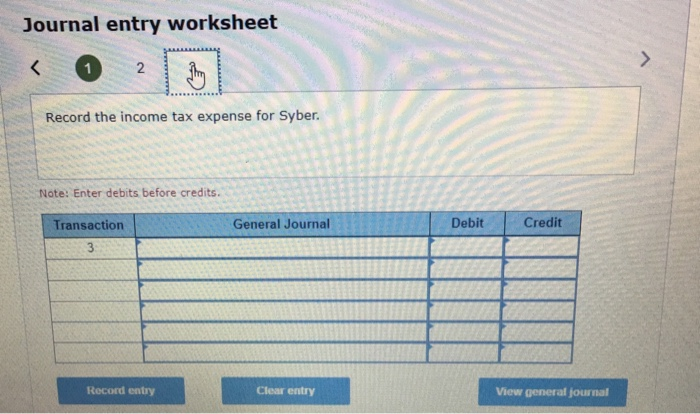

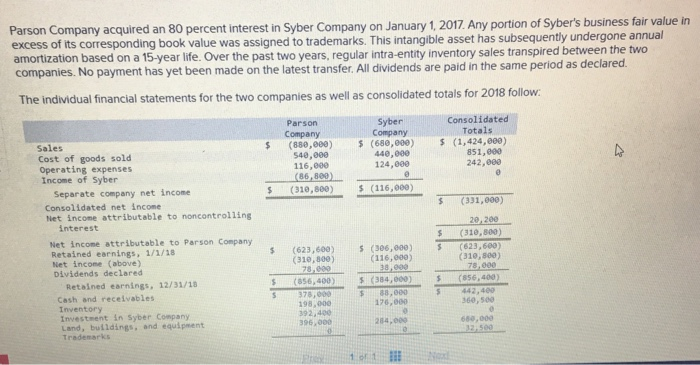

Parson Company acquired an 80 percent interest in Syber Company on January 1, 2017. Any portion of Syber's business fair value in excess of its corresponding book value was assigned to trademarks. This intangible asset has subsequently undergone annual amortization based on a 15-year life. Over the past two years, regular intra-entity inventory sales transpired between the two companies. No payment has yet been made on the latest transfer. All dividends are paid in the same period as declared. The individual financial statements for the two companies as well as consolidated totals for 2018 follow Consolidated Totals $ (1,424,000) 851,000 242,000 Syber Company $ (680,000) 440,000 Parson Company (880,000) 540,000 Sales Cost of goods sold Operating expenses Income of Syber 124,000 116,000 (86,800) $ (116,000) (310,800) Separate company net income (331,000) Consolidated net income Net income attributable to noncontrolling interest 20,200 (310,800) Net income attributable to Parson Company Retained earnings, 1/1/18 Net income (above) Dividends declared (623,600) (310,800) 78,000 S (306,00e S (623,600) (310,800) 78.e00 (116,000) 38, e00 s (384,000) (856,400) (856,400) 378,000 198,000 392,400 396,000 Retained earnings, 12/31/18 442,400 360, 500 88.000 Cash and receivables Inventory Investment in Syber Company Land, buildings, and equipment Trademarks 176,000 680,000 284.000 32.500 1 of 1 Req A to H Req I and J a. What method does Parson use to account for its investment in Syber? b. What is the balance of the intra-entity inventory gross profit deferred at the end of the current period? c. What amount was originally allocated to the trademarks? d. What is the amount of the current year intra-entity inventory sales? e. Were the intra-entity inventory sales made upstream or downstream? f. What is the balance of the intra-entity liability at the end of the current year? g. What amount of intra-entity gross profit was deferred from the preceding period and recognized in the h. What was the ending Noncontrolling Interest in Syber Company computed? Partial equity method Method that Parson use to account for its investment a Balance of the intra-entity inventory gross profit 13,500 30,000 136.000 Amount allocated to trademarks C. Current year intra-entity inventory sales Upstream Intra-entity Inventory sales made e Balance of the intra-entity liabitity Intra-entity gross profit was deferred from the preceding period 20,700 S 6.500 www Ending noncontroffling interest h Req I and J Journal entry worksheet r 3 2 1 Record the income tax expense for Parson. Note: Enter debits before credits. Credit Transaction General Journal Debit 2 Record entry Cloar entry View general joumal Journal entry worksheet 2 Record the income tax expense for Syber. Note: Enter debits before credits. Credit Debit Transaction General Journal 3 Record entry Clear entry View general journal Parson Company acquired an 80 percent interest in Syber Company on January 1, 2017. Any portion of Syber's business fair value in excess of its corresponding book value was assigned to trademarks. This intangible asset has subsequently undergone annual amortization based on a 15-year life. Over the past two years, regular intra-entity inventory sales transpired between the two companies. No payment has yet been made on the latest transfer. All dividends are paid in the same period as declared. The individual financial statements for the two companies as well as consolidated totals for 2018 follow Consolidated Totals $ (1,424,000) 851,000 242,000 Syber Company $ (680,000) 440,000 Parson Company (880,000) 540,000 Sales Cost of goods sold Operating expenses Income of Syber 124,000 116,000 (86,800) $ (116,000) (310,800) Separate company net income (331,000) Consolidated net income Net income attributable to noncontrolling interest 20,200 (310,800) Net income attributable to Parson Company Retained earnings, 1/1/18 Net income (above) Dividends declared (623,600) (310,800) 78,000 S (306,00e S (623,600) (310,800) 78.e00 (116,000) 38, e00 s (384,000) (856,400) (856,400) 378,000 198,000 392,400 396,000 Retained earnings, 12/31/18 442,400 360, 500 88.000 Cash and receivables Inventory Investment in Syber Company Land, buildings, and equipment Trademarks 176,000 680,000 284.000 32.500 1 of 1 Req A to H Req I and J a. What method does Parson use to account for its investment in Syber? b. What is the balance of the intra-entity inventory gross profit deferred at the end of the current period? c. What amount was originally allocated to the trademarks? d. What is the amount of the current year intra-entity inventory sales? e. Were the intra-entity inventory sales made upstream or downstream? f. What is the balance of the intra-entity liability at the end of the current year? g. What amount of intra-entity gross profit was deferred from the preceding period and recognized in the h. What was the ending Noncontrolling Interest in Syber Company computed? Partial equity method Method that Parson use to account for its investment a Balance of the intra-entity inventory gross profit 13,500 30,000 136.000 Amount allocated to trademarks C. Current year intra-entity inventory sales Upstream Intra-entity Inventory sales made e Balance of the intra-entity liabitity Intra-entity gross profit was deferred from the preceding period 20,700 S 6.500 www Ending noncontroffling interest h Req I and J Journal entry worksheet r 3 2 1 Record the income tax expense for Parson. Note: Enter debits before credits. Credit Transaction General Journal Debit 2 Record entry Cloar entry View general joumal Journal entry worksheet 2 Record the income tax expense for Syber. Note: Enter debits before credits. Credit Debit Transaction General Journal 3 Record entry Clear entry View general journal