Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just need these posted to adjust trial balance, only info given is in pictures posted. The Jacks Company began business on July 1 from its

just need these posted to adjust trial balance, only info given is in pictures posted.

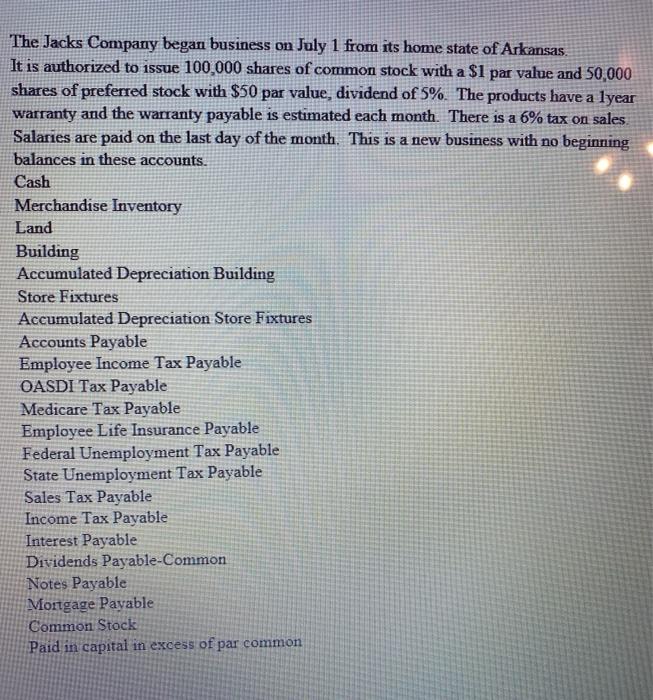

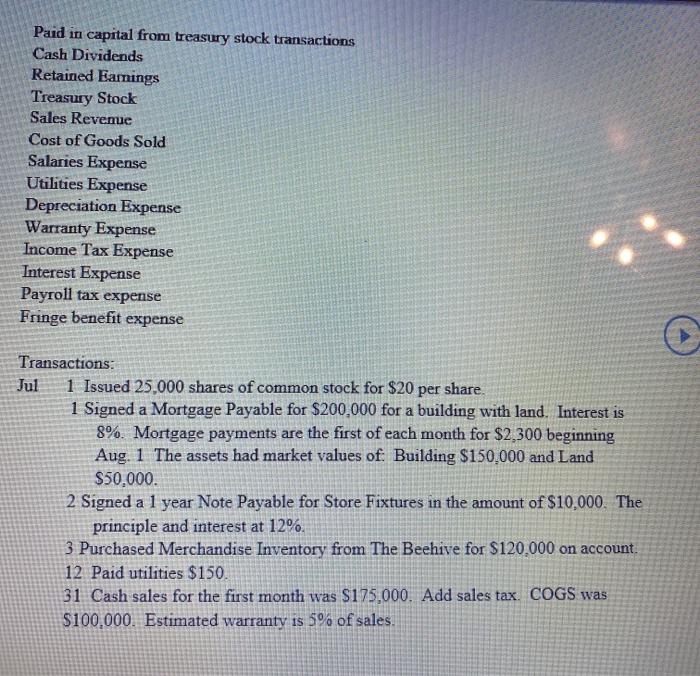

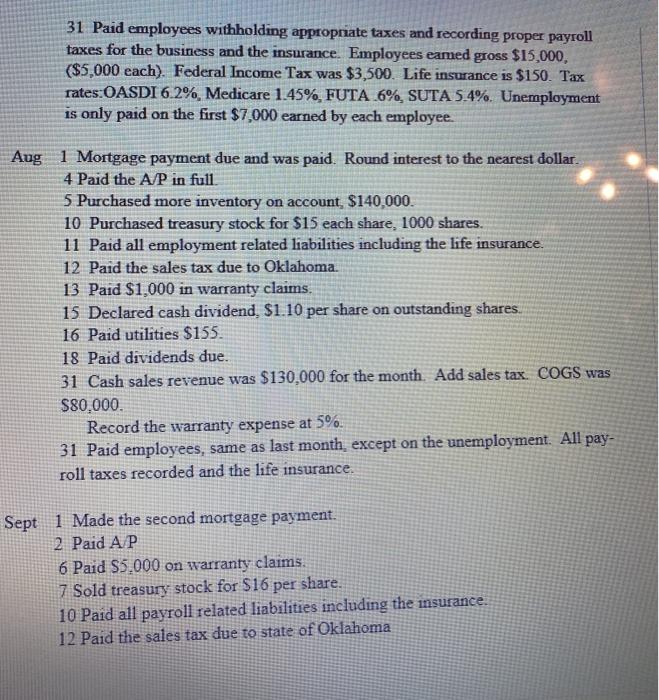

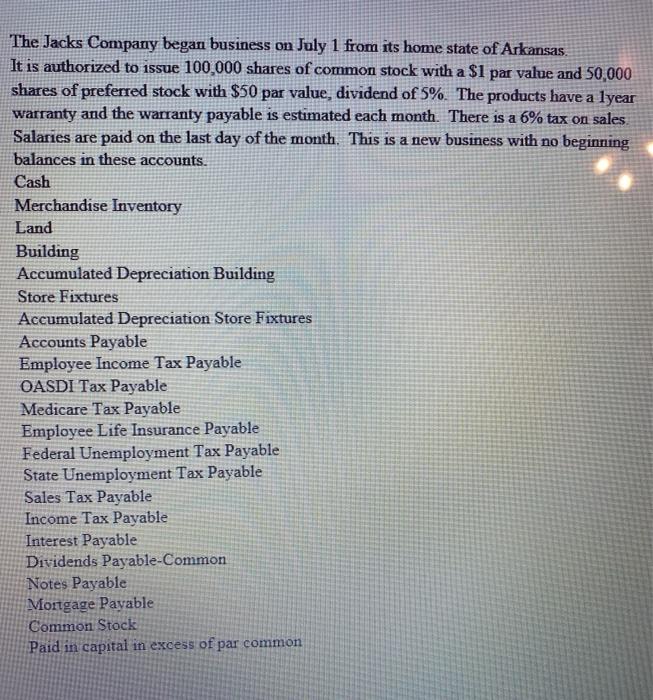

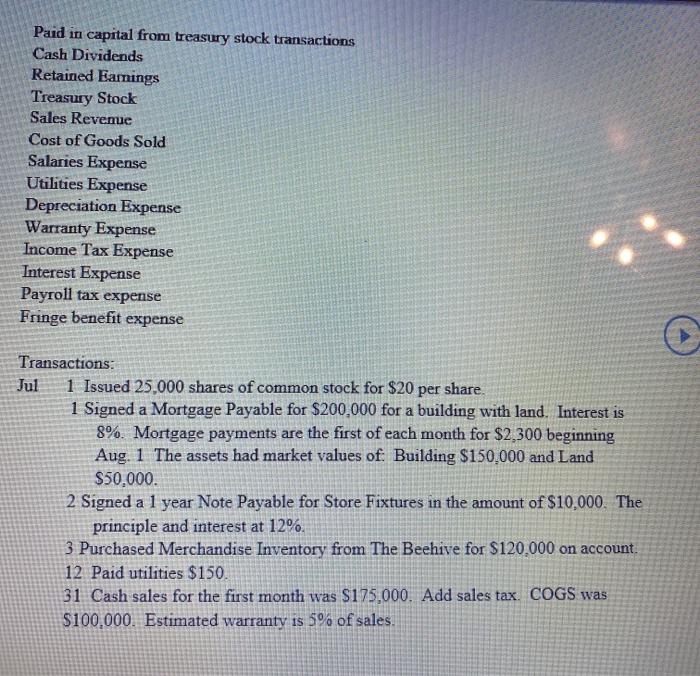

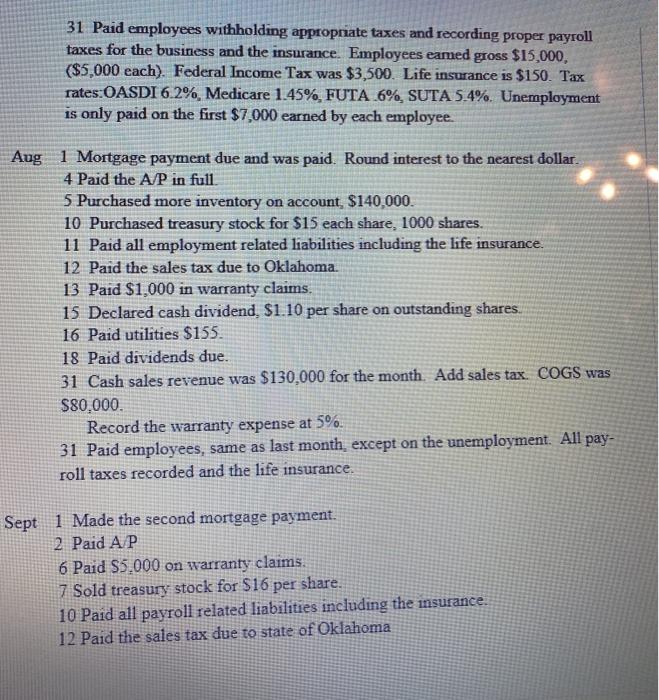

The Jacks Company began business on July 1 from its home state of Arkansas. It is authorized to issue 100,000 shares of common stock with a $1 par value and 50,000 shares of preferred stock with $50 par value, dividend of 5%. The products have a lyear warranty and the warranty payable is estimated each month. There is a 6% tax on sales Salaries are paid on the last day of the month. This is a new business with no beginning balances in these accounts. Cash Merchandise Inventory Land Building Accumulated Depreciation Building Store Fixtures Accumulated Depreciation Store Fixtures Accounts Payable Employee Income Tax Payable OASDI Tax Payable Medicare Tax Payable Employee Life Insurance Payable Federal Unemployment Tax Payable State Unemployment Tax Payable Sales Tax Payable Income Tax Payable Interest Payable Dividends Payable-Common Notes Payable Mortgage Payable Common Stock Paid in capital in excess of par co 10n Paid in capital from treasury stock transactions Cash Dividends Retained Earnings Treasury Stock Sales Revenue Cost of Goods Sold Salaries Expense Utilities Expense Depreciation Expense Warranty Expense Income Tax Expense Interest Expense Payroll tax expense Fringe benefit expense Transactions: Jul 1 Issued 25,000 shares of common stock for $20 per share. 1 Signed a Mortgage Payable for $200,000 for a building with land. Interest is 8%. Mortgage payments are the first of each month for $2,300 beginning Aug. 1 The assets had market values of: Building $150,000 and Land $50,000 2 Signed a 1 year Note Payable for Store Fixtures in the amount of $10,000. The principle and interest at 12% 3 Purchased Merchandise Inventory from The Beehive for $120,000 on account. 12 Paid utilities $150. 31 Cash sales for the first month was $175,000. Add sales tax. COGS was $100,000. Estimated warranty is 5% of sales. 31 Paid employees withholding appropriate taxes and recording proper payroll taxes for the business and the insurance. Employees eamed gross $15,000, ($5,000 each). Federal Income Tax was $3,500. Life insurance is $150. Tax rates:OASDI 6.2%, Medicare 1.45% FUTA 6% SUTA 5.4%. Unemployment is only paid on the first $7,000 earned by each employee. Aug 1 Mortgage payment due and was paid. Round interest to the nearest dollar. 4 Paid the A/P in full. 5 Purchased more inventory on account, $140,000. 10 Purchased treasury stock for $15 each share, 1000 shares. 11 Paid all employment related liabilities including the life insurance. 12 Paid the sales tax due to Oklahoma. 13 Paid $1,000 in warranty claims. 15 Declared cash dividend. $1.10 per share on outstanding shares. 16 Paid utilities $155. 18 Paid dividends due. 31 Cash sales revenue was $130,000 for the month. Add sales tax. COGS was $80,000 Record the warranty expense at 5%. 31 Paid employees, same as last month, except on the unemployment. All pay- roll taxes recorded and the life insurance. Sept 1 Made the second mortgage payment. 2 Paid AP 6 Paid S5,000 on warranty claims. 7 Sold treasury stock for $16 per share. 10 Paid all payroll related liabilities including the insurance. 12 Paid the sales tax due to state of Oklahoma 13 Paid utilities, $140. 15 Purchased inventory, on account, $80,000. 30 Cash sales for the month were $180,000. COGS was $105,000. Add sales tax. Record warranty expense. 30 Paid employees and recorded all appropriate payroll taxes and the insurance. No unemployment due. Required: Journalize transactions. No explanations, but show calculations when necessary. These are for the quarter. Post to T accounts. Adjusting entries pre- pared a. Building has estimated useful life of 40 years with $10,000 residual value, straight-line. Fixtures has 10 year estimated useful life with $1,000 residual value, SAL. b. Accrue interest expense on the Mortgage Payable. c. Accrue interest expense on the Note Payable. d. Accrue income tax expense of $25,000. C Post these, calculate account balances, and prepare an adjusted trial balance. Prepare financial statements: Multi-step Income Statement, Statement of Re- The Jacks Company began business on July 1 from its home state of Arkansas. It is authorized to issue 100,000 shares of common stock with a $1 par value and 50,000 shares of preferred stock with $50 par value, dividend of 5%. The products have a lyear warranty and the warranty payable is estimated each month. There is a 6% tax on sales Salaries are paid on the last day of the month. This is a new business with no beginning balances in these accounts. Cash Merchandise Inventory Land Building Accumulated Depreciation Building Store Fixtures Accumulated Depreciation Store Fixtures Accounts Payable Employee Income Tax Payable OASDI Tax Payable Medicare Tax Payable Employee Life Insurance Payable Federal Unemployment Tax Payable State Unemployment Tax Payable Sales Tax Payable Income Tax Payable Interest Payable Dividends Payable-Common Notes Payable Mortgage Payable Common Stock Paid in capital in excess of par co 10n Paid in capital from treasury stock transactions Cash Dividends Retained Earnings Treasury Stock Sales Revenue Cost of Goods Sold Salaries Expense Utilities Expense Depreciation Expense Warranty Expense Income Tax Expense Interest Expense Payroll tax expense Fringe benefit expense Transactions: Jul 1 Issued 25,000 shares of common stock for $20 per share. 1 Signed a Mortgage Payable for $200,000 for a building with land. Interest is 8%. Mortgage payments are the first of each month for $2,300 beginning Aug. 1 The assets had market values of: Building $150,000 and Land $50,000 2 Signed a 1 year Note Payable for Store Fixtures in the amount of $10,000. The principle and interest at 12% 3 Purchased Merchandise Inventory from The Beehive for $120,000 on account. 12 Paid utilities $150. 31 Cash sales for the first month was $175,000. Add sales tax. COGS was $100,000. Estimated warranty is 5% of sales. 31 Paid employees withholding appropriate taxes and recording proper payroll taxes for the business and the insurance. Employees eamed gross $15,000, ($5,000 each). Federal Income Tax was $3,500. Life insurance is $150. Tax rates:OASDI 6.2%, Medicare 1.45% FUTA 6% SUTA 5.4%. Unemployment is only paid on the first $7,000 earned by each employee. Aug 1 Mortgage payment due and was paid. Round interest to the nearest dollar. 4 Paid the A/P in full. 5 Purchased more inventory on account, $140,000. 10 Purchased treasury stock for $15 each share, 1000 shares. 11 Paid all employment related liabilities including the life insurance. 12 Paid the sales tax due to Oklahoma. 13 Paid $1,000 in warranty claims. 15 Declared cash dividend. $1.10 per share on outstanding shares. 16 Paid utilities $155. 18 Paid dividends due. 31 Cash sales revenue was $130,000 for the month. Add sales tax. COGS was $80,000 Record the warranty expense at 5%. 31 Paid employees, same as last month, except on the unemployment. All pay- roll taxes recorded and the life insurance. Sept 1 Made the second mortgage payment. 2 Paid AP 6 Paid S5,000 on warranty claims. 7 Sold treasury stock for $16 per share. 10 Paid all payroll related liabilities including the insurance. 12 Paid the sales tax due to state of Oklahoma 13 Paid utilities, $140. 15 Purchased inventory, on account, $80,000. 30 Cash sales for the month were $180,000. COGS was $105,000. Add sales tax. Record warranty expense. 30 Paid employees and recorded all appropriate payroll taxes and the insurance. No unemployment due. Required: Journalize transactions. No explanations, but show calculations when necessary. These are for the quarter. Post to T accounts. Adjusting entries pre- pared a. Building has estimated useful life of 40 years with $10,000 residual value, straight-line. Fixtures has 10 year estimated useful life with $1,000 residual value, SAL. b. Accrue interest expense on the Mortgage Payable. c. Accrue interest expense on the Note Payable. d. Accrue income tax expense of $25,000. C Post these, calculate account balances, and prepare an adjusted trial balance. Prepare financial statements: Multi-step Income Statement, Statement of Re

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started