Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need to do part (b) & (C) Thank You Show the steps clearly The following information was obtained for this proposal:- Two vans with

Just need to do part (b) & (C) Thank You

Show the steps clearly

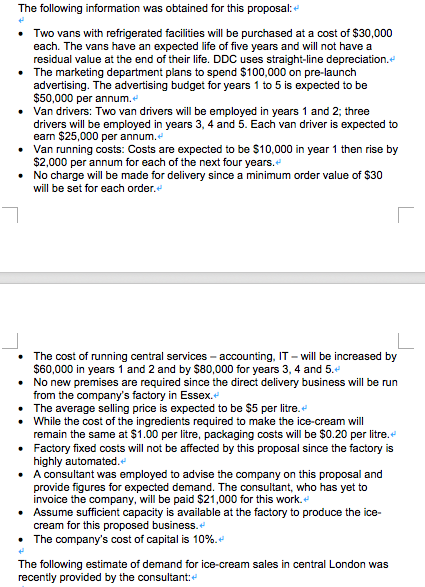

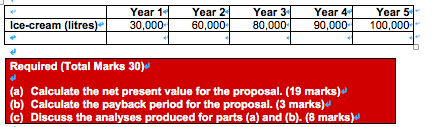

The following information was obtained for this proposal:- Two vans with refrigerated facilities will be purchased at a cost of $30,000 each. The vans have an expected life of five years and will not have a residual value at the end of their life. DDC uses straight-line depreciation. The marketing department plans to spend $100,000 on pre-launch advertising. The advertising budget for years 1 to 5 is expected to be $50,000 per annum. Van drivers: Two van drivers will be employed in years 1 and 2; three drivers will be employed in years 3, 4 and 5. Each van driver is expected to earn $25,000 per annum. . Van running costs: Costs are expected to be $10,000 in year 1 then rise by $2,000 per annum for each of the next four years. No charge will be made for delivery since a minimum order value of $30 will be set for each order. The cost of running central services - accounting, IT - will be increased by $60,000 in years 1 and 2 and by $80,000 for years 3, 4 and 5.4 No new premises are required since the direct delivery business will be run from the company's factory in Essex. The average selling price is expected to be $5 per litre. While the cost of the ingredients required to make the ice-cream will remain the same at $1.00 per litre, packaging costs will be $0.20 per litre. Factory fixed costs will not be affected by this proposal since the factory is highly automated. A consultant was employed to advise the company on this proposal and provide figures for expected demand. The consultant, who has yet to invoice the company, will be paid $21,000 for this work. Assume sufficient capacity is available at the factory to produce the ice- cream for this proposed business. The company's cost of capital is 10%. The following estimate of demand for ice-cream sales in central London was recently provided by the consultant:- Year 1- 30,000 Year 2 60,000 Year 3 80,000 Year 4 90,000 Ice-cream (litres) Year 5 100,000 Required (Total Marks 30) (a) Calculate the net present value for the proposal. (19 marks) (b) Calculate the payback period for the proposal. (3 marks) (c) Discuss the analyses produced for parts (a) and (b). (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started