Answered step by step

Verified Expert Solution

Question

1 Approved Answer

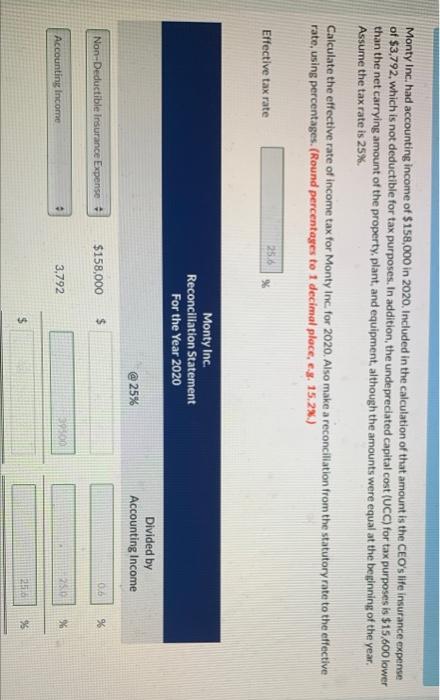

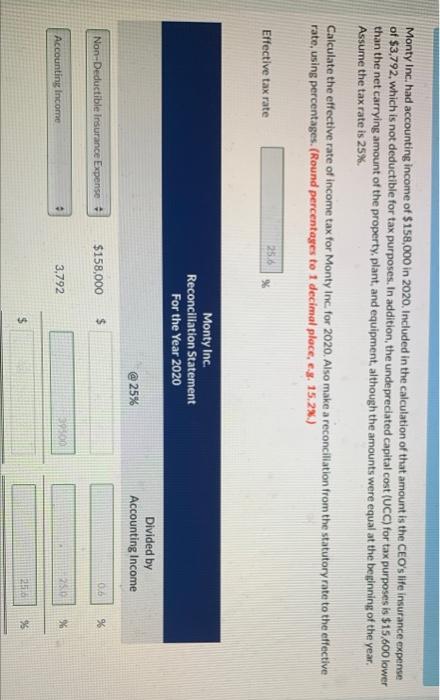

just need to fill in those 2 boxes please help thank you! Monty Inc. had accounting income of $ 158,000 in 2020. Included in the

just need to fill in those 2 boxes please help thank you!

Monty Inc. had accounting income of $ 158,000 in 2020. Included in the calculation of that amount is the CEO's life insurance expense of $3,792, which is not deductible for tax purposes. In addition, the undepreciated capital cost (UCC) for tax purposes is $15,600 lower than the net carrying amount of the property, plant, and equipment, although the amounts were equal at the beginning of the year, Assume the tax rate is 25%. Calculate the effective rate of income tax for Monty Inc. for 2020. Also make a reconciliation from the statutory rate to the effective rate, using percentages. (Round percentages to 1 decimal place, c. 15,2%) Effective tax rate 258 Monty Inc. Reconciliation Statement For the Year 2020 Divided by Accounting Income @ 25% Non-Deductible Insurance Expense $158,000 $ 0.6 % Accounting Income 3,792 25 % $ 2. 96

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started