Answered step by step

Verified Expert Solution

Question

1 Approved Answer

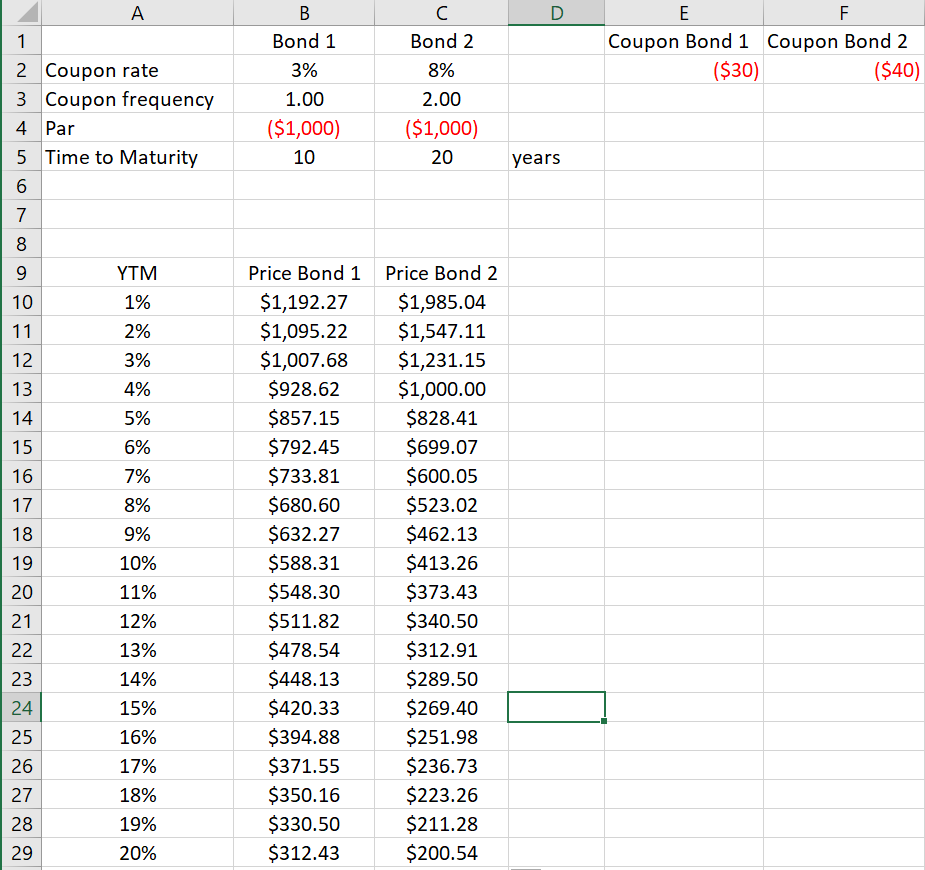

Just needing help on filling in the table above. The bond calculations are listed above the questions in the excel sheet. B Coupon Bond 1

Just needing help on filling in the table above. The bond calculations are listed above the questions in the excel sheet.

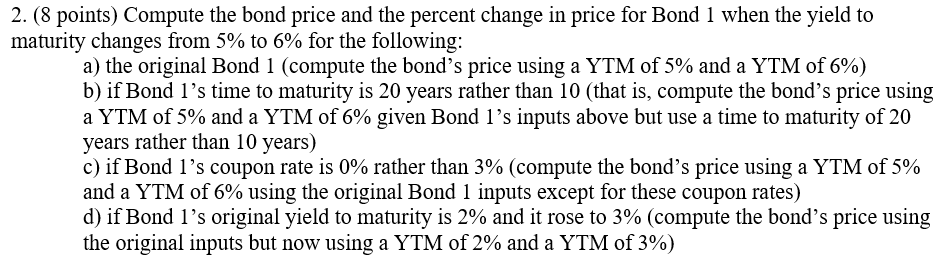

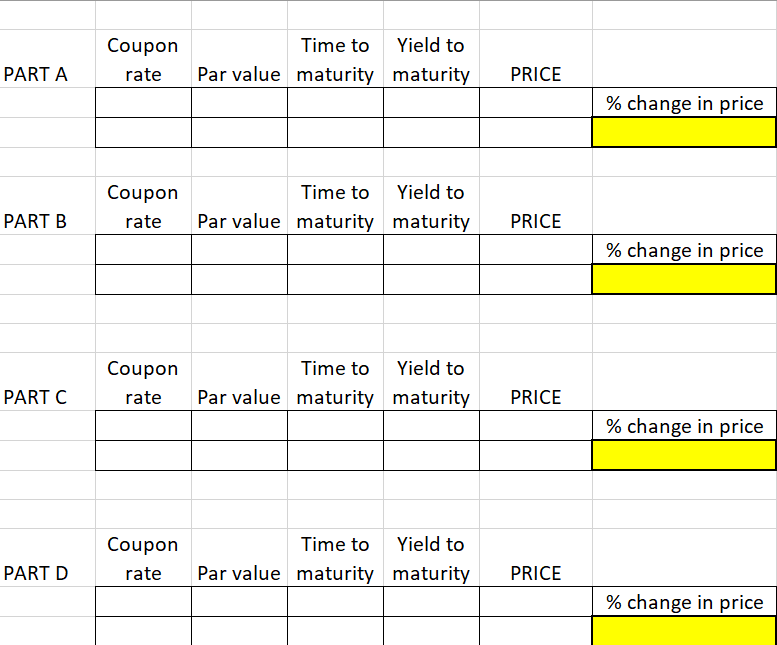

B Coupon Bond 1 Coupon Bond 2 ($30) ($40) 2 Coupon rate 3 Coupon frequency 4. Par 5 Time to Maturity Bond 1 3% 1.00 ($1,000) Bond 2 8% 2.00 ($1,000) 20 10 years YTM 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Price Bond 1 $1,192.27 $1,095.22 $1,007.68 $928.62 $857.15 $792.45 $733.81 $680.60 $632.27 $588.31 $548.30 $511.82 $478.54 $448.13 $420.33 $394.88 $371.55 $350.16 $330.50 $312.43 Price Bond 2 $1,985.04 $1,547.11 $1,231.15 $1,000.00 $828.41 $699.07 $600.05 $523.02 $462.13 $413.26 $373.43 $340.50 $312.91 $289.50 $269.40 $251.98 $236.73 $223.26 $211.28 $200.54 2. (8 points) Compute the bond price and the percent change in price for Bond 1 when the yield to maturity changes from 5% to 6% for the following: a) the original Bond 1 (compute the bond's price using a YTM of 5% and a YTM of 6%) b) if Bond 1's time to maturity is 20 years rather than 10 (that is, compute the bond's price using a YTM of 5% and a YTM of 6% given Bond l's inputs above but use a time to maturity of 20 years rather than 10 years) c) if Bond l's coupon rate is 0% rather than 3% (compute the bond's price using a YTM of 5% and a YTM of 6% using the original Bond 1 inputs except for these coupon rates) d) if Bond l's original yield to maturity is 2% and it rose to 3% (compute the bond's price using the original inputs but now using a YTM of 2% and a YTM of 3%) Coupon rate Time to Yield to Par value maturity maturity PARTA PRICE % change in price Coupon rate Time to Yield to Par value maturity maturity PART B PRICE % change in price Coupon rate Time to Yield to Par value maturity maturity PARTC PRICE % change in price Coupon rate Time to Yield to Par value maturity maturity PART D PRICE % change in priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started