Answered step by step

Verified Expert Solution

Question

1 Approved Answer

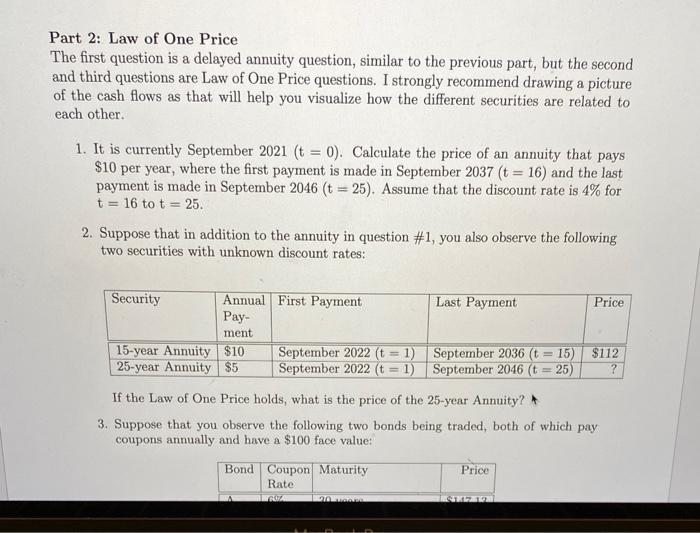

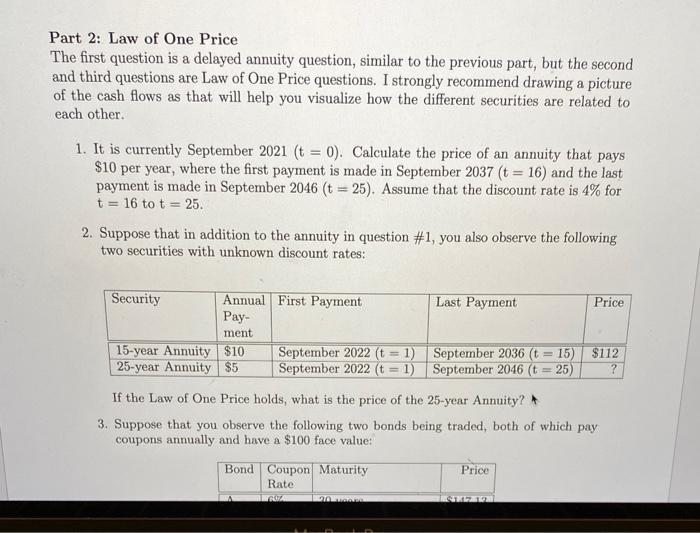

just part 3 please Part 2: Law of One Price The first question is a delayed annuity question, similar to the previous part, but the

just part 3 please

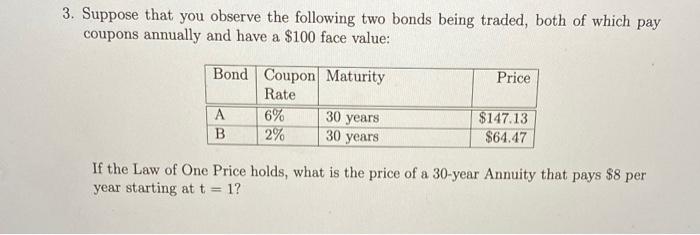

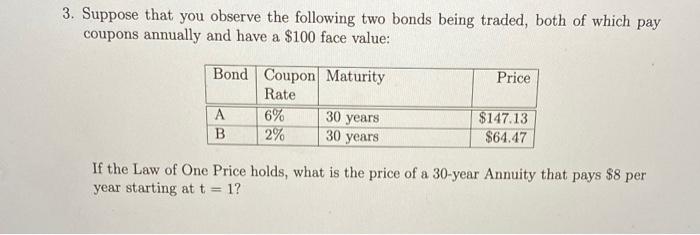

Part 2: Law of One Price The first question is a delayed annuity question, similar to the previous part, but the second and third questions are Law of One Price questions. I strongly recommend drawing a picture of the cash flows as that will help you visualize how the different securities are related to each other 1. It is currently September 2021 (t = 0). Calculate the price of an annuity that pays $10 per year, where the first payment is made in September 2037 (t = 16) and the last payment is made in September 2046 (t = 25). Assume that the discount rate is 4% for t = 16 to t = 25. 2. Suppose that in addition to the annuity in question #1, you also observe the following two securities with unknown discount rates: Price Security Annual First Payment Last Payment Pay- ment 15-year Annuity $10 September 2022 (t = 1) September 2036 (t = 15) 25-year Annuity $5 September 2022 (t = 1) September 2016 (t = 25) $112 ? If the Law of One Price holds, what is the price of the 25-year Annuity? 3. Suppose that you observe the following two bonds being traded, both of which pay coupons annually and have a $100 face value: Price Bond Coupon Maturity Rate RUTA TALEN 1122 3. Suppose that you observe the following two bonds being traded, both of which pay coupons annually and have a $100 face value: Price Bond Coupon Maturity Rate A 6% B 2% 30 years 30 years $147.13 $64.47 If the Law of One Price holds, what is the price of a 30-year Annuity that pays $8 per year starting at t = 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started