Just part B and C

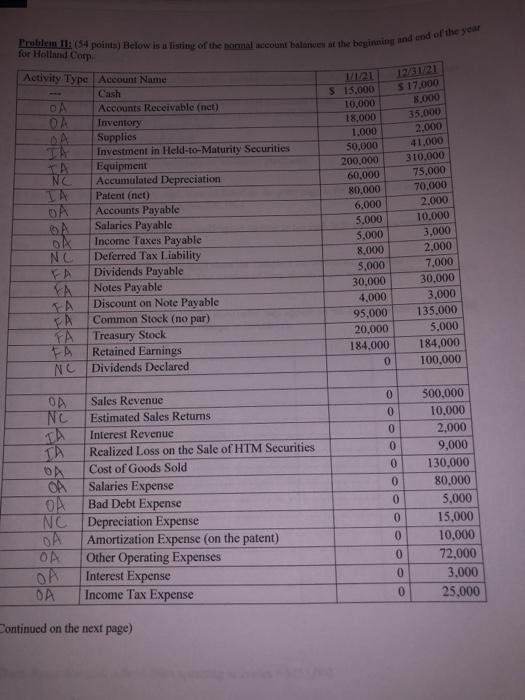

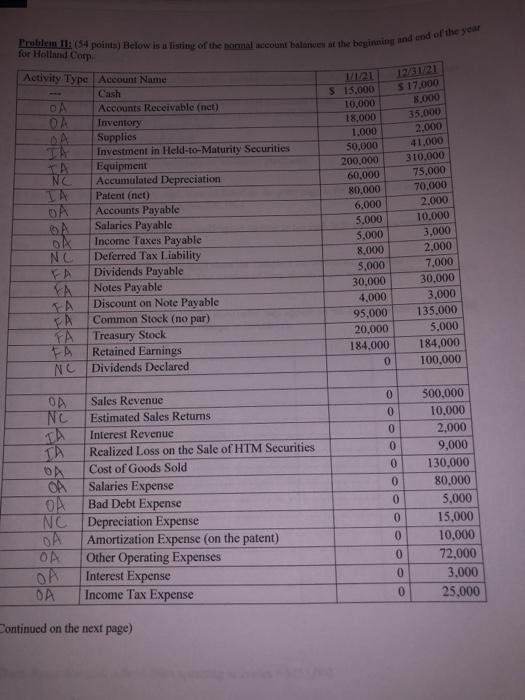

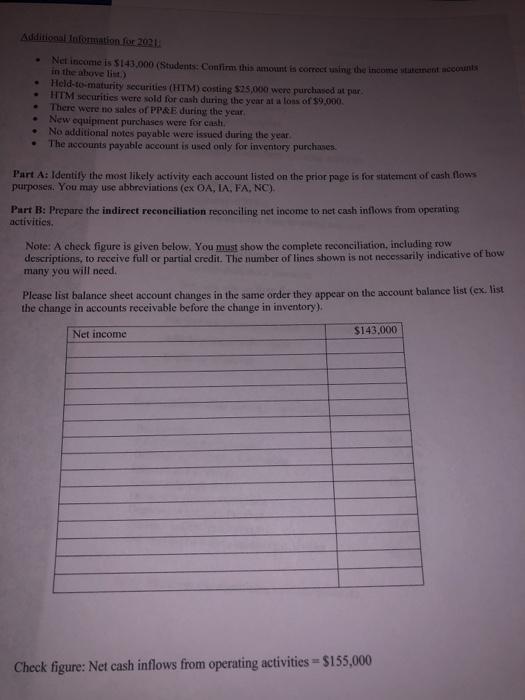

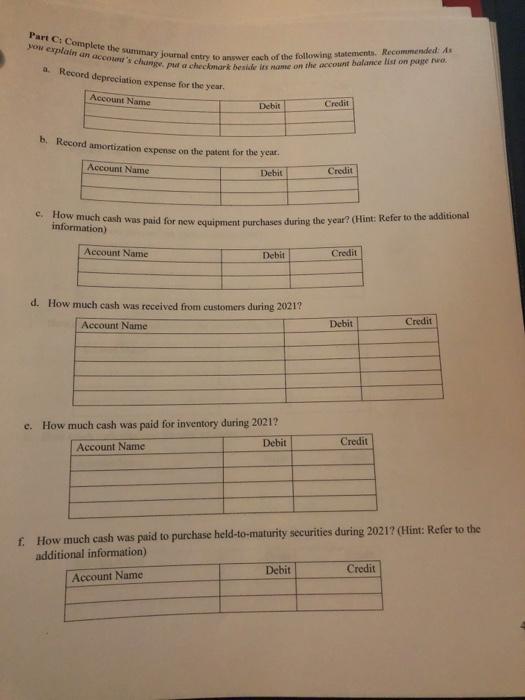

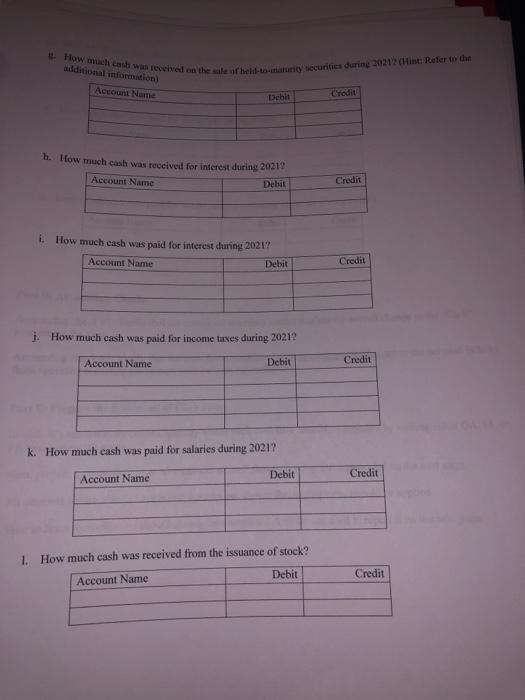

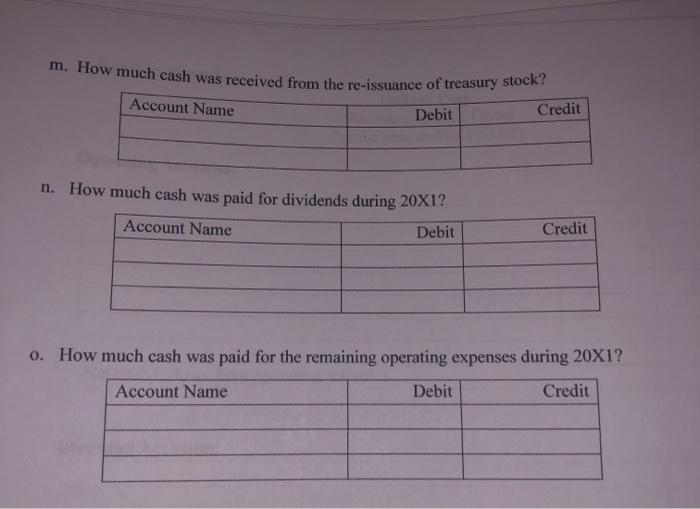

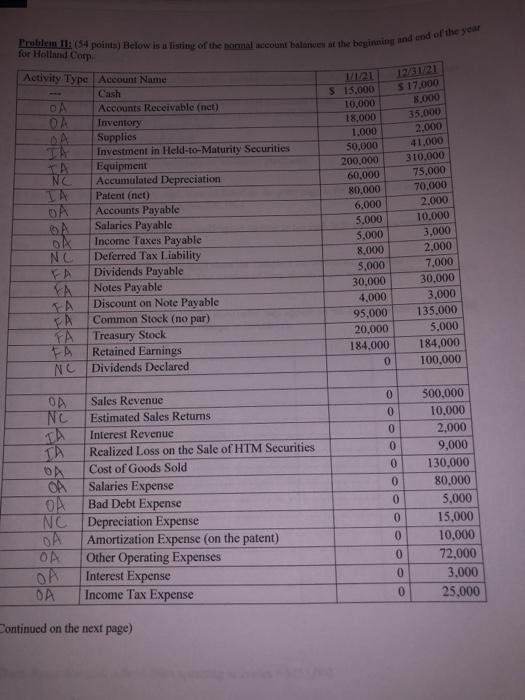

1220121 $ 17,000 8.000 35.000 2.000 for Holland Corp Emblem 11:54 points) Below is a list of the normal account balances at the beginning and end of the year Activity Type Account Name 1121 Cash $15.000 Accounts Receivable (net) 10.000 OA Inventory 18.000 DA Supplies 1.000 Investment in Held-to-Maturity Securities 50,000 41.000 TA Equipment 200,000 310,000 Nc Accumulated Depreciation 60.000 75.000 IA Patent (net) 80.000 70,000 OA Accounts Payable 6,000 2.000 A Salaries Payable 5.000 10.000 Income Taxes Payable 5.000 3,000 NC Deferred Tax Liability 8,000 2.000 Dividends Payable 5,000 7,000 Notes Payable 30,000 30,000 Discount on Note Payable 4,000 3,000 Common Stock (no par) 95,000 135.000 FA Treasury Stock 20.000 5.000 FA Retained Earnings 184.000 184.000 NC Dividends Declared 0 100.000 ON FA FA 0 0 0 TA 0 0 0 OA Sales Revenue NC Estimated Sales Returns Interest Revenue Realized Loss on the sale of HTM Securities ON Cost of Goods Sold OA Salaries Expense ON Bad Debt Expense NC Depreciation Expense Amortization Expense (on the patent) OA Other Operating Expenses OA Interest Expense DA Income Tax Expense 0 500,000 10,000 2,000 9,000 130,000 80.000 5.000 15,000 10,000 72.000 3,000 25,000 0 0 0 0 0 Continued on the next page) Additional Information for 2021 Net income is $143.000 (Students Confirm this amount is correct using the income statement coins in the above list) Held-to-maturity securities (HTM) costing $25,000 were purchased at par HTM securities were sold for cash during the year at a loss of $9.000 There were no sales of PPAE during the year New equipment purchases were for cash No additional notes payable were issued during the year The accounts payable account is used only for inventory purchases. . . Part A: Identify the most likely activity cach account listed on the prior page is for statement of cash flows purposes. You may use abbreviations (ex OA, IA, FA, NC). Part B: Prepare the indirect reconciliation reconciting net income to net cash inflows from operating activities, Note: A check figure is given below. You must show the complete reconciliation, including row descriptions, to receive full or partial credit. The number of lines shown is not necessarily indicative of how many you will need, Please list balance sheet account changes in the same order they appear on the account balance list (ex. list the change in accounts receivable before the change in inventory) Net income $143.000 Check figure: Net cash inflows from operating activities = $155,000 Part C. Complete the mary journal entry to answer each of the following statements. Recommended w explain an account's churcheckmark bere on the count balance is one Record depreciation expense for the year Account Name Debit Credit b. Record amortization expense on the patent for the year. Account Name Debit Credit How much cash was paid for new equipment purchases during the year? (Hint: Refer to the additional Account Name Debit Credit d. How much cash was received from customers during 2021? Account Name Debit Credit c. How much cash was paid for inventory during 2021? Account Name Debit Credit f. How much cash was paid to purchase held-to-maturity securities during 2021? (Hint: Refer to the additional information) Account Name Debit Credit How much eash was revered the sale of how curities during 2021 (Hint: Reler than additional information Account Name Det Credit h. How much cash was received for interest during 2017 Account Name Debil Credit 1. How much cash was paid for interest during 2021? Account Name Debit Credit j. How much cash was paid for income taxes during 2021? Account Name Debit Credit k. How much cash was paid for salaries during 2021? Debit Credit Account Name 1. How much cash was received from the issuance of stock? Account Name Debit Credit m. How much cash was received from the re-issuance of treasury stock? Debit Credit Account Name n. How much cash was paid for dividends during 20X1? Account Name Debit Credit o. How much cash was paid for the remaining operating expenses during 20X1? Account Name Debit Credit 1220121 $ 17,000 8.000 35.000 2.000 for Holland Corp Emblem 11:54 points) Below is a list of the normal account balances at the beginning and end of the year Activity Type Account Name 1121 Cash $15.000 Accounts Receivable (net) 10.000 OA Inventory 18.000 DA Supplies 1.000 Investment in Held-to-Maturity Securities 50,000 41.000 TA Equipment 200,000 310,000 Nc Accumulated Depreciation 60.000 75.000 IA Patent (net) 80.000 70,000 OA Accounts Payable 6,000 2.000 A Salaries Payable 5.000 10.000 Income Taxes Payable 5.000 3,000 NC Deferred Tax Liability 8,000 2.000 Dividends Payable 5,000 7,000 Notes Payable 30,000 30,000 Discount on Note Payable 4,000 3,000 Common Stock (no par) 95,000 135.000 FA Treasury Stock 20.000 5.000 FA Retained Earnings 184.000 184.000 NC Dividends Declared 0 100.000 ON FA FA 0 0 0 TA 0 0 0 OA Sales Revenue NC Estimated Sales Returns Interest Revenue Realized Loss on the sale of HTM Securities ON Cost of Goods Sold OA Salaries Expense ON Bad Debt Expense NC Depreciation Expense Amortization Expense (on the patent) OA Other Operating Expenses OA Interest Expense DA Income Tax Expense 0 500,000 10,000 2,000 9,000 130,000 80.000 5.000 15,000 10,000 72.000 3,000 25,000 0 0 0 0 0 Continued on the next page) Additional Information for 2021 Net income is $143.000 (Students Confirm this amount is correct using the income statement coins in the above list) Held-to-maturity securities (HTM) costing $25,000 were purchased at par HTM securities were sold for cash during the year at a loss of $9.000 There were no sales of PPAE during the year New equipment purchases were for cash No additional notes payable were issued during the year The accounts payable account is used only for inventory purchases. . . Part A: Identify the most likely activity cach account listed on the prior page is for statement of cash flows purposes. You may use abbreviations (ex OA, IA, FA, NC). Part B: Prepare the indirect reconciliation reconciting net income to net cash inflows from operating activities, Note: A check figure is given below. You must show the complete reconciliation, including row descriptions, to receive full or partial credit. The number of lines shown is not necessarily indicative of how many you will need, Please list balance sheet account changes in the same order they appear on the account balance list (ex. list the change in accounts receivable before the change in inventory) Net income $143.000 Check figure: Net cash inflows from operating activities = $155,000 Part C. Complete the mary journal entry to answer each of the following statements. Recommended w explain an account's churcheckmark bere on the count balance is one Record depreciation expense for the year Account Name Debit Credit b. Record amortization expense on the patent for the year. Account Name Debit Credit How much cash was paid for new equipment purchases during the year? (Hint: Refer to the additional Account Name Debit Credit d. How much cash was received from customers during 2021? Account Name Debit Credit c. How much cash was paid for inventory during 2021? Account Name Debit Credit f. How much cash was paid to purchase held-to-maturity securities during 2021? (Hint: Refer to the additional information) Account Name Debit Credit How much eash was revered the sale of how curities during 2021 (Hint: Reler than additional information Account Name Det Credit h. How much cash was received for interest during 2017 Account Name Debil Credit 1. How much cash was paid for interest during 2021? Account Name Debit Credit j. How much cash was paid for income taxes during 2021? Account Name Debit Credit k. How much cash was paid for salaries during 2021? Debit Credit Account Name 1. How much cash was received from the issuance of stock? Account Name Debit Credit m. How much cash was received from the re-issuance of treasury stock? Debit Credit Account Name n. How much cash was paid for dividends during 20X1? Account Name Debit Credit o. How much cash was paid for the remaining operating expenses during 20X1? Account Name Debit Credit