Answered step by step

Verified Expert Solution

Question

1 Approved Answer

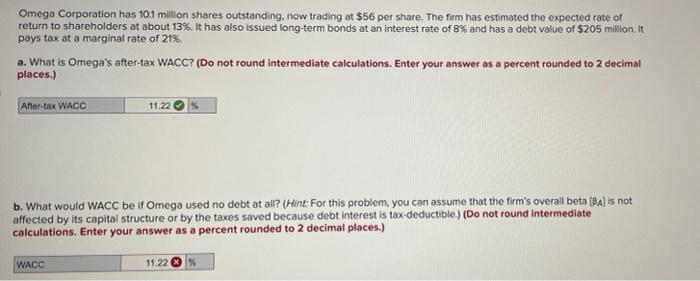

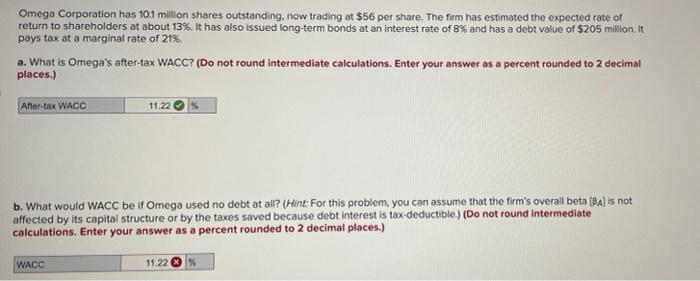

Just Part B. Please Omega Corporation has 10.1 million shares outstanding, now trading at $56 per share. The firm has estimated the expected rate of

Just Part B. Please

Omega Corporation has 10.1 million shares outstanding, now trading at $56 per share. The firm has estimated the expected rate of return to shareholders at about 13%. It has also issued long-term bonds at an interest rate of 8% and has a debt value of $205 million. It pays tax at a marginal rate of 21% a. What is Omega's after-tax WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) After-tax WACC 11.22 b. What would WACC be if Omega used no debt at all? (Hint: For this problem, you can assume that the firm's overall beta (BA) is not affected by its capital structure or by the taxes saved because debt interest is tax deductible.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) WACC 11.22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started