Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just parts B and C in the table thank you!!:) Placid Lake Corporation acquired 80 percent of the outstanding voting stock of Scenic, Inc, on

just parts B and C in the table thank you!!:)

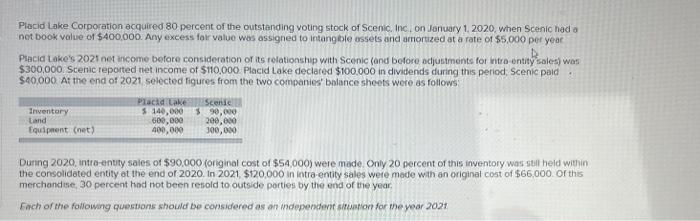

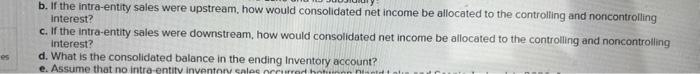

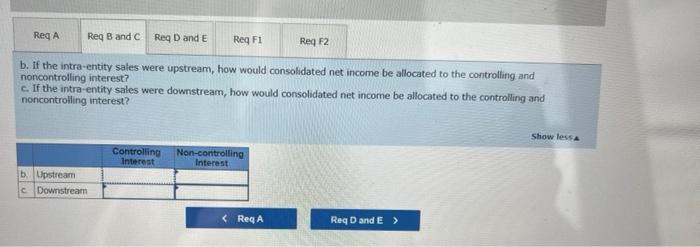

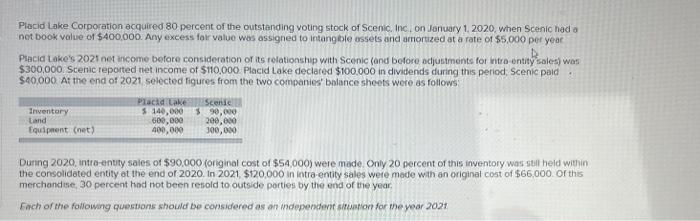

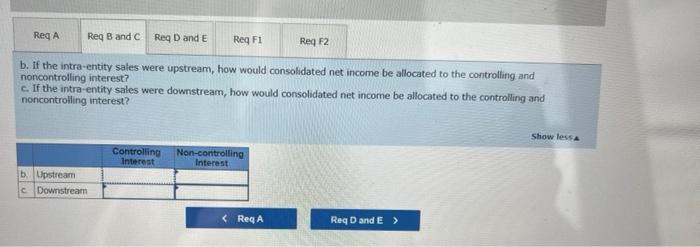

Placid Lake Corporation acquired 80 percent of the outstanding voting stock of Scenic, Inc, on January 1, 2020, when Scenic had a net book value of $400,000. Any excess for value was assigned to intang tile os sets and amortized at a rate of $5,000 pet year Placid Lake's 2021 net income before consideration of its relationshyp with Scenic (and before edjustments for kitso-entity sales) was $300.000. Stenic reported net income of $110.000 Placid Lake declared $100.000 in dividends during this period, Scenic paid $40,000 At the end of 2021 selected figures from the two companies' bolance sheets were as follows During 2020, intre-entity saies of $90.000 (original cost of $54,000) wete made. Only 20 percent of this inventory was 5 till heid within the consolidated entity at the end of 2020 . In 2021,$120,000 in intra-entity sales were made wath an oriqinal cost of $66,000. Of this merchandise, 30 percent had not been resold to outside perties by the end of the year. Ench of the following questions should be considered as an independent situation for the year 2021 b. If the intra-entity sales were upstream, how would consolidated net income be allocated to the controlling and noncontrolling interest? c. If the intra-entity sales were downstream, how would consolidated net income be allocated to the controlling and noncontrolling interest? d. What is the consolidated balance in the ending Inventory account? b. If the intra-entity sales were upstream, how would consolidated net income be allocated to the controlling and noncontrolling interest? c. If the intra-entity sales were downstream, how would consolidated net income be allocated to the controlling and noncontrolling interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started