Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just question 11 and 13 Bartov Corporation agreed to build a warehouse for a client at an agreed contract price of $300, 500. Expected (and

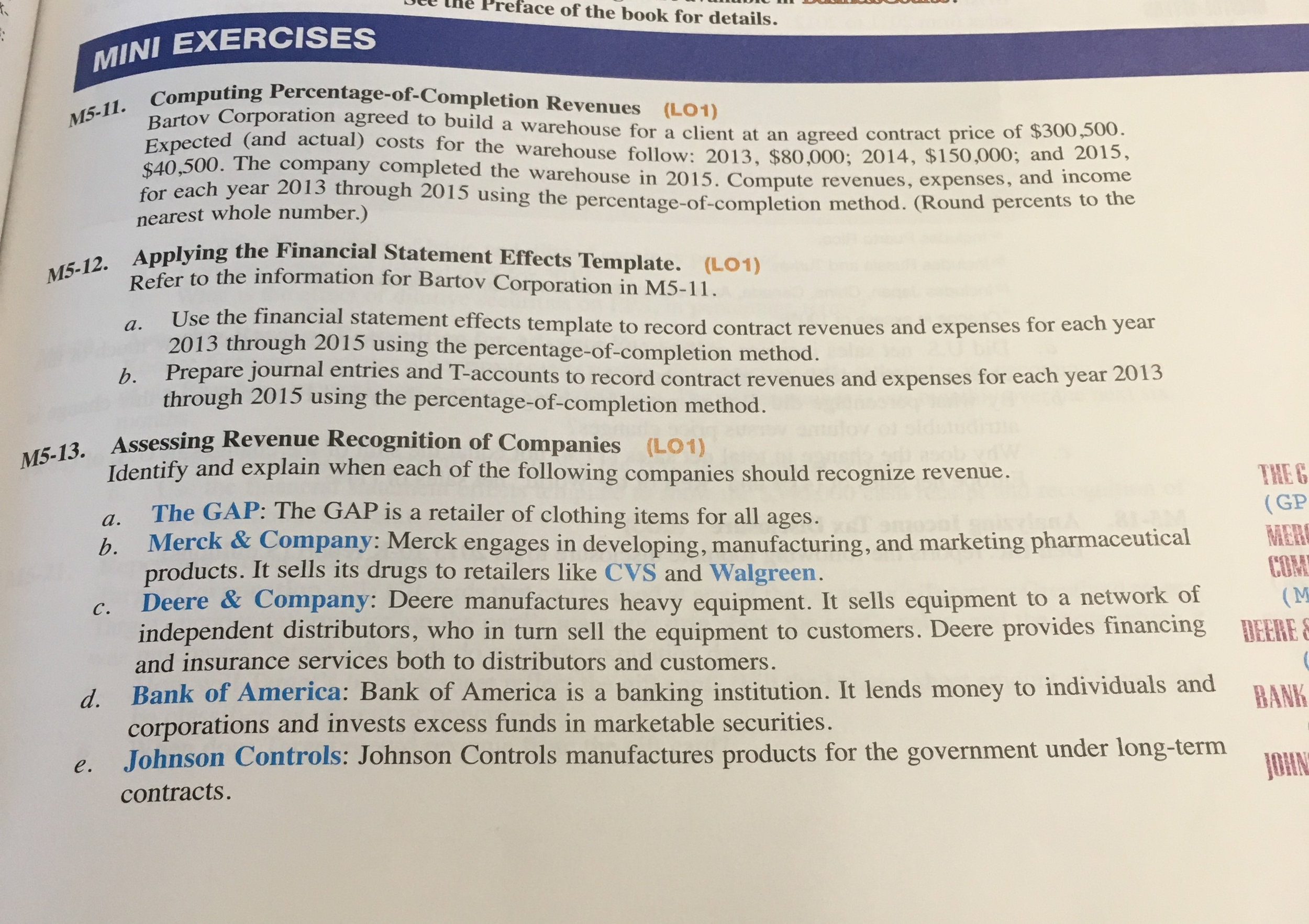

Just question 11 and 13

Bartov Corporation agreed to build a warehouse for a client at an agreed contract price of $300, 500. Expected (and actual) costs for the warehouse follow: 2013, $80,000; 2014, $150,000; and 2015, $40, 500. The company completed the warehouse in 2015. Compute revenues, expenses, and income for each year 2013 through 2015 using the percentage-of-completion method. (Round percents to the nearest whole number.) Use the financial statement effects template to record contract revenues and expenses for each year 2013 through 2015 using the percentage-of-completion method. Prepare journal entries and T-accounts to record contract revenues and expenses for each year 2013 through 2015 using the percentage-of-completion method. Identify and explain when each of the following companies should recognize revenue. The GAP: The GAP is retailer of clothing items for all ages. Merck & Company: Merck engages in developing, manufacturing, and marketing pharmaceutical products. It sells its drugs to retailers like CVS and Walgreen. Deere & Company: Deere manufactures heavy equipment. It sells equipment to a network of independent distributors, who in turn sell the equipment to customers. Deere provides financing and insurance services both to distributors and customers. Bank of America: Bank of America is a banking institution. It lends money to individuals and corporations and invests excess funds in marketable securities. Johnson Controls: Johnson Controls manufactures products for the government under long-term contracts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started