Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just question A B AND C at the end the top piece is just information and instructions. This assignment is centred on the topic Cash

Just question A B AND C at the end the top piece is just information and instructions.

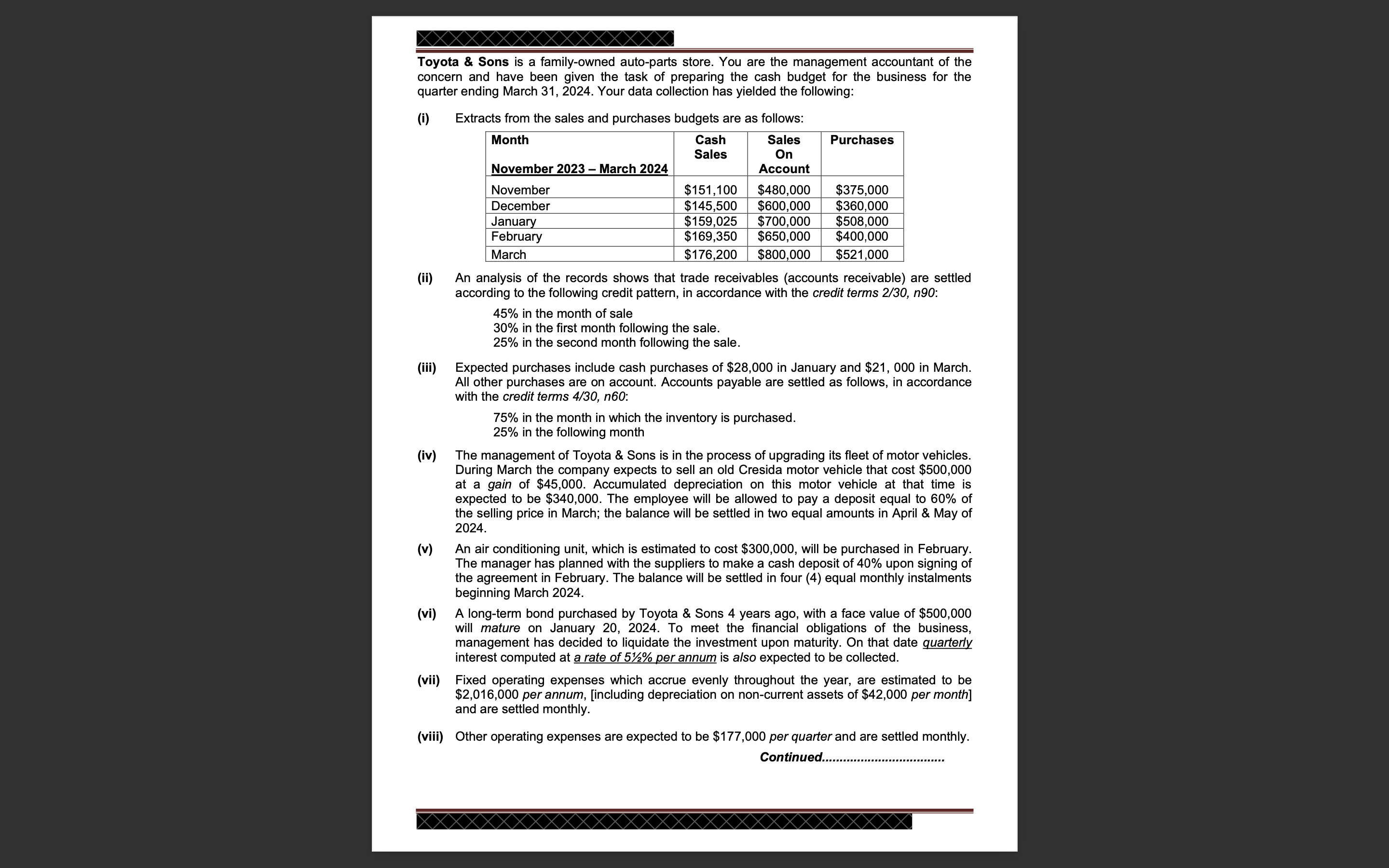

This assignment is centred on the topic "Cash Budgets". This is an individual assignment, and you are required to apply the concepts learnt in solving the problem given. The assignment seeks to examine the following selected course objectives: Course Objectives: 1) Use the stated collection policy of an entity to determine the expected monthly collections for trade receivables. 2) Given the collection policy of suppliers, compute the expected cash disbursements for accounts payable. 3) Given an expected set of expected business events for an entity, develop a monthly cash budget (with a total column) for the entity, clearly showing the cash receipts and cash payments and the minimum cash balance before financing. 4) Use the collection/payment policy to determine the balances to be reflected in the balance sheet as expected trade receivables and payables at a given date. 5) State and explain internal measures that can be implemented by a business entity to increase its' monthly cash balance. Toyota \& Sons is a family-owned auto-parts store. You are the management accountant of the concern and have been given the task of preparing the cash budget for the business for the quarter ending March 31, 2024. Your data collection has yielded the following: (i) Extracts from the sales and purchases budgets are as follows: (ii) An analysis of the records shows that trade receivables (accounts receivable) are settled according to the following credit pattern, in accordance with the credit terms 2/30,n90 : 45% in the month of sale 30% in the first month following the sale. 25% in the second month following the sale. (iii) Expected purchases include cash purchases of $28,000 in January and $21,000 in March. All other purchases are on account. Accounts payable are settled as follows, in accordance with the credit terms 4/30,n60 : 75% in the month in which the inventory is purchased. 25% in the following month (iv) The management of Toyota \& Sons is in the process of upgrading its fleet of motor vehicles. During March the company expects to sell an old Cresida motor vehicle that cost $500,000 at a gain of $45,000. Accumulated depreciation on this motor vehicle at that time is expected to be $340,000. The employee will be allowed to pay a deposit equal to 60% of the selling price in March; the balance will be settled in two equal amounts in April \& May of 2024. (v) An air conditioning unit, which is estimated to cost $300,000, will be purchased in February. The manager has planned with the suppliers to make a cash deposit of 40% upon signing of the agreement in February. The balance will be settled in four (4) equal monthly instalments beginning March 2024. (vi) A long-term bond purchased by Toyota \& Sons 4 years ago, with a face value of $500,000 will mature on January 20,2024 . To meet the financial obligations of the business, management has decided to liquidate the investment upon maturity. On that date quarterly interest computed at a rate of 51/2% per annum is also expected to be collected. (vii) Fixed operating expenses which accrue evenly throughout the year, are estimated to be $2,016,000 per annum, [including depreciation on non-current assets of $42,000 per month] and are settled monthly. (viii) Other operating expenses are expected to be $177,000 per quarter and are settled monthly. Continued. Question Continued. (ix) The management of Toyota \& Sons has negotiated with a tenant to rent office space to her beginning February 1. The rental is $540,000 per annum. The first month's rent along with one month's safety deposit is expected to be collected on February 1. Thereafter, monthly rental income becomes due at the beginning of each month. (x) Wages and salaries are expected to be $2,976,000 per annum and will be paid monthly. (xi) As part of its investing activities, the management of Toyota \& Sons has just concluded an expansion project relating to the business's storage facilities. The project required capital outlay of $1,800,000 and was funded by a loan from a family member, who is a partner in the business. $340,000 of the principal along with interest of $35,000 will become due and payable in January 2024. (xii) The cash balance on March 31, 2024, is expected to be an overdraft of $98,000. Required: (a) The business needs to have a sense of its future cashflows and therefore requires the preparation of the following: - A schedule of budgeted cash collections for trade receivables for each of the months January to March. - A schedule of expected cash disbursements for accounts payable for each of the months January to March. - A cash budget, with a total column, for the quarter ending March 31, 2024, showing the expected cash receipts and payments for each month and the endina cash balance for each of the three months, given that no financing activities took place. (b) Another team member who is preparing the Budgeted Balance Sheet for the business for the same quarter and has asked you to furnish him with the figures for the expected trade receivables and payables to be included in the statement. Is that a reasonable request? If yes, what should these amounts be? (c) Upon receipt of the budget, the team manager, Hilux James, has now informed you that, in keeping with industry players, the management of Toyota \& Sons have indicated an industry requirement to maintain a minimum cash balance of $155,000 each month. He has also noted that management is very keen on keeping the gearing ratio of the business as low as possible and would therefore prefer to cushion any gaps internally using equity financing. Based on the budget prepared, will the business be achieving this desired target? Suggest three (3) internal strategies that may be employed by management to improve the organization's monthly cash flow and militate against or reduce any possible shortfall reflected in the budget prepared. Each strategy must be fully explained

This assignment is centred on the topic "Cash Budgets". This is an individual assignment, and you are required to apply the concepts learnt in solving the problem given. The assignment seeks to examine the following selected course objectives: Course Objectives: 1) Use the stated collection policy of an entity to determine the expected monthly collections for trade receivables. 2) Given the collection policy of suppliers, compute the expected cash disbursements for accounts payable. 3) Given an expected set of expected business events for an entity, develop a monthly cash budget (with a total column) for the entity, clearly showing the cash receipts and cash payments and the minimum cash balance before financing. 4) Use the collection/payment policy to determine the balances to be reflected in the balance sheet as expected trade receivables and payables at a given date. 5) State and explain internal measures that can be implemented by a business entity to increase its' monthly cash balance. Toyota \& Sons is a family-owned auto-parts store. You are the management accountant of the concern and have been given the task of preparing the cash budget for the business for the quarter ending March 31, 2024. Your data collection has yielded the following: (i) Extracts from the sales and purchases budgets are as follows: (ii) An analysis of the records shows that trade receivables (accounts receivable) are settled according to the following credit pattern, in accordance with the credit terms 2/30,n90 : 45% in the month of sale 30% in the first month following the sale. 25% in the second month following the sale. (iii) Expected purchases include cash purchases of $28,000 in January and $21,000 in March. All other purchases are on account. Accounts payable are settled as follows, in accordance with the credit terms 4/30,n60 : 75% in the month in which the inventory is purchased. 25% in the following month (iv) The management of Toyota \& Sons is in the process of upgrading its fleet of motor vehicles. During March the company expects to sell an old Cresida motor vehicle that cost $500,000 at a gain of $45,000. Accumulated depreciation on this motor vehicle at that time is expected to be $340,000. The employee will be allowed to pay a deposit equal to 60% of the selling price in March; the balance will be settled in two equal amounts in April \& May of 2024. (v) An air conditioning unit, which is estimated to cost $300,000, will be purchased in February. The manager has planned with the suppliers to make a cash deposit of 40% upon signing of the agreement in February. The balance will be settled in four (4) equal monthly instalments beginning March 2024. (vi) A long-term bond purchased by Toyota \& Sons 4 years ago, with a face value of $500,000 will mature on January 20,2024 . To meet the financial obligations of the business, management has decided to liquidate the investment upon maturity. On that date quarterly interest computed at a rate of 51/2% per annum is also expected to be collected. (vii) Fixed operating expenses which accrue evenly throughout the year, are estimated to be $2,016,000 per annum, [including depreciation on non-current assets of $42,000 per month] and are settled monthly. (viii) Other operating expenses are expected to be $177,000 per quarter and are settled monthly. Continued. Question Continued. (ix) The management of Toyota \& Sons has negotiated with a tenant to rent office space to her beginning February 1. The rental is $540,000 per annum. The first month's rent along with one month's safety deposit is expected to be collected on February 1. Thereafter, monthly rental income becomes due at the beginning of each month. (x) Wages and salaries are expected to be $2,976,000 per annum and will be paid monthly. (xi) As part of its investing activities, the management of Toyota \& Sons has just concluded an expansion project relating to the business's storage facilities. The project required capital outlay of $1,800,000 and was funded by a loan from a family member, who is a partner in the business. $340,000 of the principal along with interest of $35,000 will become due and payable in January 2024. (xii) The cash balance on March 31, 2024, is expected to be an overdraft of $98,000. Required: (a) The business needs to have a sense of its future cashflows and therefore requires the preparation of the following: - A schedule of budgeted cash collections for trade receivables for each of the months January to March. - A schedule of expected cash disbursements for accounts payable for each of the months January to March. - A cash budget, with a total column, for the quarter ending March 31, 2024, showing the expected cash receipts and payments for each month and the endina cash balance for each of the three months, given that no financing activities took place. (b) Another team member who is preparing the Budgeted Balance Sheet for the business for the same quarter and has asked you to furnish him with the figures for the expected trade receivables and payables to be included in the statement. Is that a reasonable request? If yes, what should these amounts be? (c) Upon receipt of the budget, the team manager, Hilux James, has now informed you that, in keeping with industry players, the management of Toyota \& Sons have indicated an industry requirement to maintain a minimum cash balance of $155,000 each month. He has also noted that management is very keen on keeping the gearing ratio of the business as low as possible and would therefore prefer to cushion any gaps internally using equity financing. Based on the budget prepared, will the business be achieving this desired target? Suggest three (3) internal strategies that may be employed by management to improve the organization's monthly cash flow and militate against or reduce any possible shortfall reflected in the budget prepared. Each strategy must be fully explained Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started