Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just really need some help on this and the few parts that will follow! I will rate! Many thanks and God bless! S9-12 (similar to)

Just really need some help on this and the few parts that will follow!

Just really need some help on this and the few parts that will follow!

I will rate!

Many thanks and God bless!

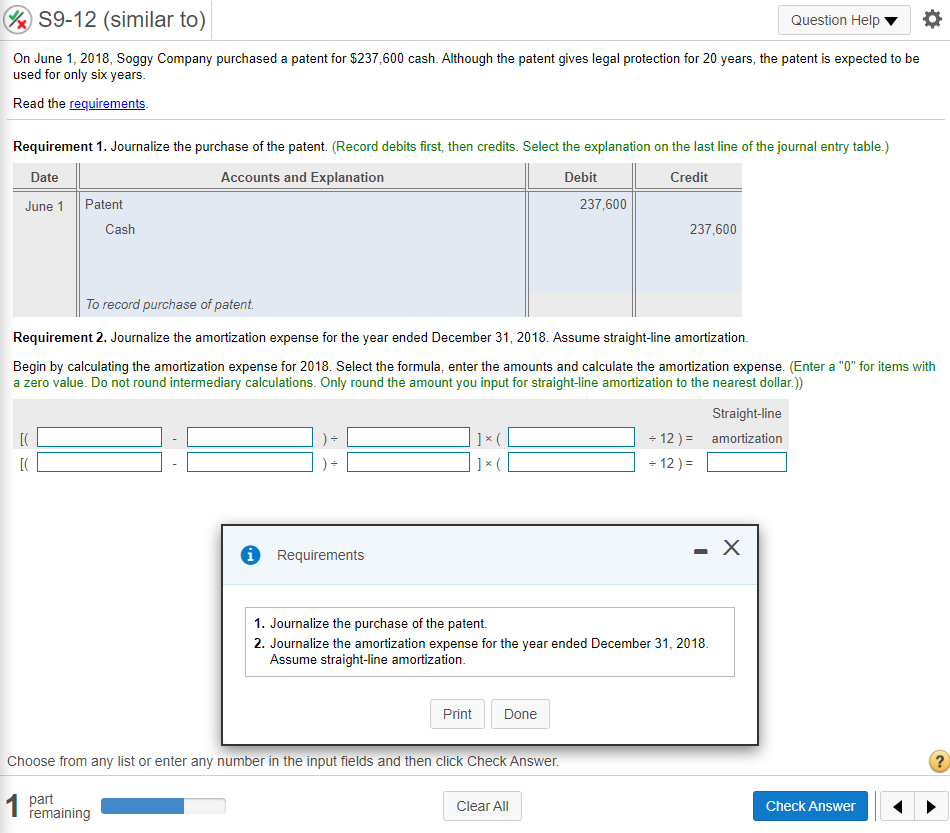

S9-12 (similar to) Question Help On June 1, 2018, Soggy Company purchased a patent for $237,600 cash. Although the patent gives legal protection for 20 years, the patent is expected to be used for only six years. Read the requirements Requirement 1. Journalize the purchase of the patent. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit June 1 Patent 237,600 Cash 237,600 To record purchase of patent Requirement 2. Journalize the amortization expense for the year ended December 31, 2018. Assume straight-line amortization. Begin by calculating the amortization expense for 2018. Select the formula, enter the amounts and calculate the amortization expense. (Enter a "0" for items with a zero value. Do not round intermediary calculations. Only round the amount you input for straight-line amortization to the nearest dollar.)) Straight-line [O = 12 )= amortization ] = 12 ) = A Requirements . X 1. Journalize the purchase of the patent. 2. Journalize the amortization expense for the year ended December 31, 2018. Assume straight-line amortization. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. ? ? 1 part Clear All remaining CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started