Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just really need some help on this! I will rate! Many thanks and God bless!!! (If you zoom in some the images will become sharper.

Just really need some help on this!

Just really need some help on this!

I will rate!

Many thanks and God bless!!!

(If you zoom in some the images will become sharper. Pinch and Zoom helps also.)

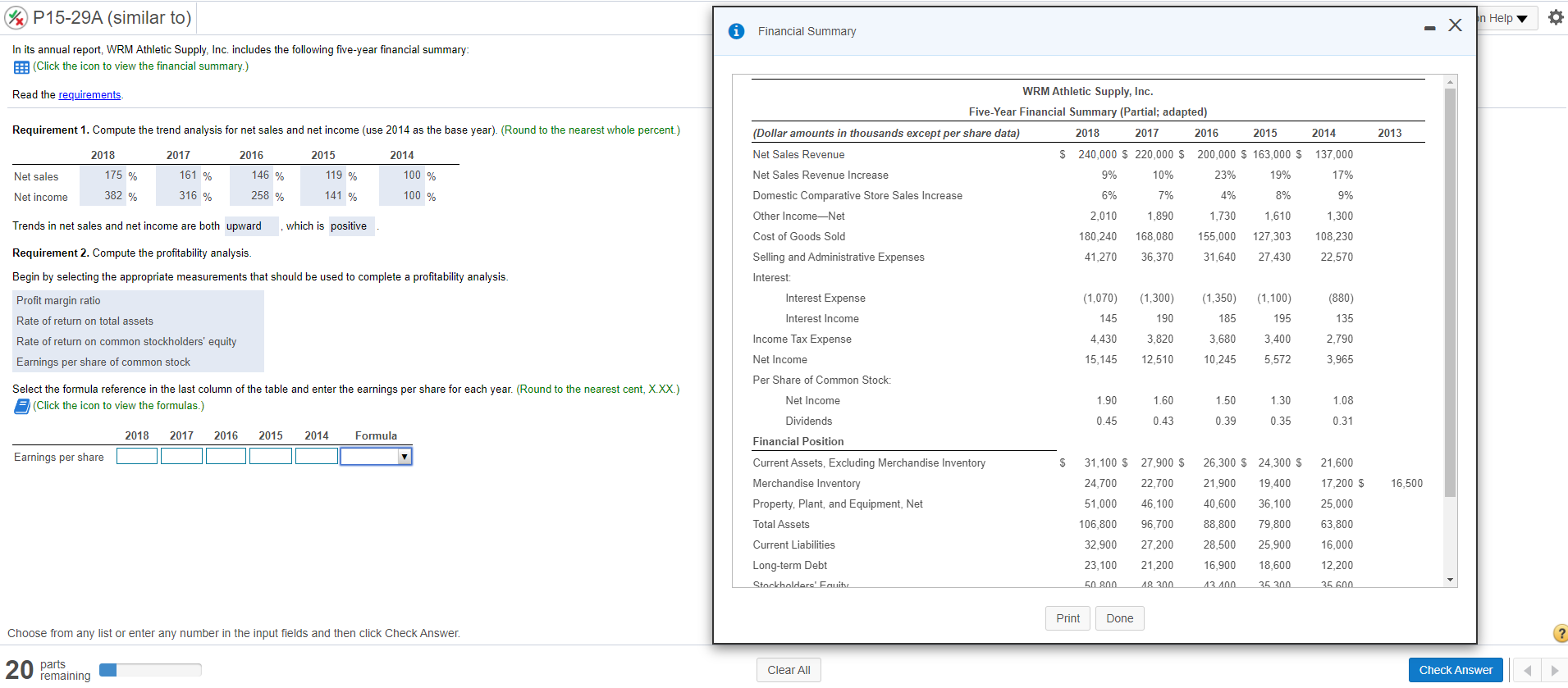

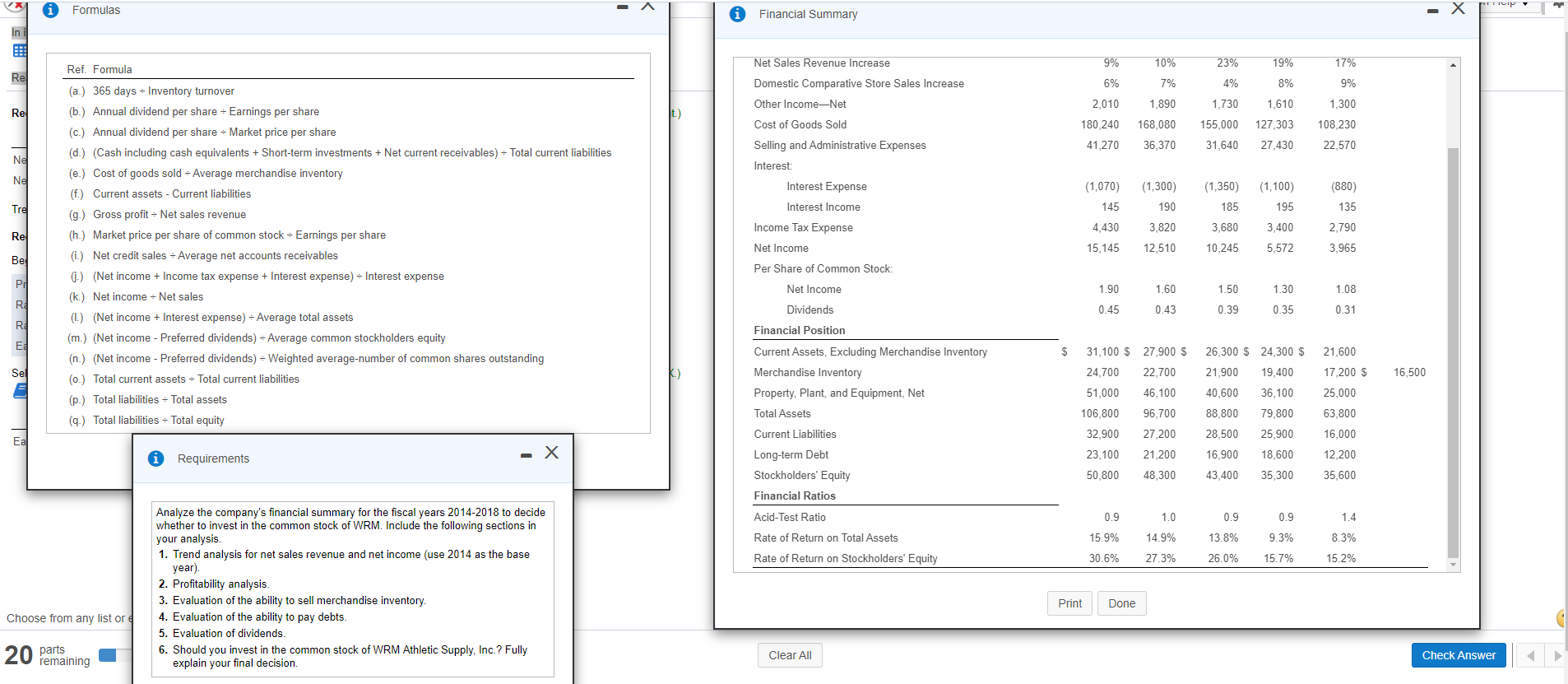

P15-29A (similar to) Financial Summary bn Help In its annual report, WRM Athletic Supply, Inc. includes the following five-year financial summary: Click the icon to view the financial summary.) Read the requirements Requirement 1. Compute the trend analysis for net sales and net income (use 2014 as the base year). (Round to the nearest whole percent.) 2013 2018 2017 2016 2015 2014 Net sales 175 % 146 % 161 % 316 % 119 % 141 % 100 % 100 % Net income 382 % 258 % Trends in net sales and net income are both upward which is positive WRM Athletic Supply, Inc. Five-Year Financial Summary (Partial; adapted) (Dollar amounts in thousands except per share data) 2018 2017 2016 2015 2014 Net Sales Revenue $ 240,000 $ 220,000 $ 200,000 $ 163,000 $ 137,000 Net Sales Revenue Increase 9% 10% 23% 19% 17% Domestic Comparative Store Sales Increase 6% 7% 4% 8% 9% Other Income-Net 2,010 1.890 1,730 1,610 1,300 Cost of Goods Sold 180,240 168,080 155,000 127,303 108,230 Selling and Administrative Expenses 41,270 36,370 31,640 27,430 22.570 Interest: Interest Expense (1.070) (1,300) (1,350) (1,100) (880) Interest Income 145 190 185 195 135 Income Tax Expense 4,430 3,820 3,680 3,400 2,790 Net Income 15,145 12,510 10,245 5,572 3,965 Per Share of Common Stoc Requirement 2. Compute the profitability analysis. Begin by selecting the appropriate measurements that should be used to complete a profitability analysis. Profit margin ratio Rate of return on total assets Rate of return on common stockholders' equity Earnings per share of common stock Select the formula reference in the last column of the table and enter the earnings per share for each year. (Round to the nearest cent, X.XX.) 2 (Click the icon to view the formulas.) 1.90 1.60 1.50 1.30 1.08 Net Income Dividends 0.45 0.43 0.39 0.35 0.31 2018 2017 2016 2015 2014 Formula Earnings per share 7 $ 26,300 $ 24,300 $ Financial Position Current Assets, Excluding Merchandise Inventory Merchandise Inventory Property, Plant, and Equipment, Net 31,100 $ 27,900 $ 24,700 22,700 21,600 17,200 $ 21,900 19,400 16,500 51.000 46,100 40,600 36,100 25.000 Total Assets 106,800 96,700 88,800 79,800 63,800 Current Liabilities 32,900 27,200 28,500 25.900 16,000 23,100 21,200 16,900 18,600 12,200 Long-term Debt Stockholdere' Eauit 50 800 18300 13.100 25 300 35 600 Print Done Choose from any list or enter any number in the input fields and then click Check Answer. 20 parts Clear All Check Answer remaining Formulas Financial Summary - X 9% 10% 23% 17% Re 19% 8% 6% 7% 4% 9% 2,010 1,890 1.730 1,610 1,300 Re Net Sales Revenue Increase Domestic Comparative Store Sales Increase Other Income,Net Cost of Goods Sold Selling and Administrative Expenses Interest: Interest Expense 180 240 155,000 127,303 168,080 36,370 108,230 22,570 41,270 31,640 27,430 Ne Ne (1,100) (880) (1,070) 145 (1,300) 190 (1,350) 185 Tre Interest Income 195 135 Income Tax Expense 4,430 3,820 3,680 3,400 2,790 Rel Ref. Formula (a.) 365 days = Inventory turnover (b.) Annual dividend per share - Earnings per share (c.) Annual dividend per share - Market price per share (d.) (Cash including cash equivalents + Short-term investments + Net current receivables) = Total current liabilities (e.) Cost of goods sold - Average merchandise inventory (f.) Current assets - Current liabilities (9.) Gross profit = Net sales revenue (h.) Market price per share of common stock = Earnings per share (i.) Net credit sales - Average net accounts receivables (.) (Net income + Income tax expense + Interest expense) = Interest expense (k.) Net income = Net sales (L) (Net income + Interest expense) = Average total assets (m.) (Net income - Preferred dividends) = Average common stockholders equity (n.) (Net income - Preferred dividends) = Weighted average number of common shares outstanding (0.) Total current assets - Total current liabilities (p.) Total liabilities = Total assets (9.) Total liabilities - Total equity Net Income 15,145 12,510 10,245 5,572 3,965 Bel Per Share of Common Stock: PO 1.90 1.60 1.50 1.30 1.08 RO 0.45 0.43 0.39 0.35 0.31 Rd EL Net Income Dividends Financial Position Current Assets, Excluding Merchandise Inventory Merchandise Inventory Property, Plant, and Equipment, Net Total Assets $ 31,100 $ 27,900 $ 21,600 Sel 24,700 22,700 17,200 $ 16,500 51,000 25,000 63,800 26,300 $ 24,300 $ 21,900 19,400 40,600 36,100 88.800 79,800 28,500 25,900 106,800 Current Liabilities 46,100 96,700 27,200 21,200 48,300 32,900 16,000 Fa 23,100 16,900 18,600 12,200 Requirements 50,800 43.400 35,300 35,600 Long-term Debt Stockholders' Equity Financial Ratios Acid-Test Ratio Rate of Return on Total Assets Rate of Return on Stockholders' Equity 0.9 1.0 0.9 0.9 1.4 14.9% 9.3% 15.9% 30.6% 13.8% 26.0% 8.3% 15.2% 27.3% 15.7% Analyze the company's financial summary for the fiscal years 2014-2018 to decide whether to invest in the common stock of WRM. Include the following sections in your analysis. 1. Trend analysis for net sales revenue and net income (use 2014 as the base year) 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WRM Athletic Supply, Inc? Fully explain your final decision. Print Done Choose from any list or 20 parts Clear All remaining CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started