Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just requirement 3 A19-4 Defined Contribution Plan (LO 19-2) Zlo Ltd. established a defined contribution pension plan at the beginning of 20X9. The company will

just requirement 3

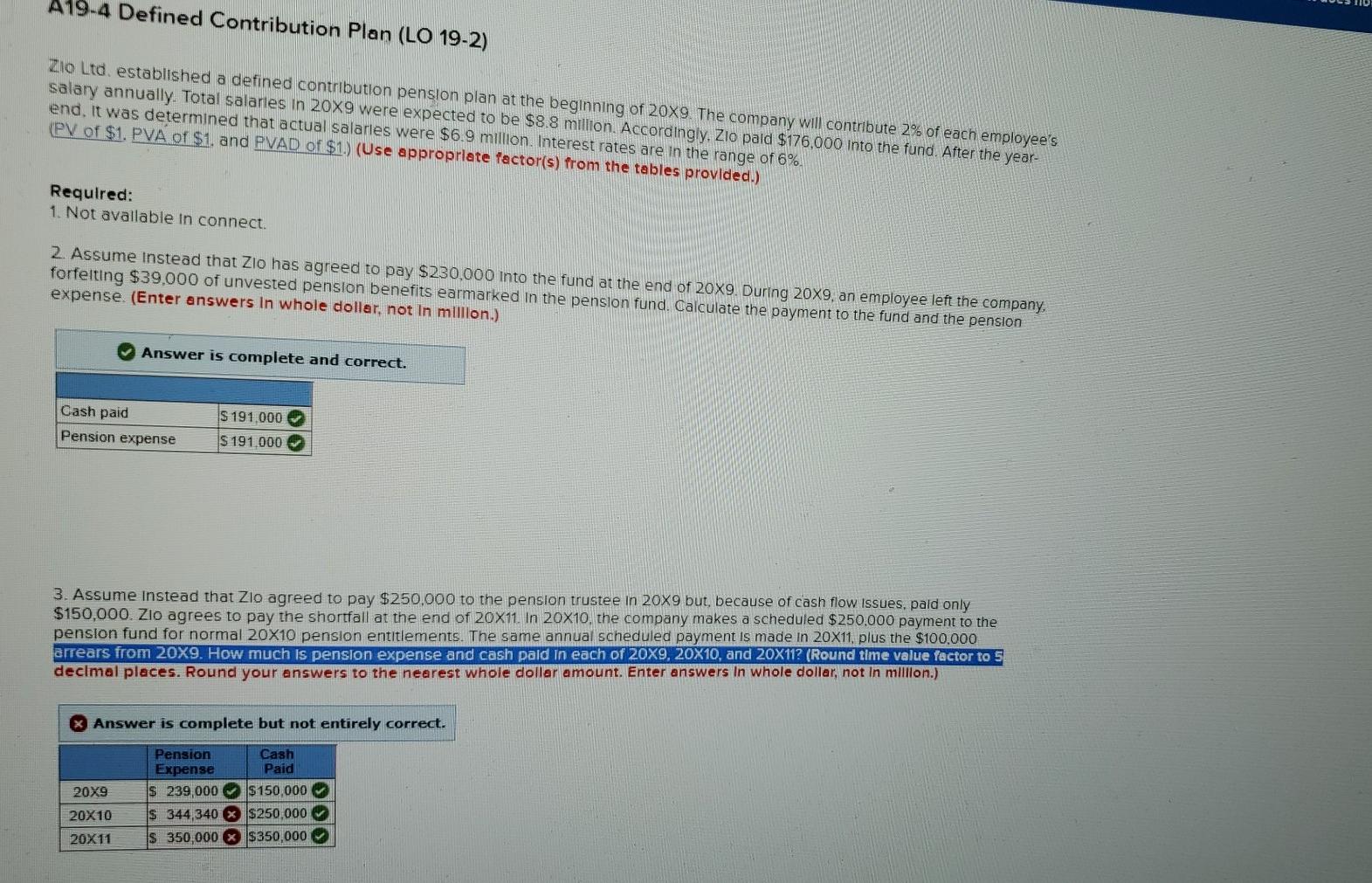

A19-4 Defined Contribution Plan (LO 19-2) Zlo Ltd. established a defined contribution pension plan at the beginning of 20X9. The company will contribute 2% of each employee's salary annually. Total salaries in 20x9 were expected to be $8.8 million. Accordingly. Zlo pald $176,000 Into the fund. After the year- end, it was determined that actual salaries were $6.9 million. Interest rates are in the range of 6% (PV of $1. PVA of $1. and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Not available in connect. 2. Assume Instead that Zio has agreed to pay $230,000 into the fund at the end of 20X9. During 20X9, an employee left the company, forfeiting $39,000 of unvested pension benefits earmarked in the pension fund. Calculate the payment to the fund and the pension expense. (Enter answers in whole dollar, not in million.) Answer is complete and correct. Cash paid Pension expense S 191,000 S 191 000 3. Assume Instead that Zlo agreed to pay $250,000 to the pension trustee in 20X9 but, because of cash flow issues, pald only $150,000. Zio agrees to pay the shortfall at the end of 20X11. In 20x10, the company makes a scheduled $250.000 payment to the pension fund for normal 20X10 pension entitlements. The same annual scheduled payment is made in 20X11, plus the $100,000 arrears from 20X9. How much is pension expense and cash paid In each of 20X9, 20X10, and 20X11? (Round time value factor to s decimal places. Round your answers to the nearest whole dollar amount. Enter answers in whole dollar, not in million.) Answer is complete but not entirely correct. 20X9 Pension Cash Expense Paid S 239,000 $ 150.000 $ 344,340 X $250.000 $ 350,000 $350,000 20X10 20X11 A19-4 Defined Contribution Plan (LO 19-2) Zlo Ltd. established a defined contribution pension plan at the beginning of 20X9. The company will contribute 2% of each employee's salary annually. Total salaries in 20x9 were expected to be $8.8 million. Accordingly. Zlo pald $176,000 Into the fund. After the year- end, it was determined that actual salaries were $6.9 million. Interest rates are in the range of 6% (PV of $1. PVA of $1. and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Not available in connect. 2. Assume Instead that Zio has agreed to pay $230,000 into the fund at the end of 20X9. During 20X9, an employee left the company, forfeiting $39,000 of unvested pension benefits earmarked in the pension fund. Calculate the payment to the fund and the pension expense. (Enter answers in whole dollar, not in million.) Answer is complete and correct. Cash paid Pension expense S 191,000 S 191 000 3. Assume Instead that Zlo agreed to pay $250,000 to the pension trustee in 20X9 but, because of cash flow issues, pald only $150,000. Zio agrees to pay the shortfall at the end of 20X11. In 20x10, the company makes a scheduled $250.000 payment to the pension fund for normal 20X10 pension entitlements. The same annual scheduled payment is made in 20X11, plus the $100,000 arrears from 20X9. How much is pension expense and cash paid In each of 20X9, 20X10, and 20X11? (Round time value factor to s decimal places. Round your answers to the nearest whole dollar amount. Enter answers in whole dollar, not in million.) Answer is complete but not entirely correct. 20X9 Pension Cash Expense Paid S 239,000 $ 150.000 $ 344,340 X $250.000 $ 350,000 $350,000 20X10 20X11Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started