just scenario 3 and 4 please

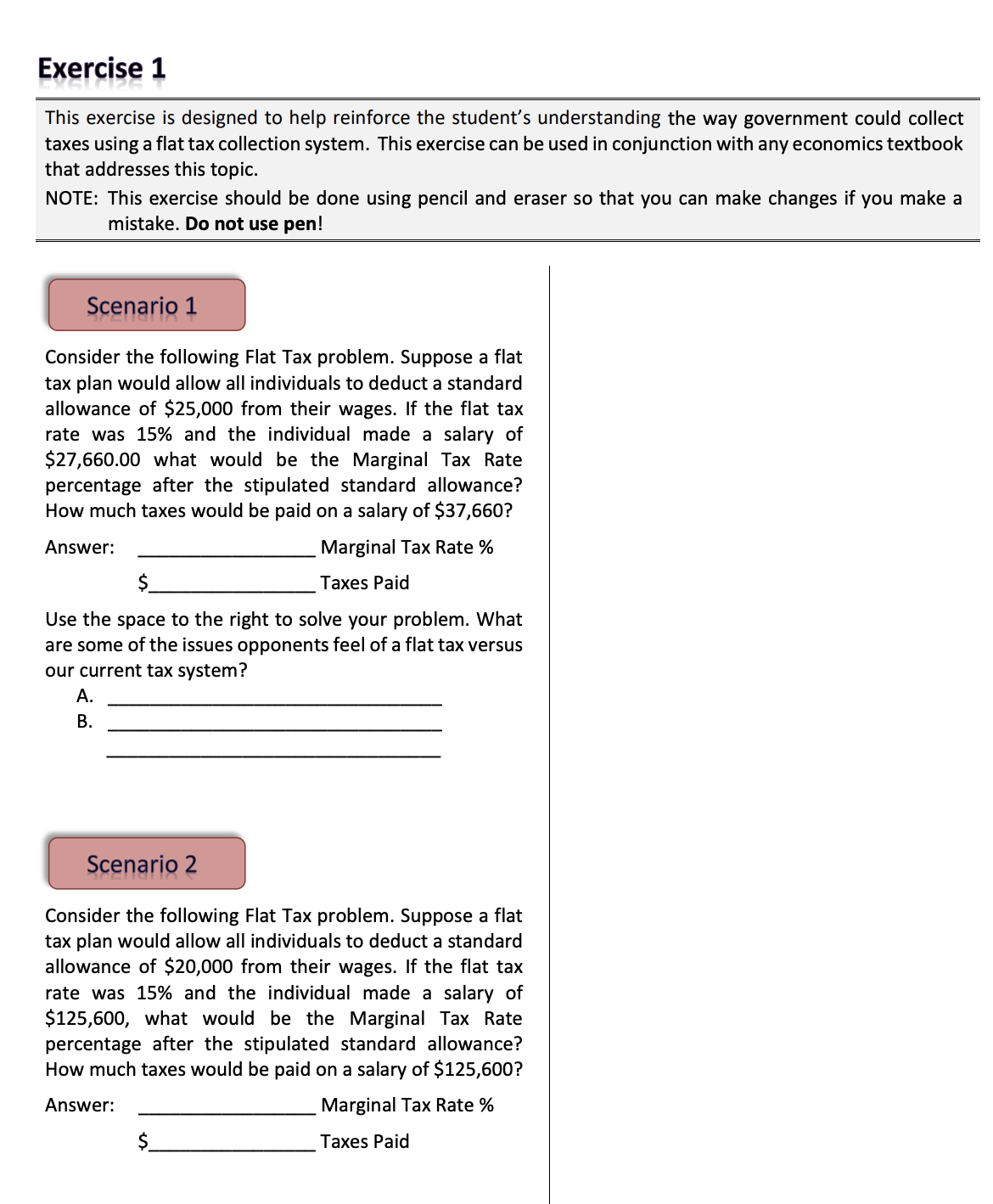

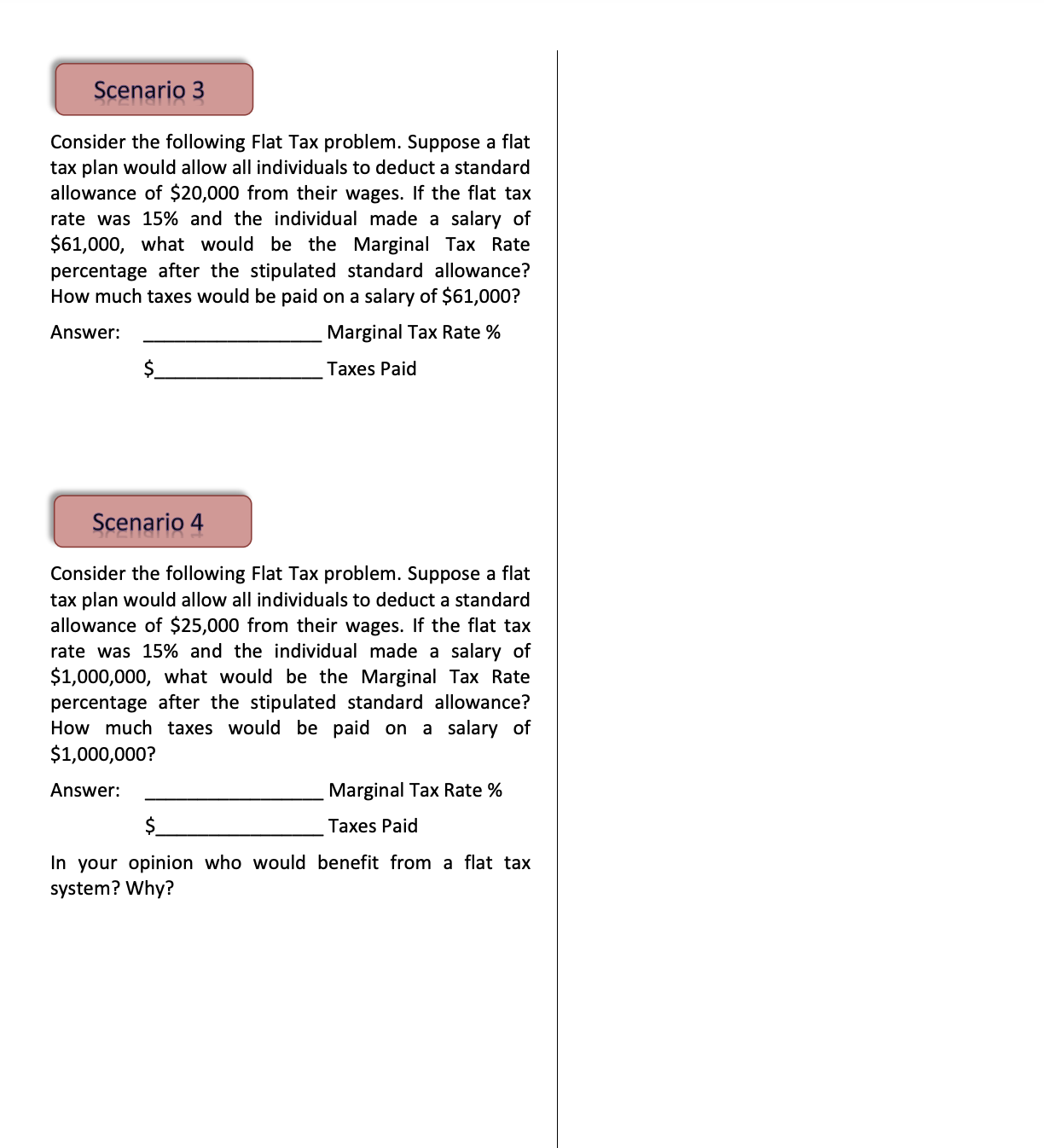

Exercise 1 This exercise is designed to help reinforce the student's understanding the way government could collect taxes using a flat tax collection system. This exercise can be used in conjunction with any economics textbook that addresses this topic. NOTE: This exercise should be done using pencil and eraser so that you can make changes if you make a mistake. Do not use pen! Consider the following Flat Tax problem. Suppose a flat tax plan would allow all individuals to deduct a standard allowance of $25,000 from their wages. If the flat tax rate was 15% and the individual made a salary of $27,660.00 what would be the Marginal Tax Rate percentage after the stipulated standard allowance? How much taxes would be paid on a salary of $37,660? Answer: Marginal Tax Rate 96 $ Taxes Paid Use the space to the right to solve your problem. What are some of the issues opponents feel of a flat tax versus our current tax system? A. B. Consider the following Flat Tax problem. Suppose a flat tax plan would allow all individuals to deduct a standard allowance of $20,000 from their wages. If the at tax rate was 15% and the individual made a salary of $125,600, what would be the Marginal Tax Rate percentage after the stipulated standard allowance? How much taxes would be paid on a salary of $125,600? Answer: Marginal Tax Rate % $ Taxes Paid Consider the following Flat Tax problem. Suppose a flat tax plan would allow all individuals to deduct a standard allowance of $20,000 from their wages. If the at tax rate was 15% and the individual made a salary of $61,000, what would be the Marginal Tax Rate percentage after the stipulated standard allowance? How much taxes would be paid on a salary of $61,000? Answer: Marginal Tax Rate % 5 Taxes Paid Consider the following Flat Tax problem. Suppose a flat tax plan would allow all individuals to deduct a standard allowance of $25,000 from their wages. If the at tax rate was 15% and the individual made a salary of $1,000,000, what would be the Marginal Tax Rate percentage after the stipulated standard allowance? How much taxes would be paid on a salary of $1,000,000? Answer: Marginal Tax Rate % $ Taxes Paid In your opinion who would benefit from a at tax system? Why