Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just that is provided in my question Suppose that a mutual fund manager has a $30 million portfolio with a beta of 1.7. Also suppose

just that is provided in my question

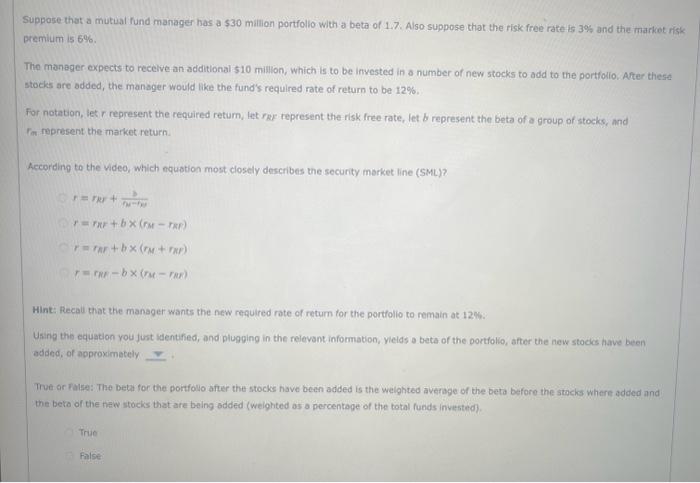

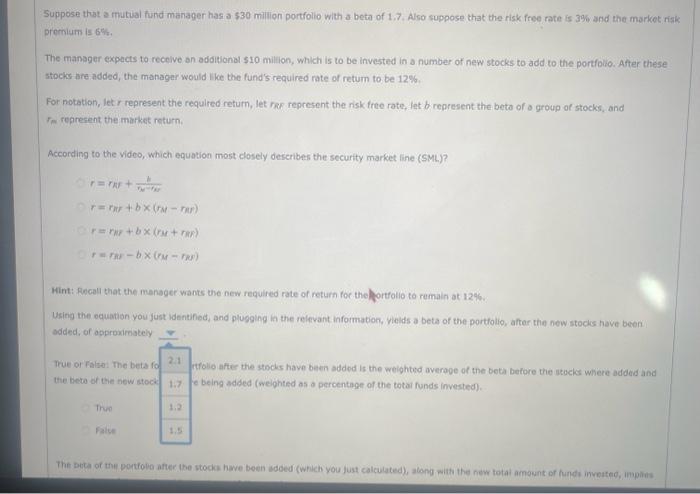

Suppose that a mutual fund manager has a $30 million portfolio with a beta of 1.7. Also suppose that the risk free rate is 3% and the market rish premium is 6%. The manager expects to recelve an additional 510 million, which is to be invested in a number of new stocks to add to the portfollo. Ater these stocks are added, the manager would like the fund's required rate of return to be 12%. For notation, let r represent the required retum, let rkF represent the risk free rate, let b represent the beta of a group of stocis, and Fin represent the market return. According to the video, which equation most dosely describes the security morket line (SML)? r=rRr+Mtrbr=rR+b(rMrMR)r=rm+b(rM+rMr)r=rMrb(rMrMR) Hint: Recall that the manager wants the new required rate of return for the portfollo to remain at 12 . Using the equation you just identifed, and plugging in the reievant information, yields o beta of the portfolio, after the new stodes have been added, of approximately True or false: The beta for the portfollo after the stocks have been added is the weighted average of the beta before the stochs where added and the beta of the new stocks that are being odded (weighted as a percentage of the total funds invested). True false Suppose that a mutial fund manager has a $30 millipn portfolio with a beta of 1.7. Also suppose that the risk free rate is 3% and the market risk premium is 6% The manager expects to receive an additiond 510 million, which is to be invested in a number of new stocks to add to the portfolio. After these stocks are added, the manager would like the fund's required rate of retum to be 12%. For notation, let r represent the required return, let riks represent the risk free rate, let b represent the beta of a group of stocks, and rim represent the market return. According to the video, which equation most closely describes the security market line (SML.)? r=rN+NMTsbr=rMr+b(rMrM)r=rM+b(rM+rR)r=rMrb(rMrM) Hint: Ancell that the menager wants the new required rate of return foc thelportfollo to remain at 1296 . Using the oquation you just identined; and plogging in the relevant information, vields a beta of the portfolio, after the new stocks have been added, of approximately r=rM+mkk3 r=rRF+b(rMrRF) r=rEE+b(rM+rR) r=rNrb(rMrR) Hint: Recall that the manager wants the new required rate of return for the portfollo to remain at 12%. Using the equation you fust Identified, and plugging in the relevant information, yields a beta of the portfolio, ofter the new stocks have oeen added, of spproximately True or faise: The beta for the portfolio after the stocks have been added is the weighted average of the beta before the stocks where added and the beto of the new stocks that are being added (weighted as a percentage of the total funds invested). True Faise The beta of the porffolio after the stocks have been added (which you just calculoted), along with the new total amount of funds invested, implies) that the beta of the stocis added to the portfolio must be Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started