just the answers

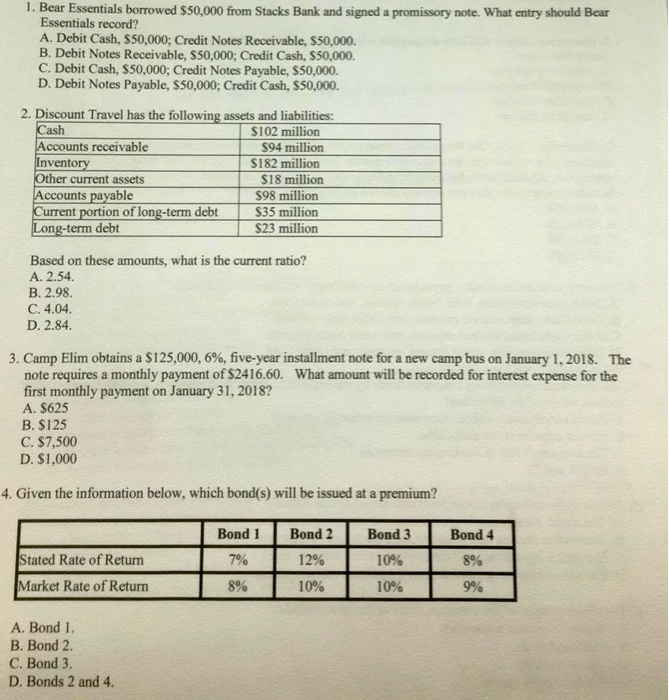

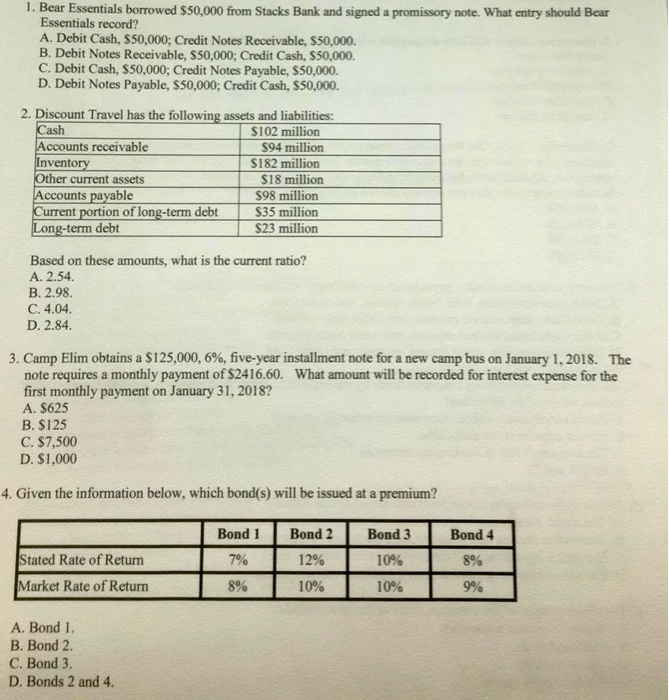

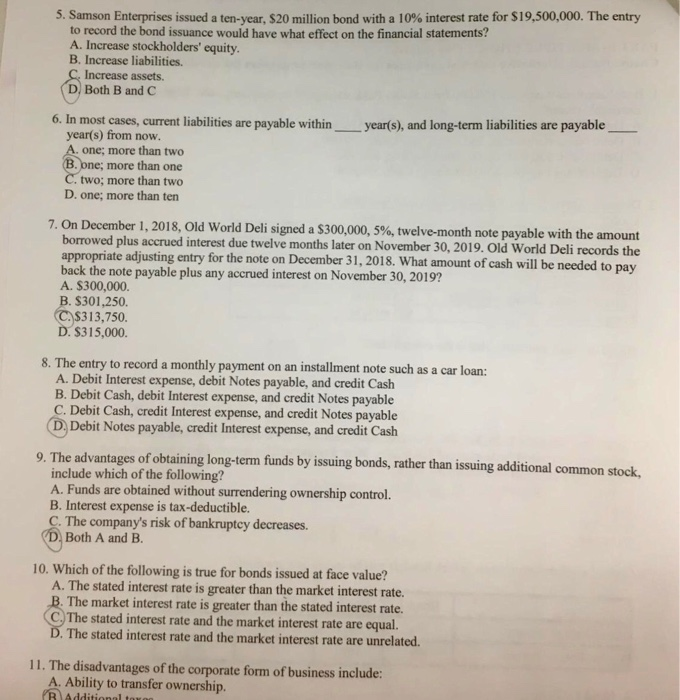

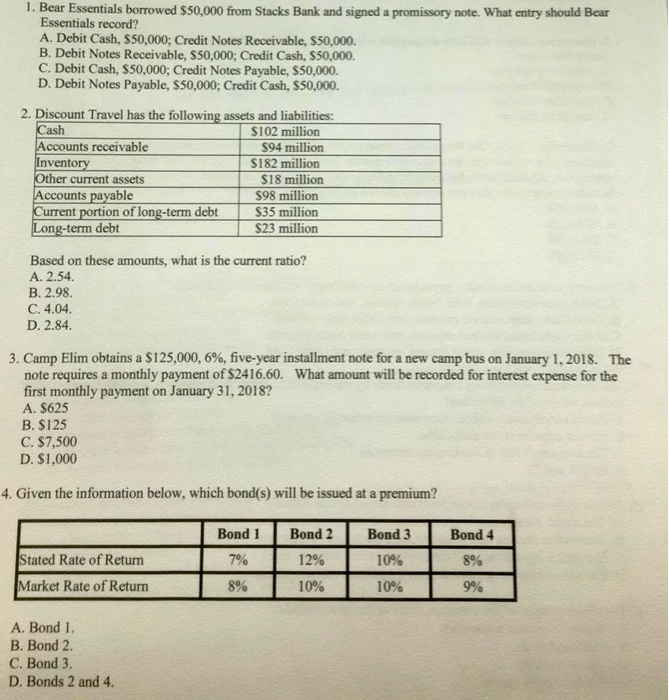

1. Bear Essentials borrowed $50,000 from Stacks Bank and signed a promissory note. What entry should Bear Essentials record? A. Debit Cash, 550,000; Credit Notes Receivable, $50,000. B. Debit Notes Receivable, S50,000; Credit Cash, $50,000. C. Debit Cash, $50,000; Credit Notes Payable, $50,000. D. Debit Notes Payable, $50,000; Credit Cash, $50,000. Cash 2. Discount Travel has the following assets and liabilities: $102 million Accounts receivable 594 million Inventory S182 million Other current assets $18 million Accounts payable $98 million Current portion of long-term debt $35 million Long-term debt $23 million Based on these amounts, what is the current ratio? A. 2.54. B. 2.98. C. 4.04. D. 2.84. 3. Camp Elim obtains a $125,000, 6%, five-year installment note for a new camp bus on January 1, 2018. The note requires a monthly payment of $2416.60. What amount will be recorded for interest expense for the first monthly payment on January 31, 2018? A. $625 B. $125 C. $7,500 D. $1,000 4. Given the information below, which bond(s) will be issued at a premium? Stated Rate of Return Market Rate of Return Bond 1 7% 8% Bond 2 12% 10% Bond 3 10% 10% 1 1 Bond 4 8 % 9 % A. Bond 1 B. Bond 2 C. Bond 3. D. Bonds 2 and 4 5. Samson Enterprises issued a ten-year, $20 million bond with a 10% interest rate for $19,500,000. The entry to record the bond issuance would have what effect on the financial statements? A. Increase stockholders' equity. B. Increase liabilities. C. Increase assets. D. Both B and C year(s), and long-term liabilities are payable 6. In most cases, current liabilities are payable within year(s) from now. A. one; more than two (B. one; more than one C. two, more than two D. one; more than ten 7. On December 1, 2018, Old World Deli signed a $300,000, 5%, twelve-month note payable with the amount borrowed plus accrued interest due twelve months later on November 30, 2019. Old World Deli records the appropriate adjusting entry for the note on December 31, 2018. What amount of cash will be needed to pay back the note payable plus any accrued interest on November 30, 2019? A. $300,000 B. $301,250. C. $313,750. D. $315,000. 8. The entry to record a monthly payment on an installment note such as a car loan: A. Debit Interest expense, debit Notes payable, and credit Cash B. Debit Cash, debit Interest expense, and credit Notes payable C. Debit Cash, credit Interest expense, and credit Notes payable (D. Debit Notes payable, credit Interest expense, and credit Cash 9. The advantages of obtaining long-term funds by issuing bonds, rather than issuing additional common stock. include which of the following? A. Funds are obtained without surrendering ownership control. B. Interest expense is tax-deductible. C. The company's risk of bankruptcy decreases. D. Both A and B. 10. Which of the following is true for bonds issued at face value? A. The stated interest rate is greater than the market interest rate. B. The market interest rate is greater than the stated interest rate. C. The stated interest rate and the market interest rate are equal. D. The stated interest rate and the market interest rate are unrelated. 11. The disadvantages of the corporate form of business include: A. Ability to transfer ownership. B Additional town