Just the big picture please and fast please

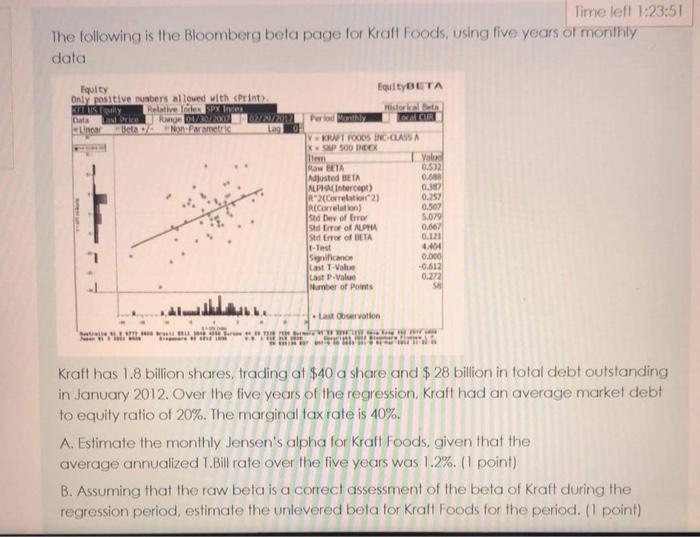

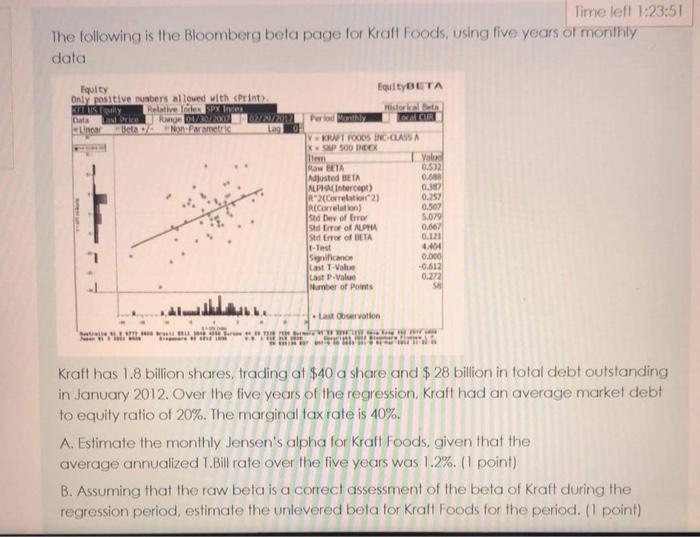

Rolle's Theorem is not applicable to f(x) = |x| in (-2, 2), because: Time left 1:23:51 The following is the Bloomberg bela page for Kraft Foods, using five years of monthly data Equity Equity BETA Only positive numbers allowed with Print) KERUSI Relative alex PX TV Histo Data RUTO DI WIN/2012 Para Uncar Beta Non Parametri lagg VERT FOODS INCLASSA SP 500 DOX Valod Row BETA 0.52 justed BETA 000 ALPHA(Intercept) 01 2(Creator) 0.52 Recorrelation) 0.507 Sed Dev offre 5.029 ShError of ALPHA 0.667 Std Error of ETA 0.121 -Test 4404 Significance 0.000 Last Value -0.612 Last P-value 0.272 Member of points Last Observation Kraft has 1.8 billion shares, trading at $40 a share and $ 28 billion in total debt outstanding in January 2012. Over the five years of the regression, Kraft had an average market debt to equity ratio of 20%. The marginal tax rate is 40%. A. Estimate the monthly Jensen's alpha for Kraft Foods, given that the average annualized T.Bill rate over the five years was 1.2%. (1 point) B. Assuming that the raw beta is a correct assessment of the beta of Kraft during the regression period, estimate the unlevered beta for Kraft Foods for the period. (1 point) Rolle's Theorem is not applicable to f(x) = |x| in (-2, 2), because: Time left 1:23:51 The following is the Bloomberg bela page for Kraft Foods, using five years of monthly data Equity Equity BETA Only positive numbers allowed with Print) KERUSI Relative alex PX TV Histo Data RUTO DI WIN/2012 Para Uncar Beta Non Parametri lagg VERT FOODS INCLASSA SP 500 DOX Valod Row BETA 0.52 justed BETA 000 ALPHA(Intercept) 01 2(Creator) 0.52 Recorrelation) 0.507 Sed Dev offre 5.029 ShError of ALPHA 0.667 Std Error of ETA 0.121 -Test 4404 Significance 0.000 Last Value -0.612 Last P-value 0.272 Member of points Last Observation Kraft has 1.8 billion shares, trading at $40 a share and $ 28 billion in total debt outstanding in January 2012. Over the five years of the regression, Kraft had an average market debt to equity ratio of 20%. The marginal tax rate is 40%. A. Estimate the monthly Jensen's alpha for Kraft Foods, given that the average annualized T.Bill rate over the five years was 1.2%. (1 point) B. Assuming that the raw beta is a correct assessment of the beta of Kraft during the regression period, estimate the unlevered beta for Kraft Foods for the period. (1 point)

Just the big picture please and fast please

Just the big picture please and fast please