Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just the calculation bit part A Exchange rate is the price of che cunency expeesied in terms of another currency and it is determined by

just the calculation bit part A

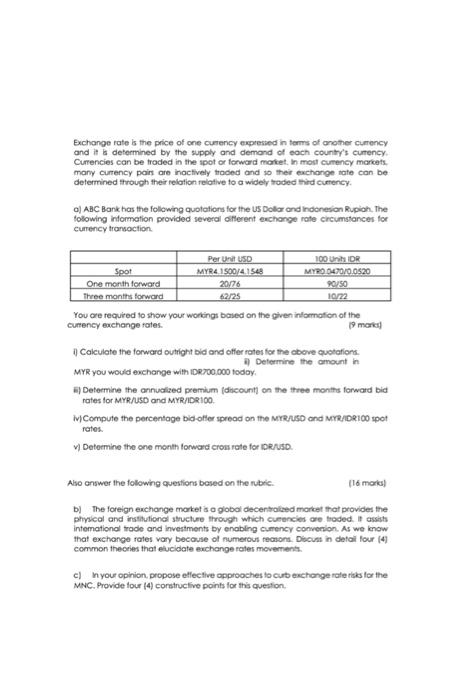

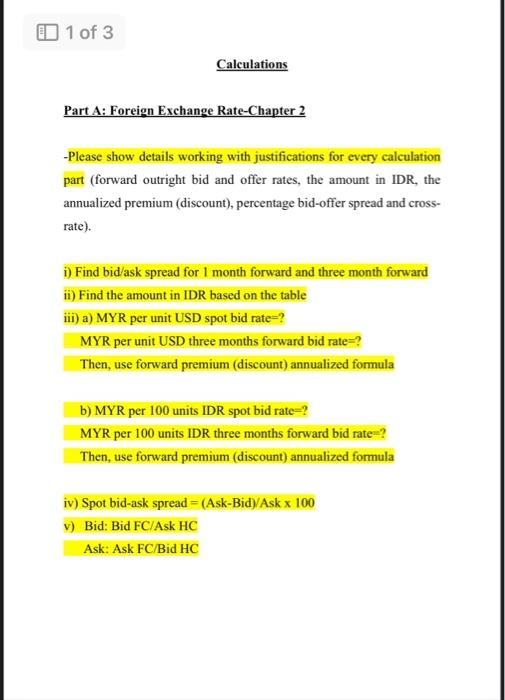

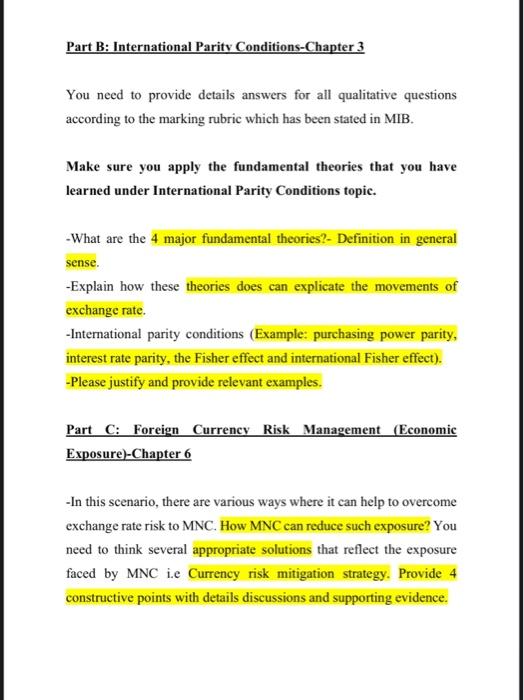

Exchange rate is the price of che cunency expeesied in terms of another currency and it is determined by the supply and demand of each country's currency. Cumencies can be troded in the spot or forward matet. In most cumency marcets. many currency pairs are inoctively troded and to their exchange tate can be detemined trough their reiation relative to a widely troded thit currency. a) ABC Bank has the following quotations for the US Dollor and indonesion Rupioh. The folowing intormation provided severd olferent exchange rate creumstances for cumency transoction. You are required to show your workings based on the given inlamation of the curency eachange rates. (1) Calculate the forward outright bid and offer rates for the obove quetafions. i Determine the amount in MYR you would exchange with IDRJo0, 000 todoy, E) Determine the annuclized premium (discount) on the three montts forward bid rates for MYRASD and MYR/DR100. iv) Compute the percentage bid-offer spread on the Mrrefso and MrefDe100 spot rates. v) Determine the one month forward cross rate for IDR/150. Aso answer the folowing questions based on the rubtic. (16 mork) b) The foreign exchange morket is a giobal decentralted market that provides the physcal and institutioned structure through which cueencies are troded. If assish intemational trade and investments by enabing cumency converion. As we know that exchange rates vary because of numerous recions. Dicust in defail four [4] common thecries that elucidate exchange rates movernenth. c) In your opinion, propose elfective opprooches to curb eschange rafe risk for fhe MNC. Provide four (4) constructive points for this question. Part A: Foreign Exchange Rate-Chapter 2 -Please show details working with justifications for every calculation part (forward outright bid and offer rates, the amount in IDR, the annualized premium (discount), percentage bid-offer spread and crossrate). i) Find bid/ask spread for 1 month forward and three month forward ii) Find the amount in IDR based on the table iii) a) MYR per unit USD spot bid rate=? MYR per unit USD three months forward bid rate=? Then, use forward premium (discount) annualized formula b) MYR per 100 units IDR spot bid rate=? MYR per 100 units IDR three months forward bid rate=? Then, use forward premium (discount) annualized formula iv) Spot bid-ask spread =( Ask-Bid )/ Ask 100 v) Bid: Bid FC/Ask HC Ask: Ask FC/Bid HC Part B: International Parity Conditions-Chapter 3 You need to provide details answers for all qualitative questions according to the marking rubric which has been stated in MIB. Make sure you apply the fundamental theories that you have learned under International Parity Conditions topic. -What are the 4 major fundamental theories?- Definition in general sense. -Explain how these theories does can explicate the movements of exchange rate. -International parity conditions (Example: purchasing power parity, interest rate parity, the Fisher effect and international Fisher effect). -Please justify and provide relevant examples. Part C: Foreign Currency Risk Management (Economic Exposure)-Chapter 6 -In this scenario, there are various ways where it can help to overcome exchange rate risk to MNC. How MNC can reduce such exposure? You need to think several appropriate solutions that reflect the exposure faced by MNC i.e Currency risk mitigation strategy. constructive points with details discussions and supporting evidence. Example: With all the alternative solution, it could help MNC to strategize the most practical ways to reduce the foreign exchange rate risk. Note: Please provide the references using Harvard referencing style. You need to have at least 810 references. Due date for submission: Week 9, 28th October 2022 (Friday, by 6.00pm) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started