Question: just the last part needs to be calculated! here is the information that is from previous ABU Upally S LUIer sildle price 15 19.UU all

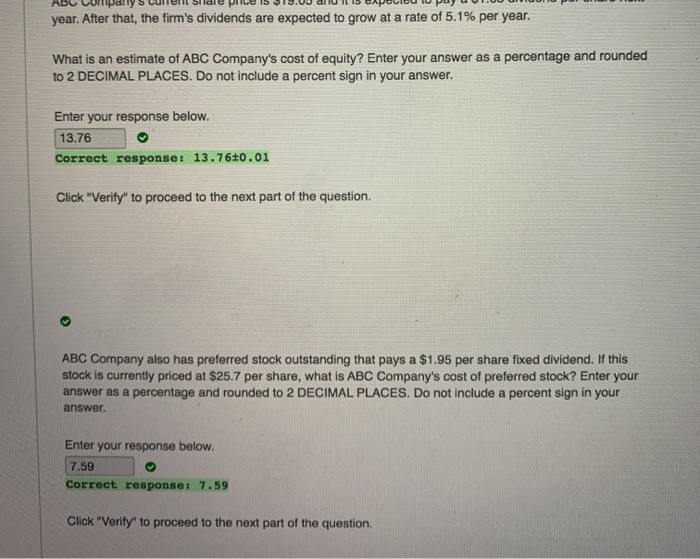

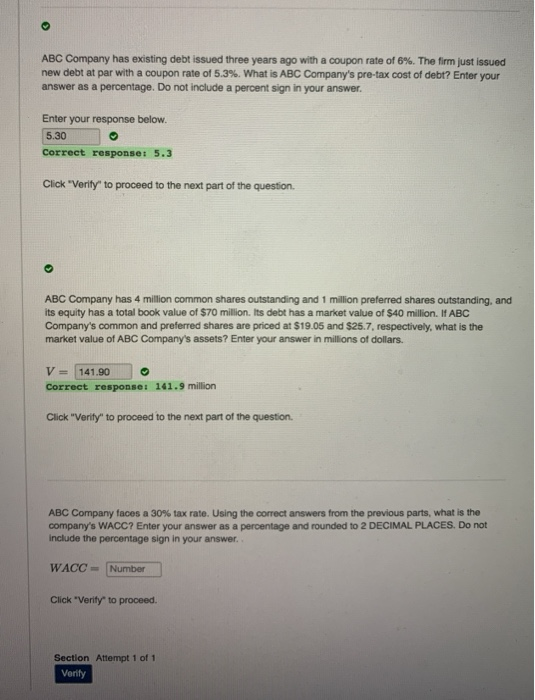

ABU Upally S LUIer sildle price 15 19.UU all IL 15 OAPOLIUUIU puyu1.00 UIVUUN PU year. After that, the firm's dividends are expected to grow at a rate of 5.1% per year. What is an estimate of ABC Company's cost of equity? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include a percent sign in your answer. Enter your response below. 13.760 Correct response: 13.760.01 Click "Verify" to proceed to the next part of the question. ABC Company also has preferred stock outstanding that pays a $1.95 per share fixed dividend. If this stock is currently priced at $25.7 per share, what is ABC Company's cost of preferred stock? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include a percent sign in your answer. Enter your response below. 7.59 Correct response: 7.59 Click "Verify" to proceed to the next part of the question. ABC Company has existing debt issued three years ago with a coupon rate of 6%. The firm just issued new debt at par with a coupon rate of 5.3%. What is ABC Company's pre-tax cost of debt? Enter your answer as a percentage. Do not include a percent sign in your answer. Enter your response below. 5.30 Correct response: 5.3 Click "Verity to proceed to the next part of the question. ABC Company has 4 million common shares outstanding and 1 million preferred shares outstanding, and its equity has a total book value of $70 million. Its debt has a market value of $40 million. If ABC Company's common and preferred shares are priced at $19.05 and $25.7, respectively, what is the market value of ABC Company's assets? Enter your answer in millions of dollars. V = 141.90 Correct response: 141.9 million Click "Verity" to proceed to the next part of the question ABC Company faces a 30% tax rate. Using the correct answers from the previous parts, what is the company's WACC7 Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include the percentage sign in your answer. WACC - Number Click "Verity to proceed Section Attempt 1 of 1 Verify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts