just the purchaces journal

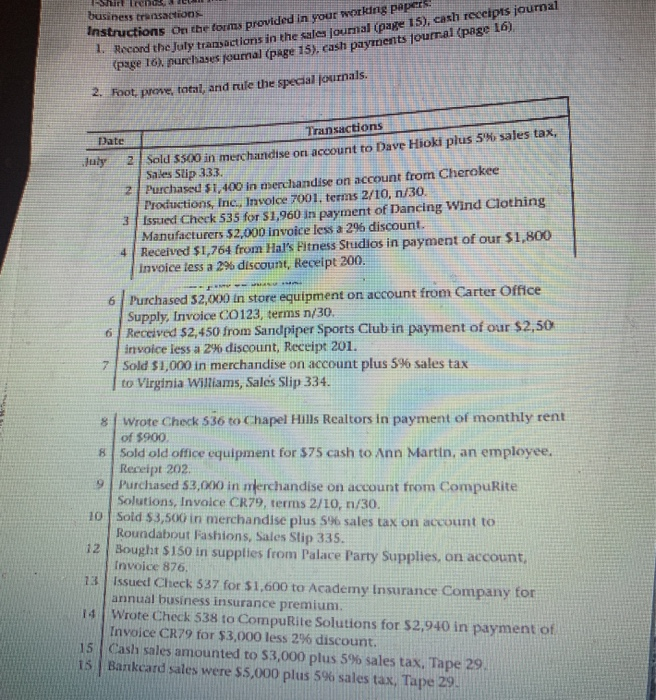

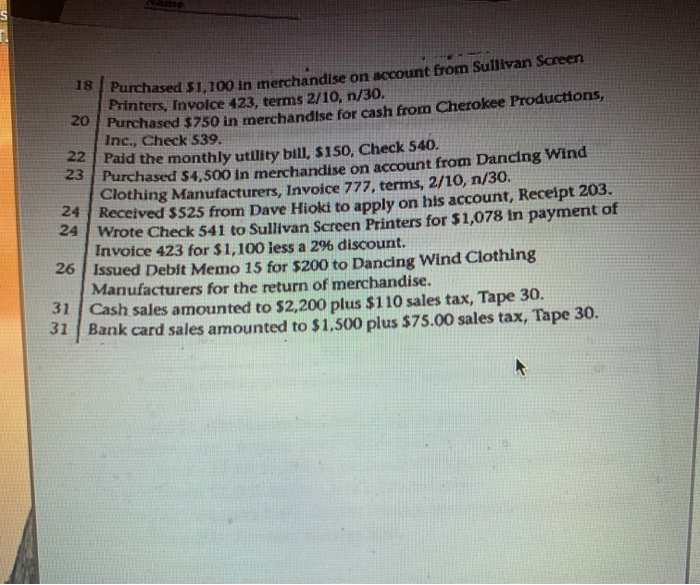

Instructions on the forms provided in your working papers business transactions 1. Record the July transactions in the sales journal (page 15), cash receipts joumal (page 16). purchases poumal (page 15). cash payments Journal (page 16) 2. Foot, prove, total, and rule the special journals. Date Transactions July 2 Sold 5500 in merchandise on account to Dave Hioki plus 5% sales tax, Sales Suip 333 2 Purchased $1,400 in merchandise on account from Cherokee Productions, Inc., Invoice 7001, terms 2/10, n/30 3 Issured Check 535 for $1,960 in payment of Dancing Wind Clothing Manufacturers 52,000 invoice less a 296 discount 4 Received $1,764 from Hal's Fitness Studios in payment of our $1,800 Invoice less a 2% discount, Receipt 200, 6 Purchased $2,000 in store equipment on account from Carter Office Supply, Invoice C0123, terms n/30. 6 Received 52,450 from Sandpiper Sports Club in payment of our $2,50 invoice less a 2% discount, Receipt 201. 7 Sold $1,000 in merchandise on account plus 5% sales tax to Virginia Williams, Sales Slip 334. 8 Wrote Check 536 to Chapel Hills Realtors in payment of monthly rent of $90 Sold old office equipment for 575 cash to Ann Martin, an employee. Receipt 202 Purchased 53,000 in merchandise on account from CompuRite Solutions, Invoice CR79, terms 2/10, n/30. 10 Sold $3,500 in merchandise plus 5% sales tax on account to Roundabout Fashions, Sales Slip 335. 12 Bought $150 in supplies from Palace Party Supplies, on account, Invoice 876. 73 Issued Check 537 for $1,600 to Academy Insurance Company for annual business insurance premium. 14 Wrote Check 538 to CompuRite Solutions for $2,940 in payment of Invoice CR79 for $3,000 less 2% discount. 15 Cash sales amounted to $3,000 plus 5% sales tax, Tape 29 15 Bankcard sales were $5,000 plus 5% sales tax, Tape 29. 18 Purchased 51,100 in merchandise on account from Sullivan Screen Printers, Invoice 423, terms 2/10, n/30. 20 Purchased $750 in merchandise for cash from Cherokee Productions, Inc., Check S39. 22 Paid the monthly utility bill, siso, Check 540. 23 Purchased $4,500 in merchandise on account from Dancing Wind Clothing Manufacturers, Invoice 777, terms, 2/10, n/30. 24 Received $525 from Dave Hioki to apply on his account, Receipt 203. 24 Wrote Check 541 to Sullivan Screen Printers for $1,078 in payment of Invoice 423 for $1,100 less a 2% discount. 26 Issued Debit Memo 15 for $200 to Dancing Wind Clothing Manufacturers for the return of merchandise. 31 Cash sales amounted to $2,200 plus $110 sales tax, Tape 30. Bank card sales amounted to $1,500 plus $75.00 sales tax, Tape 30. 31