Just to be clear, this is not actually from a quiz. It is a practice quiz problem that will be on the real quiz and I'd like to see how someone else would do it. Thanks.

Just to be clear, this is not actually from a quiz. It is a practice quiz problem that will be on the real quiz and I'd like to see how someone else would do it. Thanks.

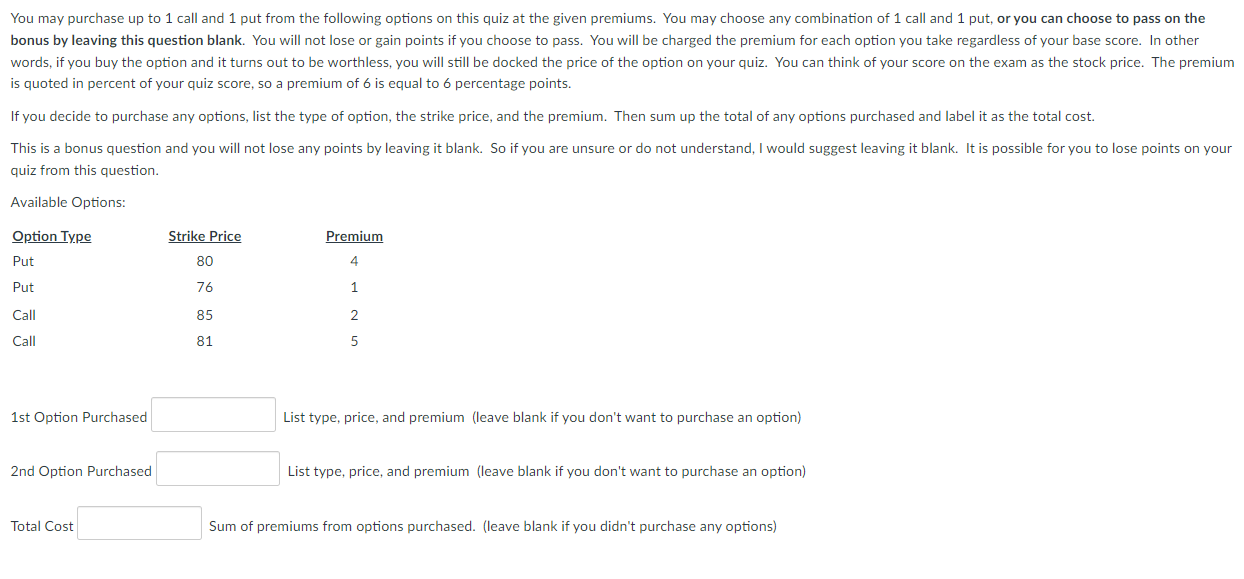

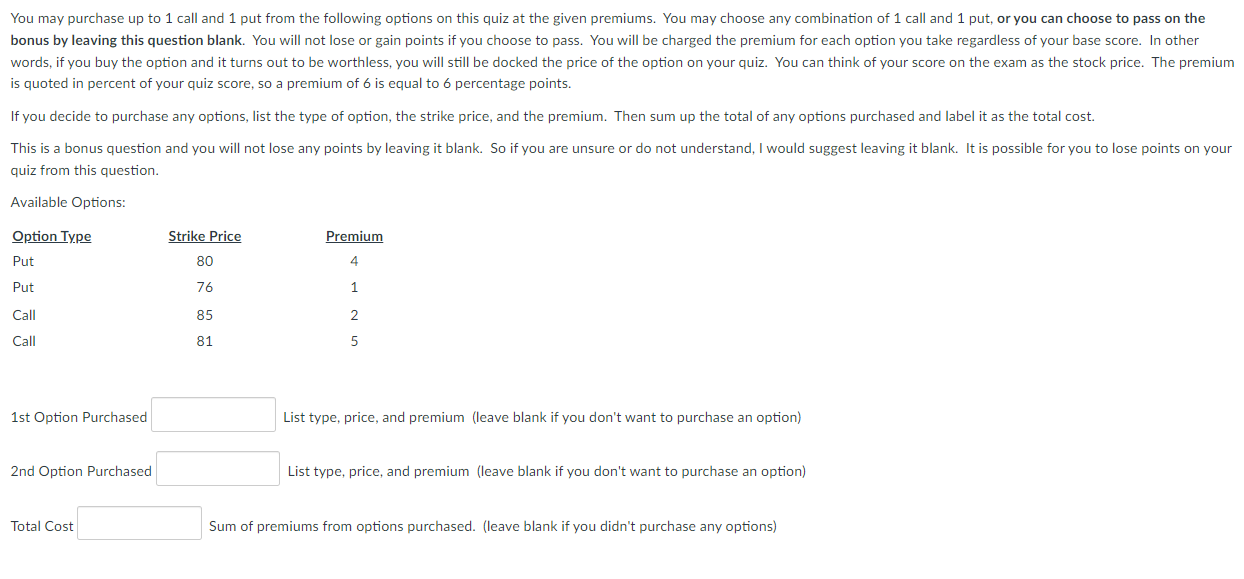

You may purchase up to 1 call and 1 put from the following options on this quiz at the given premiums. You may choose any combination of 1 call and 1 put, or you can choose to pass on the bonus by leaving this question blank. You will not lose or gain points if you choose to pass. You will be charged the premium for each option you take regardless of your base score. In other words, if you buy the option and it turns out to be worthless, you will still be docked the price of the option on your quiz. You can think of your score on the exam as the stock price. The premium is quoted in percent of your quiz score, so a premium of 6 is equal to 6 percentage points. If you decide to purchase any options, list the type of option, the strike price, and the premium. Then sum up the total of any options purchased and label it as the total cost. This is a bonus question and you will not lose any points by leaving it blank. So if you are unsure or do not understand, I would suggest leaving it blank. It is possible for you to lose points on your quiz from this question. Available Options: Option Type Strike Price Premium Put 80 4 Put 76 1 Call 85 2 Call 81 5 1st Option Purchased List type, price, and premium (leave blank if you don't want to purchase an option) 2nd Option Purchased List type, price, and premium (leave blank if you don't want to purchase an option) Total Cost Sum of premiums from options purchased. (leave blank if you didn't purchase any options) You may purchase up to 1 call and 1 put from the following options on this quiz at the given premiums. You may choose any combination of 1 call and 1 put, or you can choose to pass on the bonus by leaving this question blank. You will not lose or gain points if you choose to pass. You will be charged the premium for each option you take regardless of your base score. In other words, if you buy the option and it turns out to be worthless, you will still be docked the price of the option on your quiz. You can think of your score on the exam as the stock price. The premium is quoted in percent of your quiz score, so a premium of 6 is equal to 6 percentage points. If you decide to purchase any options, list the type of option, the strike price, and the premium. Then sum up the total of any options purchased and label it as the total cost. This is a bonus question and you will not lose any points by leaving it blank. So if you are unsure or do not understand, I would suggest leaving it blank. It is possible for you to lose points on your quiz from this question. Available Options: Option Type Strike Price Premium Put 80 4 Put 76 1 Call 85 2 Call 81 5 1st Option Purchased List type, price, and premium (leave blank if you don't want to purchase an option) 2nd Option Purchased List type, price, and premium (leave blank if you don't want to purchase an option) Total Cost Sum of premiums from options purchased. (leave blank if you didn't purchase any options)

Just to be clear, this is not actually from a quiz. It is a practice quiz problem that will be on the real quiz and I'd like to see how someone else would do it. Thanks.

Just to be clear, this is not actually from a quiz. It is a practice quiz problem that will be on the real quiz and I'd like to see how someone else would do it. Thanks.