just try to solve what u can read

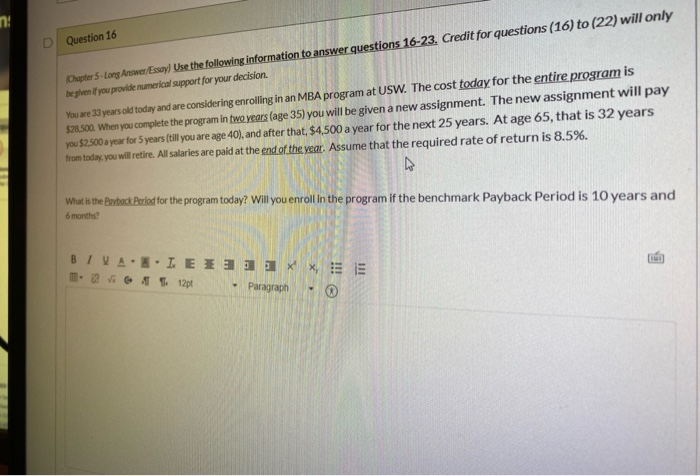

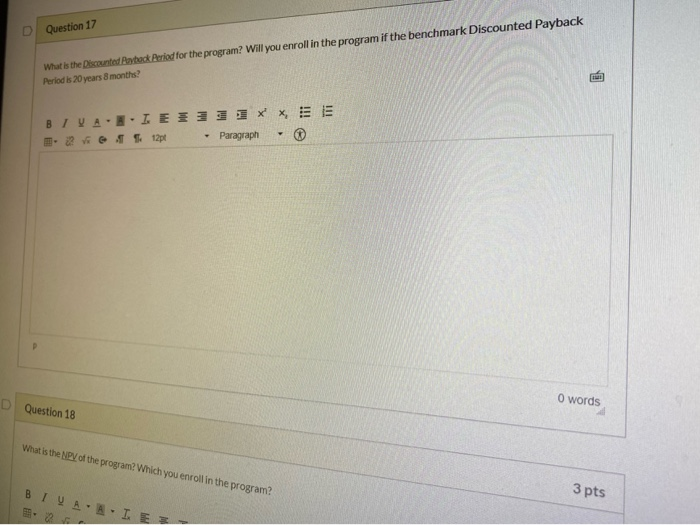

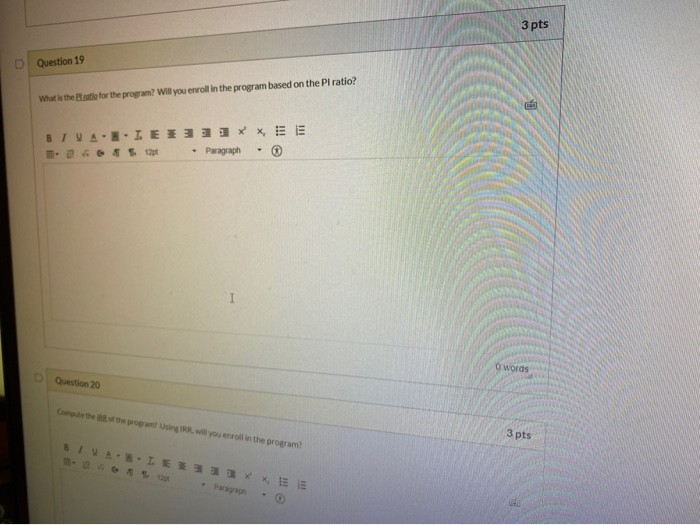

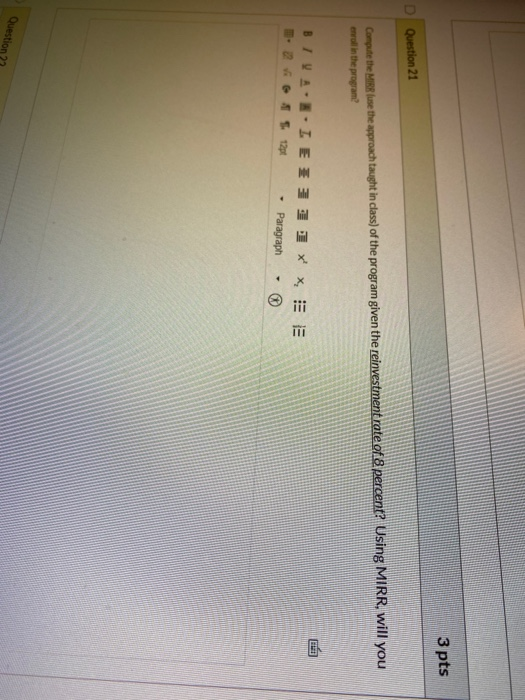

D Question 16 Chapter 5- Long Answer/Essay) Use the following information to answer questions 16-23. Credit for questions (16) to (22) will only begiven if you provide numerical support for your decision. You are 3 years old today and are considering enrolling in an MBA program at USW. The cost today for the entire program is $28.500. When you complete the program in two years (age 35) you will be given a new assignment. The new assignment will pay you $2.500 a year for 5 years (till you are age 40), and after that, $4,500 a year for the next 25 years. At age 65, that is 32 years from today, you will retire. All salaries are paid at the end of the vear. Assume that the required rate of return is 8.5%. What is the Barback Period for the program today? Will you enroll in the program if the benchmark Payback Period is 10 years and 6 months? BIVA. IEEE - 2 G 12pt - Paragraph X, - Question 17 What is the Discounted stock period for the program? Will you enroll in the program if the benchmark Discounted Payback Period is 20 years 8 months BIVAI EI11*, . . . 128 - Paragraph O words Question 18 What is the NPV of the program? Which you enroll in the program? BIVAAIE 3 pts Question 19 3 pts what the ratio for the program? Will you enroll in the program based on the Piratio? BIVARIEE 33XXE Question 20 Come will you in the program 3 pts 3 pts Question 21 the approach taught in class) of the program given the reinvestment rate of 8 percent? Using MIRR, will you Compute the evol in the program BILA I EX31XX.EE 2 1 250 Paragraph - 3F Question 22 Does the Payback Period, Discounted Payback Period, NPV, IRR, PI ratio and MIRR given you the same accept/reject decision. Disco the limitations of the methods that give you a decision different than that of the NPV BIVA. LEI 31 x , Em 12 Paragraph Numbered ist o words 3 pts Question 23 There is n eative program at UO which has the following information: Payback Period: 10 year montt Discounted Payback Period: 20 years 6 months, NPV: $5.000, PI Ratio: 1.17. IRR: 10 percent. MRR percent. Which program (USW or OU) will you choose using each of the different criteria? BIVA. I EX - 120 XX, Paragraph