Answered step by step

Verified Expert Solution

Question

1 Approved Answer

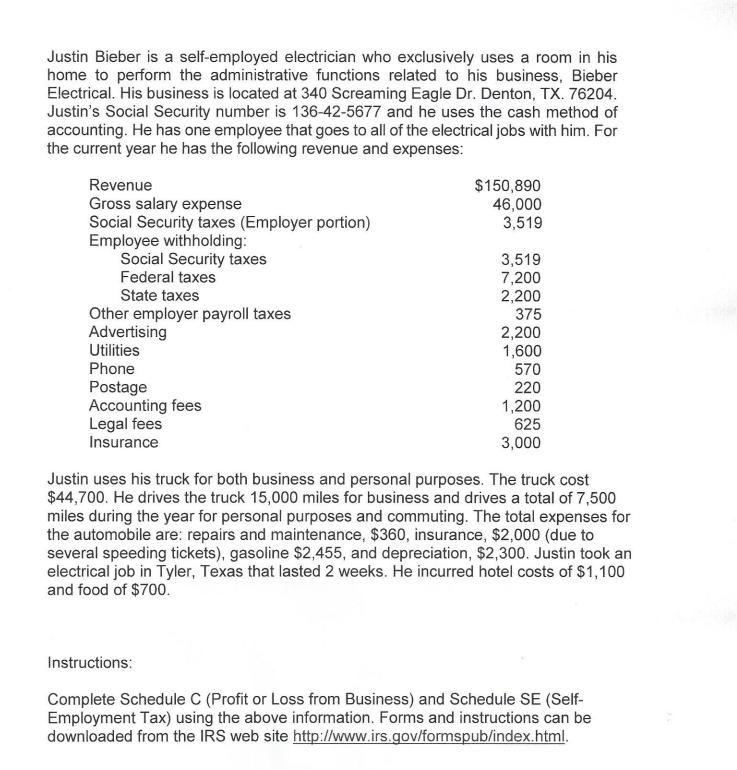

Justin Bieber is a self-employed electrician who exclusively uses a room in his home to perform the administrative functions related to his business, Bieber

Justin Bieber is a self-employed electrician who exclusively uses a room in his home to perform the administrative functions related to his business, Bieber Electrical. His business is located at 340 Screaming Eagle Dr. Denton, TX. 76204. Justin's Social Security number is 136-42-5677 and he uses the cash method of accounting. He has one employee that goes to all of the electrical jobs with him. For the current year he has the following revenue and expenses: Revenue Gross salary expense Social Security taxes (Employer portion) Employee withholding: Social Security taxes Federal taxes State taxes Other employer payroll taxes Advertising Utilities Phone Postage Accounting fees Legal fees Insurance $150,890 46,000 3,519 3,519 7,200 2,200 375 2,200 1,600 570 220 1,200 625 3,000 Justin uses his truck for both business and personal purposes. The truck cost $44,700. He drives the truck 15,000 miles for business and drives a total of 7,500 miles during the year for personal purposes and commuting. The total expenses for the automobile are: repairs and maintenance, $360, insurance, $2,000 (due to several speeding tickets), gasoline $2,455, and depreciation, $2,300. Justin took an electrical job in Tyler, Texas that lasted 2 weeks. He incurred hotel costs of $1,100 and food of $700. Instructions: Complete Schedule C (Profit or Loss from Business) and Schedule SE (Self- Employment Tax) using the above information. Forms and instructions can be downloaded from the IRS web site http://www.irs.gov/formspub/index.html.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Schedule C Profit or Loss from Business Part I Income 1 Gross Receipts or Sales 150890 46000 196890 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started