Question

Justin Company is in the process of preparing its budget for next year. Cost of goods sold has been estimated at 60 percent of sales.

Justin Company is in the process of preparing its budget for next year. Cost of goods sold has been estimated at 60 percent of sales. Merchandise purchases are to be made during the month preceding the month of the sales. Button pays 60 percent in the month of purchase and 40 percent in the month following. Wages are estimated at 20 percent of sales and are paid during the month of sale. Other operating costs amounting to 10 percent of sales are to be paid in the month following the sale.

Prepare a schedule of cash disbursements for January, February, and March

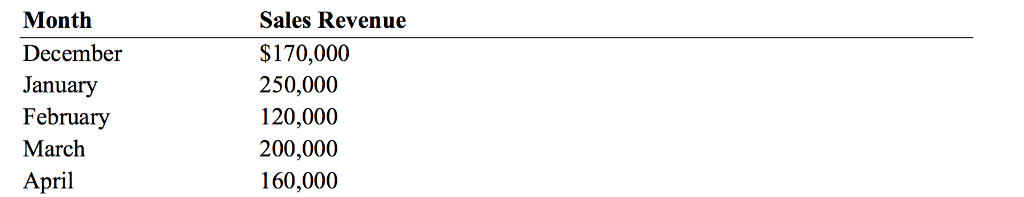

Month December January February March April Sales Revenue $170,000 250,000 120,000 200,000 160,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started