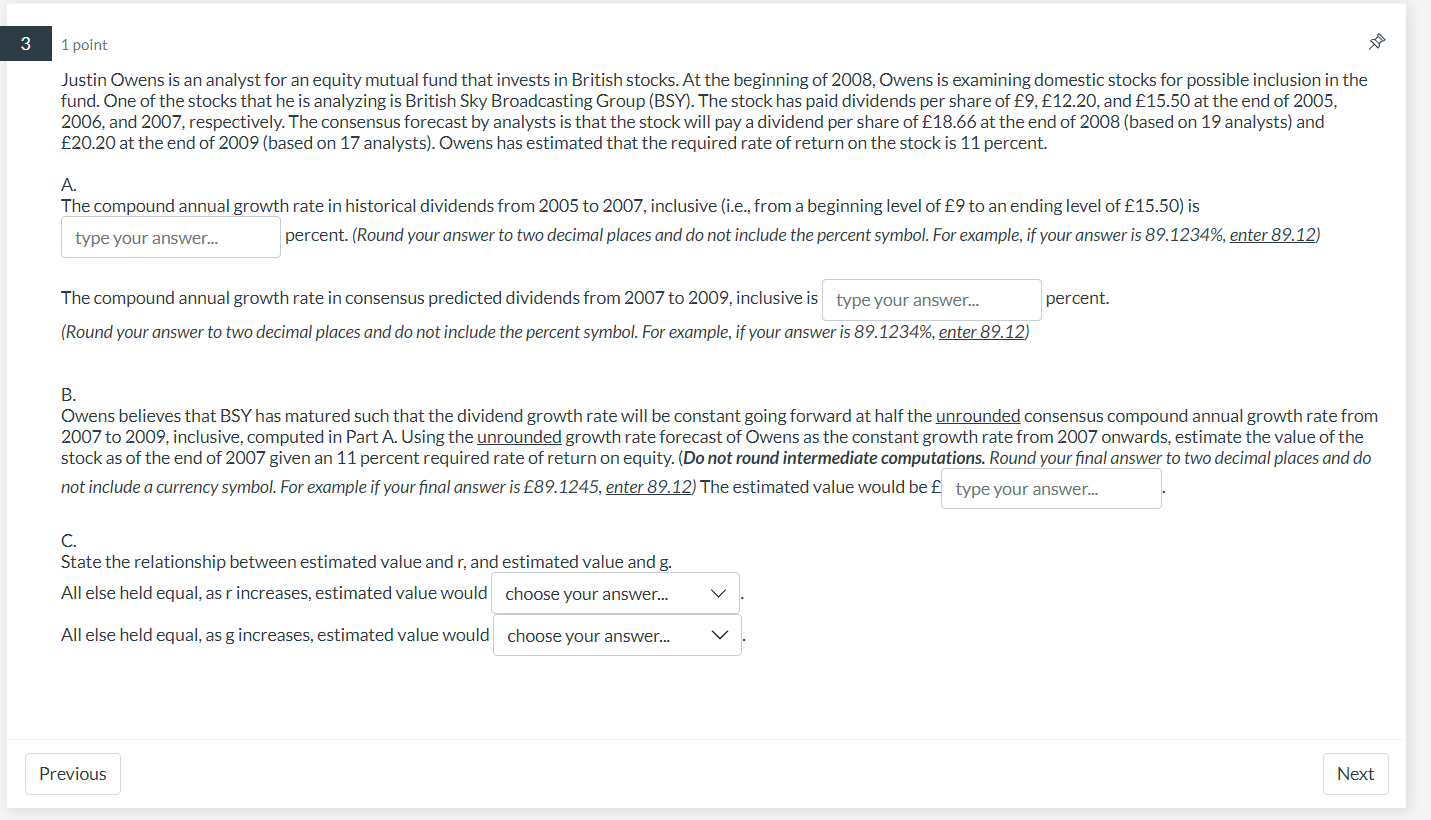

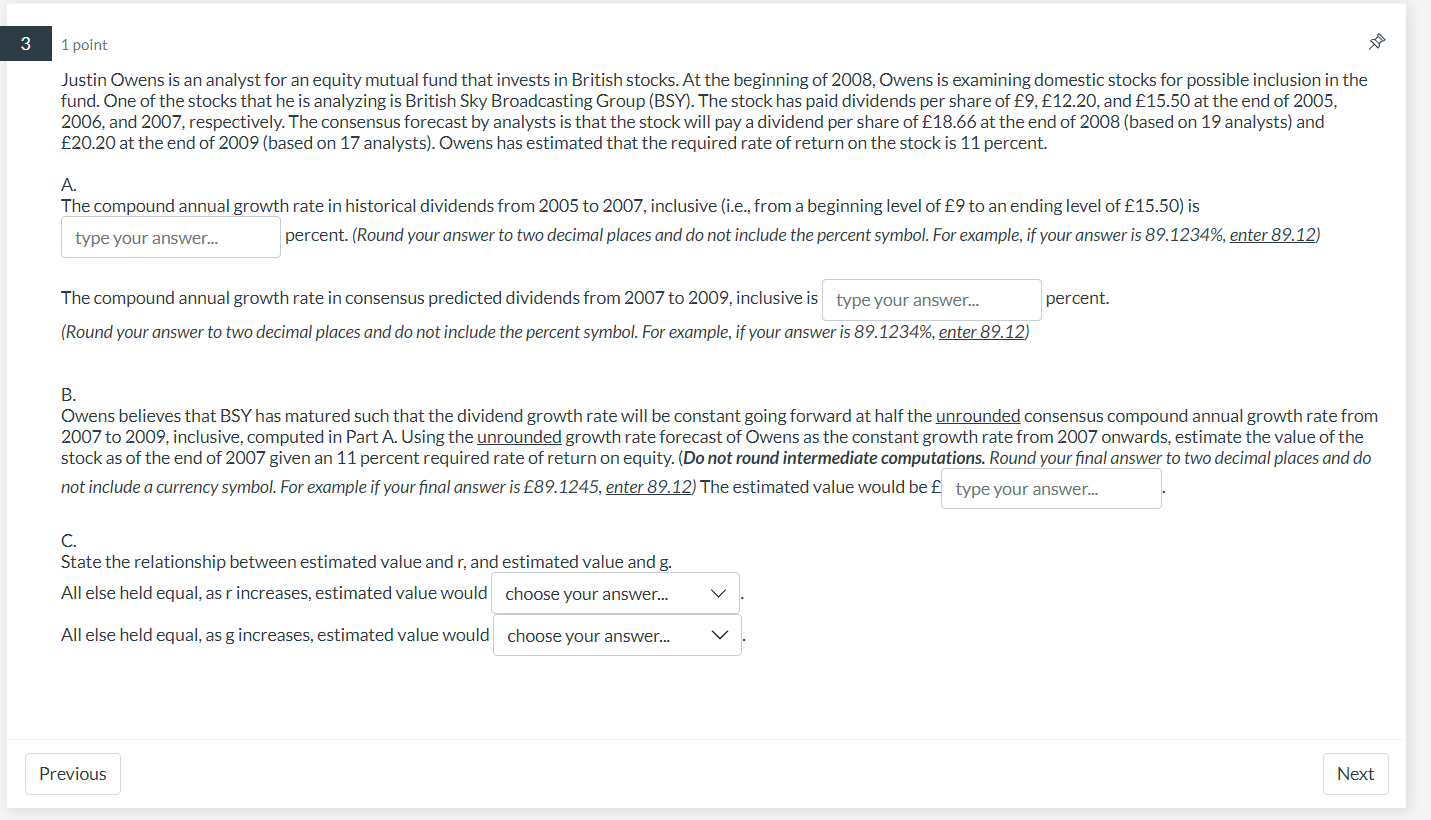

Justin Owens is an analyst for an equity mutual fund that invests in British stocks. At the beginning of 2008, Owens is examining domestic stocks for possible inclusion in the fund. One of the stocks that he is analyzing is British Sky Broadcasting Group (BSY). The stock has paid dividends per share of 9, 12.20, and 15.50 at the end of 2005 , 2006 , and 2007, respectively. The consensus forecast by analysts is that the stock will pay a dividend per share of 18.66 at the end of 2008 (based on 19 analysts) and 20.20 at the end of 2009 (based on 17 analysts). Owens has estimated that the required rate of return on the stock is 11 percent. A. The compound annual growth rate in historical dividends from 2005 to 2007 , inclusive (i.e., from a beginning level of 9 to an ending level of 15.50 ) is percent. (Round your answer to two decimal places and do not include the percent symbol. For example, if your answer is 89.1234%, enter 89.12 ) The compound annual growth rate in consensus predicted dividends from 2007 to 2009 , inclusive is percent. (Round your answer to two decimal places and do not include the percent symbol. For example, if your answer is 89.1234%, enter 89.12 ) B. Owens believes that BSY has matured such that the dividend growth rate will be constant going forward at half the unrounded consensus compound annual growth rate from 2007 to 2009, inclusive, computed in Part A. Using the unrounded growth rate forecast of Owens as the constant growth rate from 2007 onwards, estimate the value of the not include a currency symbol. For example if your final answer is 89.1245, enter 89.12 ) The estimated value would be C. State the relationship between estimated value and r, and estimated value and g. All else held equal, as r increases, estimated value would All else held equal, as g increases, estimated value would Justin Owens is an analyst for an equity mutual fund that invests in British stocks. At the beginning of 2008, Owens is examining domestic stocks for possible inclusion in the fund. One of the stocks that he is analyzing is British Sky Broadcasting Group (BSY). The stock has paid dividends per share of 9, 12.20, and 15.50 at the end of 2005 , 2006 , and 2007, respectively. The consensus forecast by analysts is that the stock will pay a dividend per share of 18.66 at the end of 2008 (based on 19 analysts) and 20.20 at the end of 2009 (based on 17 analysts). Owens has estimated that the required rate of return on the stock is 11 percent. A. The compound annual growth rate in historical dividends from 2005 to 2007 , inclusive (i.e., from a beginning level of 9 to an ending level of 15.50 ) is percent. (Round your answer to two decimal places and do not include the percent symbol. For example, if your answer is 89.1234%, enter 89.12 ) The compound annual growth rate in consensus predicted dividends from 2007 to 2009 , inclusive is percent. (Round your answer to two decimal places and do not include the percent symbol. For example, if your answer is 89.1234%, enter 89.12 ) B. Owens believes that BSY has matured such that the dividend growth rate will be constant going forward at half the unrounded consensus compound annual growth rate from 2007 to 2009, inclusive, computed in Part A. Using the unrounded growth rate forecast of Owens as the constant growth rate from 2007 onwards, estimate the value of the not include a currency symbol. For example if your final answer is 89.1245, enter 89.12 ) The estimated value would be C. State the relationship between estimated value and r, and estimated value and g. All else held equal, as r increases, estimated value would All else held equal, as g increases, estimated value would