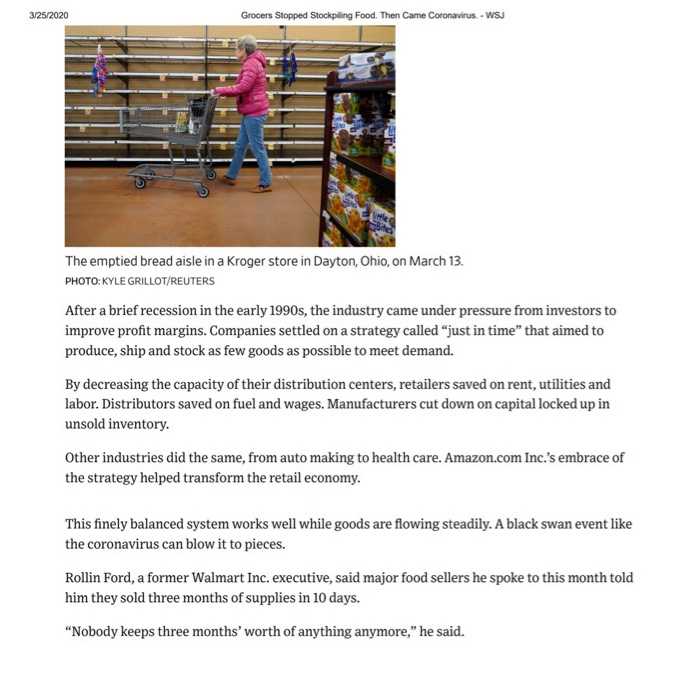

Just-In-Time Inventory ("JIT") Assignment Wall Street Journal Article dated March 23, 2020 "Grocers Stopped Stockpiling Food. Then Came Coronavirus." Acc 1B Spring 2020-T/TH Worth 25 Points After reading the article noted above, please answer the following questions on a separate sheet of paper. Your papers will be graded on their professional appearance, grammar, quality of thought process in addressing question, and how effectively you integrate things we've learned and/or discussed in class. 1. What do you think is the key element that ensures JIT works and why? 2. In the article, one paragraph reads: "By decreasing the capacity of their distribution centers, grocery retailers saved on rent, utilities and labor. Distributors saved on fuel and wages. Manufacturers cut down on capital locked up in unsold inventory." Explain how you think Grocery Retailers, Distributors and Manufacturers accomplished the above. 3. In the paragraphs that talk about Amazon.com, why does Amazon incentivize their Marketplace sellers the way they do? In your opinion, are those practices good or bad, and why? 4. Should grocers hold large inventories for unexpected events at a cost to their profit margins? Explain your thoughts. 5. What are the risks Grocery Retailers, Distributors and Manufacturers face if demand slows quickly? What should they do to mitigate the impact of this possibility? Grocers Stopped Stockpiling Food. Then Came Coronavirus. Supermarkets once kept months of inventory but drastically cut that to save on costs. Facing a shopper rush, they're now buying all they can get. By Annie Gasparro, Jennifer Smith and Jaewon Kang Updated March 23, 2020 1:05 pm ET Food sellers in the U.S. spent years making their supply chains efficient. Then a pandemic hit, and the strategy backfired. In the past two decades, producers and grocery stores such as Kroger Co. have gone from keeping months of inventory on hand to holding only a four to six weeks' supply. For many items this month, though, that amount sold out in days. The run has exposed the downside of the food industry's push to hold less stock in warehouses and operate fewer, fuller trucks to increase profit margins. Abruptly, manufacturers, distributors and retailers have thrown that strategy into reverse. Now they are making as much food as they can, delivering it as fast as possible and adding staff, all to restock shelves denuded by folks stocking up for weeks at home. "We were all surprised. We did not come into the quarter with elevated levels of inventory in the U.S. or frankly anywhere," said General Mills Inc. Chief Executive Jeff Harmening. General Mills is trying to skip steps in a carefully calibrated process. It is delivering truckloads of Cheerios, Gold Medal flour and Annie's Homegrown pasta straight to stores' warehouses, instead of first sending products to its own warehouses, to eliminate a link in the supply chain. Retailers, meanwhile, are overriding the sophisticated algorithms that say how much of what products they should buy, after seeing how those models failed to account for this month's demand surge. Instead, retail executives are talking directly to manufacturers and making decisions in real time, Mr. Harmening said. 3/25/2020 Grocers Stopped Stockpiling Food. Then Came Coronavirus - WSJ The emptied bread aisle in a Kroger store in Dayton, Ohio, on March 13. PHOTO: KYLE GRILLOT/REUTERS After a brief recession in the early 1990s, the industry came under pressure from investors to improve profit margins. Companies settled on a strategy called "just in time that aimed to produce,ship and stock as few goods as possible to meet demand. By decreasing the capacity of their distribution centers, retailers saved on rent, utilities and labor. Distributors saved on fuel and wages. Manufacturers cut down on capital locked up in unsold inventory. Other industries did the same, from auto making to health care. Amazon.com Inc.'s embrace of the strategy helped transform the retail economy. This finely balanced system works well while goods are flowing steadily. A black swan event like the coronavirus can blow it to pieces. Rollin Ford, a former Walmart Inc. executive, said major food sellers he spoke to this month told him they sold three months of supplies in 10 days. "Nobody keeps three months' worth of anything anymore," he said