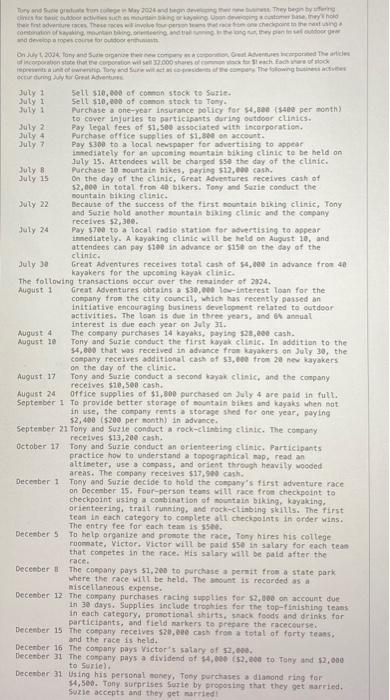

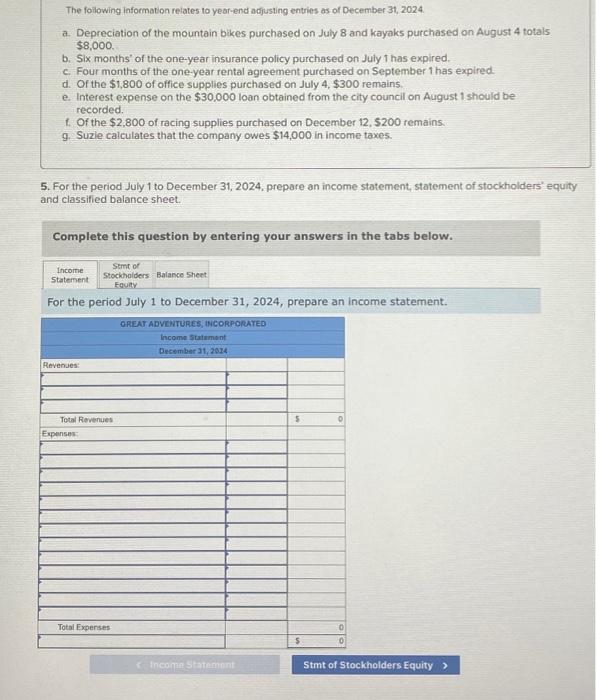

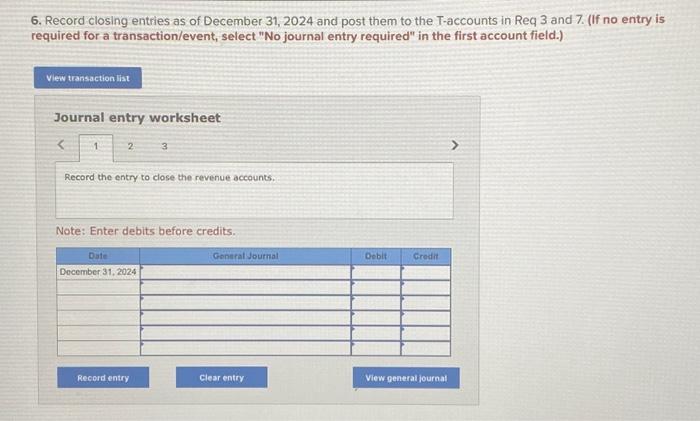

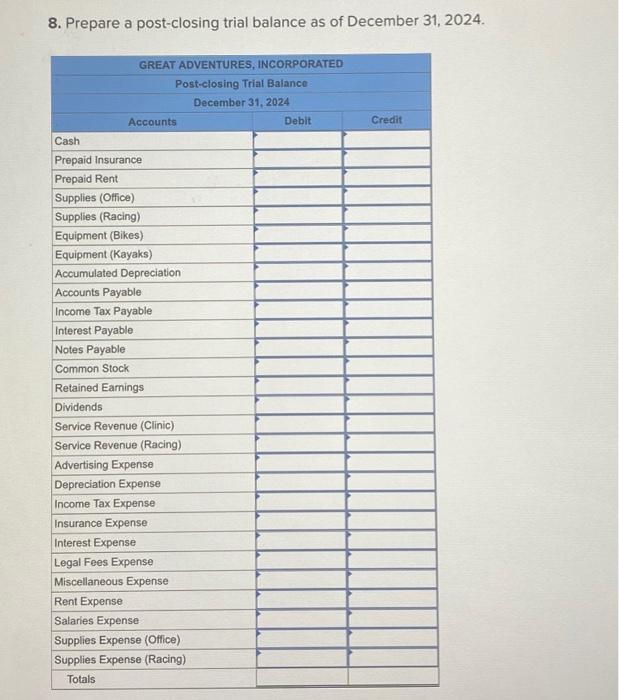

Juty1Juty1Juty1July2:Juty4July7July8July15 Juty 22 Sett s10, eso of comen stock to serte. Sell $10, ede of comon stock to Tooy. Purchase a one-year insurance poticy for s4,gee (s4ee per month) to cover injurles to participasts doring outdoor clitics. Pay lepat fees of 51 , see associated vith incorporatien. purchase office supelies of \$1.8ce on account. Pay $300 to a local nesspaper for advertisitg to appear istediately for an upconing nountain biking ctinic to be held on july 15. Attendees wilt be charged sse the day of the clinfe. Purchase io molntain bakes, payisg 512 , 000 cash. On the day of the ctinic, Great Adventures recelves cash of 52, 009 in total fron 40 bikers. Tepy and Sarie cooduct the bountain biking clinic. Because of the suecess of the first noontais biking clinic, Tony and 5 uzie bold another nountain biking ctinic and the corpany receives $2,300. Pay $700 to a local radis station for asvertising to appear innediately. A kayaking clinic w1li be held on August 10, and attendecs can pay s1ee in advasce or s1st oe the day of the clinic. Great Adventures receives totol cay of 54, eee in advance fron 40 kayakers for the upcening kayak clinfe. The following transactions occur over the renainder of 2324. August 1 Great Adventures obtains a 530,060 lov-interest loan for the conpany from the city councti, which has recently, poised an initiative encourajing business developent related to cutdeor activities. The loan is due in three years, and is anaul interest is due eoch year on 3uly 31 . August 4. The conpany purchuses 14 kayaks, paying 12d, eee cash. Aogust 1e Tony and Suzie conduct the first byok clinic. In addition to the 54, ees that was received in advance from kinakers on July 30 , the compacy receives sdiltional cast of 53,600 tron 2a nex kayokers on the day of the clinic. August 17 Tony and Surie conduct a second kayak clinic, and the conpany receives 510,500 cash. office supelies of 11,600 purchased an July 4 are paid in full. August 24 0ffice supelies of 31,600 purchased an July 4 are paid in fult. September. 1 To provide better storage of sovntain biles and kayaks when Bot in use, the conpany rents a sterage shed for one year, paying $2,460 ( $200 per month) in advance. Septeaber 21 Tony and Suzie conduct a rock-clinbing etiate. The conpany recelves $13,200 cash. october 17 Tony and Suzie conduct an erienteering clinic. Participants practice how to understand a topographical map, read an altieeter, use a conpass, ant orient through heavily wocded areas. The conpany receives $17,900 cast. Deceaber 1: Thoy and Suzie dectide to hold the conguny's first adventure race on Decenber 15. Four-berson teans with race froe checkpoint to checkpoint using a corbination of novatain biking, kayaling, orienteering, trail running, and rock-clinbing skills. The first tean in each category to coeplete all checipolnts in order inins. The entry fee for each tean is. 35t. Decenber 5 To belp organize and prowote the race, Tony hires his coltege. roomate, Victor. Victor will be paid 15se in satary for each tean that conpetes in the race. His salary wa1t be paid after the race. Deceeber II. The comoany pays 51,200 to purchase a pemit from a state park where the race will be held. The ansont is recorced as a inscellaneous expense. Decenber 12: The canpany purchases racing supelies tor $2,100 an accouid due In 3 days. Supplies inclode trupties for the top-linisting teats in each categery, pronotional 1hirts, smack foods and drinks for participants, and field markers to prepare the raceceurse. Deceeber 15 the cospany recelves sie, bee cash tree a total of forty teans. and the race is held. Decerber 16. The company pays victor's salary of 22,003 . Decerber-31 The cospany pays a dividend it 44,060 (52, 200 to tony and $2, ove to suriel. Decenber 31 using his personal money, Toby purchases a dianond ring for 4, 5es. Tony surprises sunte by proposing that they get arried. The foilowing informaton relates to year-end adjusting entries as of December 31,2024 a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $8,000 b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,800 of office supplies purchased on July 4,$300 remains. e. Interest expense on the $30,000 loan obtained from the city council on August 1 should be recorded. 1. Of the $2,800 of racing supplies purchased on December 12,5200 remains. 9. Suzle calculates that the company owes $14,000 in income taxes. 5. For the period July 1 to December 31, 2024, prepare an income statement, statement of stockholders' equity and classified balance sheet. Complete this question by entering your answers in the tabs below. For the period July 1 to December 31,2024 , prepare an income statement. 6. Record closing entries as of December 31,2024 and post them to the T-accounts in Req 3 and 7 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 3 Record the entry to close the revenue accounts. Note: Enter debits before credits. 8. Prepare a post-closing trial balance as of December 31, 2024. Juty1Juty1Juty1July2:Juty4July7July8July15 Juty 22 Sett s10, eso of comen stock to serte. Sell $10, ede of comon stock to Tooy. Purchase a one-year insurance poticy for s4,gee (s4ee per month) to cover injurles to participasts doring outdoor clitics. Pay lepat fees of 51 , see associated vith incorporatien. purchase office supelies of \$1.8ce on account. Pay $300 to a local nesspaper for advertisitg to appear istediately for an upconing nountain biking ctinic to be held on july 15. Attendees wilt be charged sse the day of the clinfe. Purchase io molntain bakes, payisg 512 , 000 cash. On the day of the ctinic, Great Adventures recelves cash of 52, 009 in total fron 40 bikers. Tepy and Sarie cooduct the bountain biking clinic. Because of the suecess of the first noontais biking clinic, Tony and 5 uzie bold another nountain biking ctinic and the corpany receives $2,300. Pay $700 to a local radis station for asvertising to appear innediately. A kayaking clinic w1li be held on August 10, and attendecs can pay s1ee in advasce or s1st oe the day of the clinic. Great Adventures receives totol cay of 54, eee in advance fron 40 kayakers for the upcening kayak clinfe. The following transactions occur over the renainder of 2324. August 1 Great Adventures obtains a 530,060 lov-interest loan for the conpany from the city councti, which has recently, poised an initiative encourajing business developent related to cutdeor activities. The loan is due in three years, and is anaul interest is due eoch year on 3uly 31 . August 4. The conpany purchuses 14 kayaks, paying 12d, eee cash. Aogust 1e Tony and Suzie conduct the first byok clinic. In addition to the 54, ees that was received in advance from kinakers on July 30 , the compacy receives sdiltional cast of 53,600 tron 2a nex kayokers on the day of the clinic. August 17 Tony and Surie conduct a second kayak clinic, and the conpany receives 510,500 cash. office supelies of 11,600 purchased an July 4 are paid in full. August 24 0ffice supelies of 31,600 purchased an July 4 are paid in fult. September. 1 To provide better storage of sovntain biles and kayaks when Bot in use, the conpany rents a sterage shed for one year, paying $2,460 ( $200 per month) in advance. Septeaber 21 Tony and Suzie conduct a rock-clinbing etiate. The conpany recelves $13,200 cash. october 17 Tony and Suzie conduct an erienteering clinic. Participants practice how to understand a topographical map, read an altieeter, use a conpass, ant orient through heavily wocded areas. The conpany receives $17,900 cast. Deceaber 1: Thoy and Suzie dectide to hold the conguny's first adventure race on Decenber 15. Four-berson teans with race froe checkpoint to checkpoint using a corbination of novatain biking, kayaling, orienteering, trail running, and rock-clinbing skills. The first tean in each category to coeplete all checipolnts in order inins. The entry fee for each tean is. 35t. Decenber 5 To belp organize and prowote the race, Tony hires his coltege. roomate, Victor. Victor will be paid 15se in satary for each tean that conpetes in the race. His salary wa1t be paid after the race. Deceeber II. The comoany pays 51,200 to purchase a pemit from a state park where the race will be held. The ansont is recorced as a inscellaneous expense. Decenber 12: The canpany purchases racing supelies tor $2,100 an accouid due In 3 days. Supplies inclode trupties for the top-linisting teats in each categery, pronotional 1hirts, smack foods and drinks for participants, and field markers to prepare the raceceurse. Deceeber 15 the cospany recelves sie, bee cash tree a total of forty teans. and the race is held. Decerber 16. The company pays victor's salary of 22,003 . Decerber-31 The cospany pays a dividend it 44,060 (52, 200 to tony and $2, ove to suriel. Decenber 31 using his personal money, Toby purchases a dianond ring for 4, 5es. Tony surprises sunte by proposing that they get arried. The foilowing informaton relates to year-end adjusting entries as of December 31,2024 a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $8,000 b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,800 of office supplies purchased on July 4,$300 remains. e. Interest expense on the $30,000 loan obtained from the city council on August 1 should be recorded. 1. Of the $2,800 of racing supplies purchased on December 12,5200 remains. 9. Suzle calculates that the company owes $14,000 in income taxes. 5. For the period July 1 to December 31, 2024, prepare an income statement, statement of stockholders' equity and classified balance sheet. Complete this question by entering your answers in the tabs below. For the period July 1 to December 31,2024 , prepare an income statement. 6. Record closing entries as of December 31,2024 and post them to the T-accounts in Req 3 and 7 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 3 Record the entry to close the revenue accounts. Note: Enter debits before credits. 8. Prepare a post-closing trial balance as of December 31, 2024