Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JUULUSSITUUTU /Message factions create&do=created posthistedit=true&requestType=thread&course id-98856_1&nav=discussion board entry contid=1 30 Apps Bookmarks www.kenton kyscho UT Direct - Bealo. Printer On Printing View Filing Data The

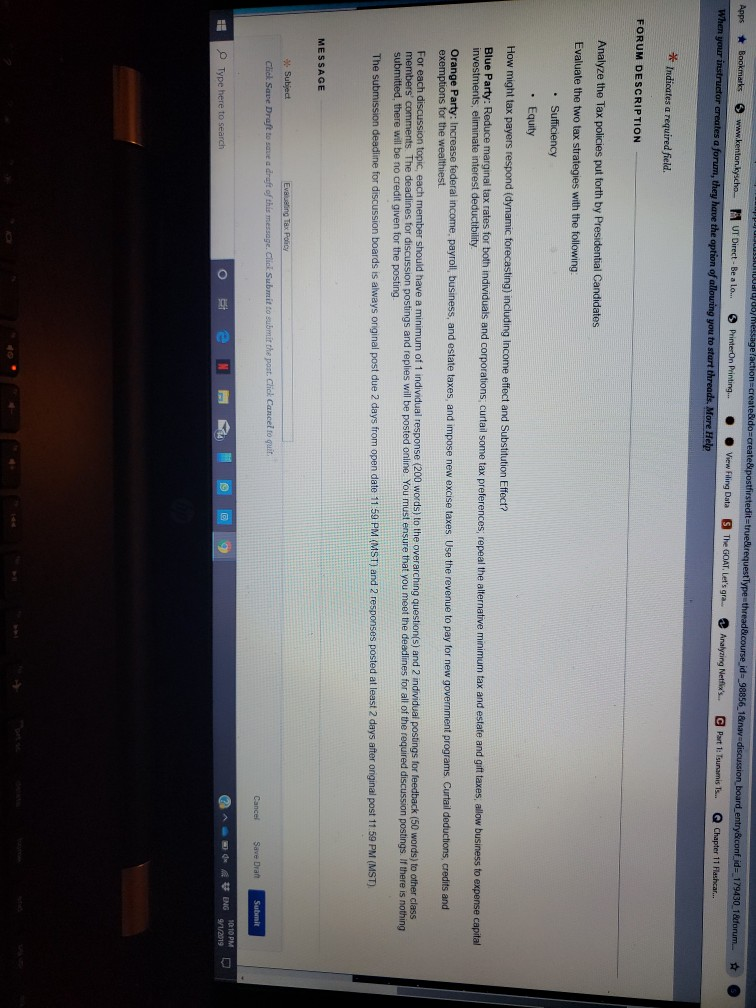

JUULUSSITUUTU /Message factions create&do=created posthistedit=true&requestType=thread&course id-98856_1&nav=discussion board entry contid=1 30 Apps Bookmarks www.kenton kyscho UT Direct - Bealo. Printer On Printing View Filing Data The GOAT Let's gra.. Analyzing Netflix's. C Part 1: Tsunamiss Q Chapter 11 Flashcar When your instructor creates a forum, they have the option of allowing you to start threads. More Help mm * Indicates a required field. FORUM DESCRIPTION Analyze the Tax policies put forth by Presidential candidates Evaluate the two tax strategies with the following Sufficiency Equity How might tax payers respond (dynamic forecasting) including Income effect and Substitution Effect? Blue Party: Reduce marginal tax rates for both individuals and corporations curtail some tax preferences, repeal the alternative minimum tax and estate and gift taxes allow business to expense capital investments, eliminate interest deductibility Orange Party: Increase federal income, payroll, business, and estate taxes, and impose new excise taxes Use the revenue to pay for new government programs Curtail deductions, credits and exemptions for the wealthiest. For each discussion topic, each member should have a minimum of 1 individual response (200 words) to the overarching question(s) and 2 individual postings for feedback (50 words) to other class members' comments. The deadlines for discussion postings and replies will be posted online You must ensure that you meet the deadlines for all of the required discussion postings. If there is nothing submitted, there will be no credit given for the posting The submission deadline for discussion boards is always original post due 2 days from open date 11:59 PM (MST) and 2 responses posted at least 2 days after original post 11:59 PM (MST) MESSAGE Subject Evaluating Tax Policy Click Save Draft to save a draft of this message. Click Submit to submit the past. Chick Cancel to quit. Cancel Save Drat Submit Type here to search 2 A V 1010 PM ENG1 /2019 JUULUSSITUUTU /Message factions create&do=created posthistedit=true&requestType=thread&course id-98856_1&nav=discussion board entry contid=1 30 Apps Bookmarks www.kenton kyscho UT Direct - Bealo. Printer On Printing View Filing Data The GOAT Let's gra.. Analyzing Netflix's. C Part 1: Tsunamiss Q Chapter 11 Flashcar When your instructor creates a forum, they have the option of allowing you to start threads. More Help mm * Indicates a required field. FORUM DESCRIPTION Analyze the Tax policies put forth by Presidential candidates Evaluate the two tax strategies with the following Sufficiency Equity How might tax payers respond (dynamic forecasting) including Income effect and Substitution Effect? Blue Party: Reduce marginal tax rates for both individuals and corporations curtail some tax preferences, repeal the alternative minimum tax and estate and gift taxes allow business to expense capital investments, eliminate interest deductibility Orange Party: Increase federal income, payroll, business, and estate taxes, and impose new excise taxes Use the revenue to pay for new government programs Curtail deductions, credits and exemptions for the wealthiest. For each discussion topic, each member should have a minimum of 1 individual response (200 words) to the overarching question(s) and 2 individual postings for feedback (50 words) to other class members' comments. The deadlines for discussion postings and replies will be posted online You must ensure that you meet the deadlines for all of the required discussion postings. If there is nothing submitted, there will be no credit given for the posting The submission deadline for discussion boards is always original post due 2 days from open date 11:59 PM (MST) and 2 responses posted at least 2 days after original post 11:59 PM (MST) MESSAGE Subject Evaluating Tax Policy Click Save Draft to save a draft of this message. Click Submit to submit the past. Chick Cancel to quit. Cancel Save Drat Submit Type here to search 2 A V 1010 PM ENG1 /2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started