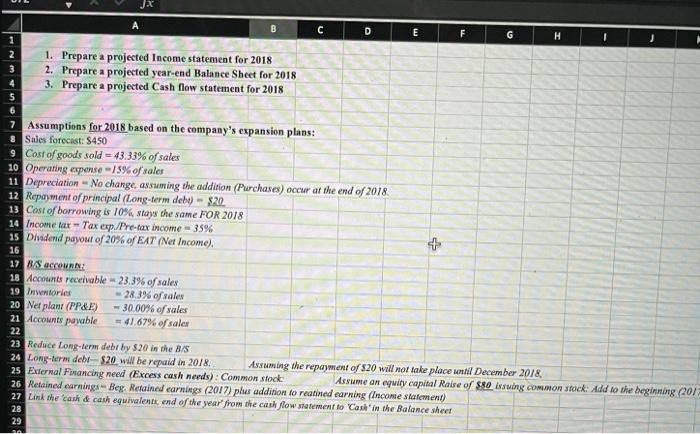

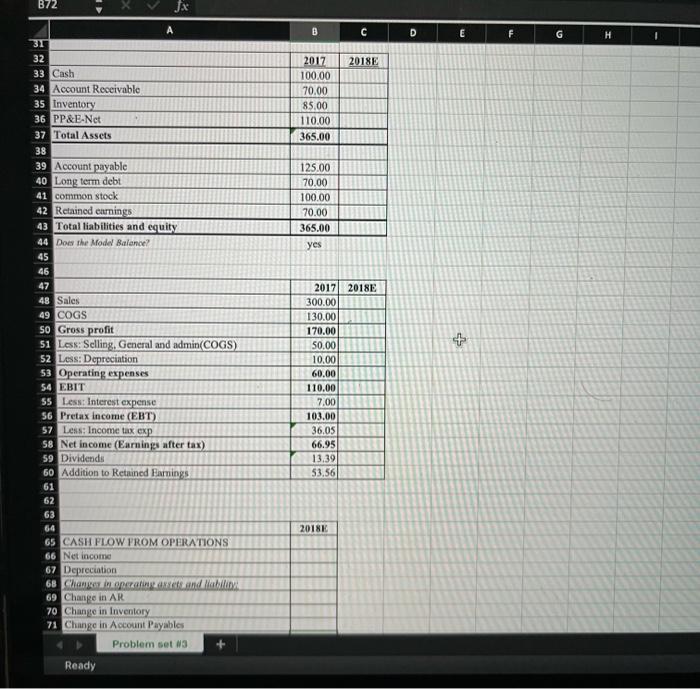

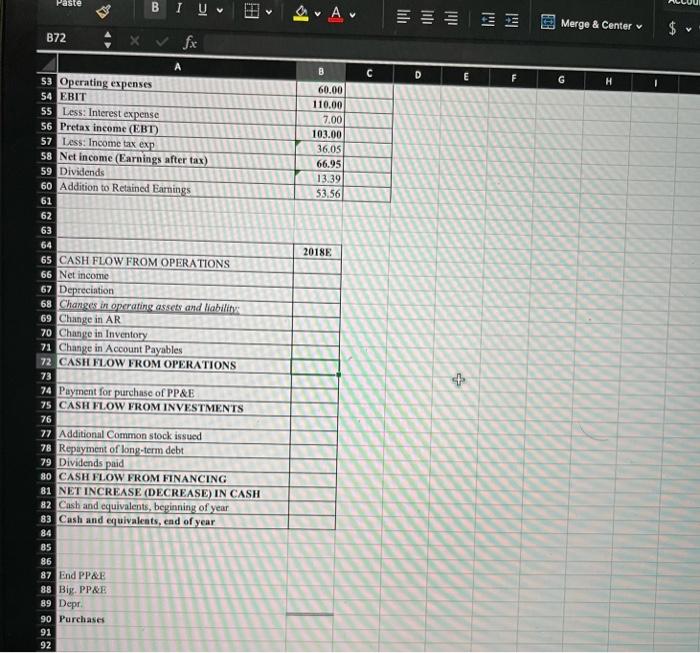

JX C D F H 3 4 1. Prepare a projected Income statement for 2018 2. Prepare a projected year-end Balance Sheet for 2018 3. Prepare a projected Cash flow statement for 2018 Assumptions for 2018 based on the company's expansion plans: Sales forecast: $450 9 Cost of goods sold - 43.33% of sales 10 Operating expense -15% of sales 11 Depreciation - No change, assuming the addition (Purchases) occur at the end of 2018 12 Repayment of principal (Long-term debt) - $20 13 Cost of borrowing is 10%, stays the same FOR 2018 14 Income tax -- Tax exp/Pre-tax income = 35% 15 Dividend payout of 20% of EAT (Net Income). + 16 17 B/S CON 18 Accounts receivable - 23.3% of sales 19 Inventories 28.3% of sales 20 Net plant (PP&E) 30.00% of sales 21 Accounts payable - 41.67% of saler 22 23 Reduce Long-term debt by 320 in the B/S 24 Long-term debt $20 will be repaid in 2018 Assuming the repayment of $20 will not take place until December 2018, 25 External Fmancing need (Excess cash needs): Common stock Assume an equity capital Raise of $80 issuing common stock: Add to the beginning 2017 26 Retained earnings - Beg Retained earnings (2017) plus addition to reatined earning (Income statement) 27 Link the cash & cash equivalent and of the year from the cash flow statement to ask in the Balance sheet 28 29 B72 Jx B D E F G H 2018E 2017 100.00 70.00 85.00 110.00 365.00 125.00 70.00 100.00 70.00 365.00 yes 2018E A 3T 32 33 Cash 34 Account Receivable 35 Inventory 36 PP&E-Nct 37 Total Assets 38 39 Account payable 40 Long term debt 41 common stock 42 Retained earnings 43 Total liabilities and equity 44 Does the Model Balance? 45 46 47 48 Sales 49 COGS So Gross profit 51 Less: Selling, General and admin(COGS) 52 Less: Depreciation 53 Operating expenses 54 EBIT SS Less: Interest expense 56 Pretax income (EBT) 57 Less: Income tax exp 58 Net Income (Earnings after tax) 59 Dividends 60 Addition to Retained Farnings 61 62 63 64 65 CASH FLOW FROM OPERATIONS 66 Net income 67 Depreciation 68 Changes in operating nets and abili 69 Change in AR 70 Change in Inventory 71 Change in Account Payables Problem set 3 + 2017 300.00 130.00 170.00 50.00 10.00 60.00 110.00 7.00 103.00 36,05 66.95 13.39 53.56 2018 Ready Paste BIU v A ilil Il IMI 02 Merge & Center $ V B72 fx B C D E F G 60.00 110.00 7.00 103.00 3605 66.95 13.39 53.56 2018E 53 Operating expenses 54 EBIT 55 Less: Interest expense 56 Pretax income (EBT) 57 Less: Income tax exp 58 Net income (Earnings after tax) 59 Dividends 60 Addition to Retained Earnings 61 62 63 64 65 CASH FLOW FROM OPERATIONS 66 Net income 67 Depreciation 68 Changes in operating assets and liability 69 Change in AR 70 Change in Inventory 71 Change in Account Payables 72 CASH FLOW FROM OPERATIONS 73 74 Payment for purchase of PP&E 75 CASH FLOW FROM INVESTMENTS 76 77 Additional Common stock issued 78 Repayment of long-term debt 79 Dividends paid 80 CASH FLOW FROM FINANCING 81 NET INCREASE (DECREASE) IN CASH 82 Cash and equivalents, beginning of year 83 Cash and equivalents, end of year 84 85 86 87 End PP&E 88 Big, PP&E 89 Depr 90 Purchases 91 92 +