Answered step by step

Verified Expert Solution

Question

1 Approved Answer

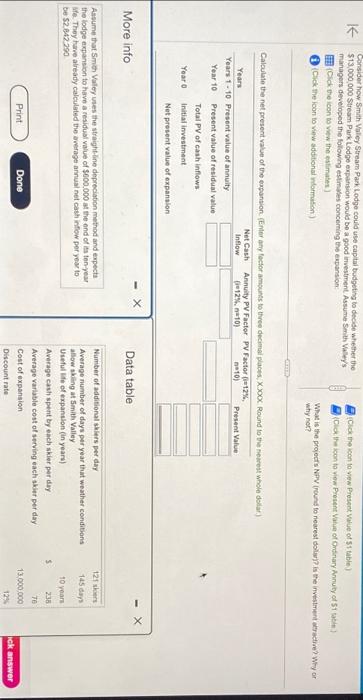

K Consider how Smith Valley Stream Park Lodge could use capital budgeting to decide whether the $13,000,000 Stream Park Lodge expansion would be a good

K Consider how Smith Valley Stream Park Lodge could use capital budgeting to decide whether the $13,000,000 Stream Park Lodge expansion would be a good investment. Assume Smith Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) (Click the icon to view additional information.) Years Years 1-10 Year 10 Calculate the net present value of the expansion. (Enter any factor amounts to three decimal places, X.XXX. Round to the nearest whole dollar.) Net Cash Annuity PV Factor PV Factor (i=12%, Inflow (i=12%, n=10) n=10) More info Year 0 Present value of annuity Present value of residual value Total PV of cash inflows Initial investment Net present value of expansion Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $600,000 at the end of its ten-year life. They have already calculated the average annual net cash inflow per year to be $2,842,290. Print Done X (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) What is the project's NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data table Present Value Number of additional skiers per day Average number of days per year that weather conditions allow skiing at Smith Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variabl cost of serving each skier per day Cost of expansion Discount rate $ 121 skiers 145 days 10 years 238 76 13,000,000 12% eck answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started